Understanding Quantitative Tightening (QT) and impact on Treasury Yields

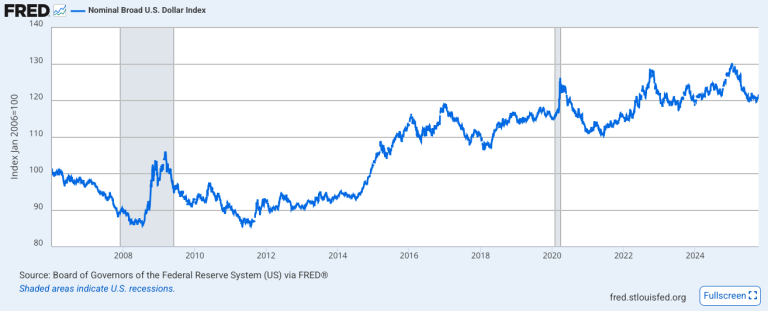

The Federal Reserve is in the midst of one of the most significant monetary policy operations in its history: the great unwinding of its multi-trillion-dollar balance sheet. This process, known as Quantitative Tightening (QT), is the reversal of the massive bond-buying programs (Quantitative Easing, or QE) that supported the economy through the 2008 financial crisis and the COVID-19 pandemic.

For the past two years, this process has proceeded with the quiet hum of a well-oiled machine. But the easy part is now over. QT is entering a new, more delicate phase, where the risks of an accident are higher and the consequences more severe. The financial system’s primary shock absorber has been depleted, and the Fed is now flying closer to the ground, navigating by instruments that have been tested only once before—with explosive results.

Understanding this new phase is critical for anyone trying to make sense of markets, interest rates, and the stability of the financial system itself.

From a Flood to a Drain: How QT Actually Works

At its core, QT is simple: the Fed shrinks its balance sheet by allowing its holdings of Treasury and mortgage-backed securities to mature without reinvesting the principal. When a Treasury bond held by the Fed matures, the Treasury pays the Fed. To raise that cash, the Treasury issues a new bond to the public. A private investor—say, a pension fund—buys that new bond, and the money flows from the pension fund’s commercial bank account to the Treasury’s account at the Fed.

The final step is the crucial one: the commercial bank settles the payment by transferring its own cash, known as reserves, to the Treasury. The end result is that a security that was on the Fed’s balance sheet is now in private hands, and the central bank money (reserves) that was on the commercial bank’s balance sheet has been extinguished. The system’s total liquidity has been reduced.

For the first couple of years of this QT cycle, which began in June 2022, this direct drain on bank reserves was largely avoided. The system had a massive buffer: the Fed’s Overnight Reverse Repo (ON RRP) facility. This facility had absorbed over $2 trillion in excess cash, mostly from money market funds (MMFs). As QT proceeded, MMFs were the primary buyers of new Treasury bills, funding their purchases by pulling cash out of the ON RRP. The Fed’s balance sheet shrank, but the impact was felt on its ON RRP liability, leaving the crucial stock of bank reserves largely untouched.

That buffer is now gone. The ON RRP balance has fallen to near-zero operational levels. From here on out, every dollar of QT will result in a nearly one-for-one drain of bank reserves—the ultimate settlement asset for the entire financial system. This is where the risks begin to mount.

The Ghost of September 2019: A Cautionary Tale

To understand the Fed’s current caution, one must look back to September 2019. The Fed was then in the final stages of its first-ever attempt at QT. Over two years, it had steadily drained reserves from the system. On September 16, a perfect storm hit: a quarterly corporate tax deadline coincided with a large settlement of Treasury securities, creating a massive, simultaneous demand for cash.

The system buckled. There weren’t enough reserves in the right places to meet the demand. The interest rate on overnight collateralized loans—the repo rate—spiked from around 2% to as high as 10% intraday. The chaos spilled over into other markets, forcing the Fed into an emergency intervention, injecting billions of dollars back into the system and abruptly ending QT.

The 2019 repo spike was a stark lesson: it is incredibly difficult to know the precise level at which bank reserves transition from “ample” to “scarce.” And that transition can be sudden and violent.

This Time is Different… But the Risks Have Evolved

The Fed is determined to avoid a repeat performance. The current environment is structurally different from the 2017-2019 period in several key ways.

First, the starting point was vastly different. The post-COVID balance sheet was nearly $9 trillion, more than double its predecessor, and the initial pace of runoff was much faster. Second, the massive ON RRP facility provided the aforementioned buffer that simply didn’t exist last time.

Third, and most importantly, the Fed now has a critical new tool: the Standing Repo Facility (SRF). Established in 2021, the SRF acts as a permanent backstop, allowing eligible banks and dealers to borrow cash from the Fed overnight against Treasury collateral at a fixed rate. In theory, this facility creates a hard ceiling on money market rates and should prevent the kind of uncontrolled spike seen in 2019. However, its effectiveness depends on market participants treating it as a routine tool rather than a sign of crisis, a proposition that remains untested.

A New Buyer of Last Resort: Who is Absorbing the Supply?

A crucial consequence of QT is the change in who is buying all the Treasury bonds the Fed is no longer purchasing. During QE, the Fed was a massive, price-insensitive buyer, absorbing huge amounts of government debt. With the Fed on the sidelines, that burden falls to the private sector.

Data shows a clear shift in the investor base. Historically stable buyers like foreign central banks and, to some extent, U.S. commercial banks have reduced their holdings. The new marginal buyers are more price-sensitive and opportunistic: households, hedge funds, and mutual funds.

This matters profoundly. A market dominated by price-sensitive investors is likely to demand higher yields to absorb new supply and may exhibit greater volatility. It means that to clear auctions, interest rates may need to rise more than they would have when a non-economic behemoth like the Fed was the primary buyer.

What to Watch: The Instrument Panel for Financial Plumbing

As the Fed navigates this descent, several key indicators will signal whether the system is approaching a dangerously low level of reserves.

- The EFFR-IORB Spread: The Effective Federal Funds Rate (EFFR) is the main interbank lending rate, and the Interest on Reserve Balances (IORB) is the rate the Fed pays banks on their reserves. In an ample system, EFFR trades a few basis points below IORB. If this spread narrows and EFFR begins to trade persistently at or above IORB, it’s a clear sign that banks are becoming protective of their reserves and are willing to pay more to borrow cash. This is the first warning light.

- Standing Repo Facility (SRF) Usage: Any significant, non-test use of the SRF would be a major market event. It would signal that private markets are unable to clear, forcing dealers to turn to the Fed’s backstop. While the facility is designed for this purpose, its first real use would indicate that reserves are becoming scarce.

- Repo Market Volatility: Watch for increased volatility in the Secured Overnight Financing Rate (SOFR), the primary benchmark for the repo market. Frequent upward spikes, especially on non-quarter-end dates, would suggest growing friction in the system’s most critical funding market.

Why Stopping QT Could Lower Treasury Yields

Stopping Quantitative Tightening (QT) can lead to a drop in Treasury yields through a combination of supply dynamics, market signaling, and changes in investor risk appetite. While QT is designed to put upward pressure on yields, halting the process does more than just remove that pressure; it can actively reverse it.

Here are the primary reasons why stopping QT may cause Treasury yields to fall:

- Halting the Supply Increase (The Portfolio Balance Channel): The core mechanism of QT is increasing the supply of Treasury securities that the private sector must absorb. During QT, the Federal Reserve—a large, price-insensitive buyer—stops reinvesting the proceeds of its maturing bonds, forcing the Treasury to issue more debt to the public to replace that funding. This “injection of duration” into the private market puts upward pressure on yields as more price-sensitive investors (like households, hedge funds, and mutual funds) must be induced to buy the increased supply. When QT stops, this constant stream of new supply being forced upon the market ceases. The removal of this upward pressure on yields can cause them to fall as the market finds a new equilibrium with a more stable supply-demand balance.

- A Powerful Dovish Signal: A decision by the Fed to stop QT is a significant policy signal to the markets. It is often interpreted as a precursor to a more accommodative monetary policy stance, such as interest rate cuts. This signal is typically driven by the Fed’s concerns over weakening economic conditions, such as a deteriorating labor market or a sharp drop in inflation. In response to this signal, market participants will begin to price in a higher probability of future rate cuts, which directly pulls down Treasury yields, particularly at the shorter end of the curve.

- Reduction in the Term Premium: The “term premium” is the extra compensation investors demand for the risk of holding a longer-term bond compared to rolling over a series of short-term bonds. QT increases the term premium by forcing private investors to hold more of this duration risk. When the Fed stops QT, it signals an end to the increasing supply of duration risk. This can cause the term premium to stabilize or decline as investor uncertainty about future supply diminishes, leading to lower long-term yields.

- Shift in Market Psychology and Investor Behavior: The announcement that a monetary tightening program is ending can trigger a significant shift in market sentiment. Investors who were hesitant to buy bonds due to the ongoing upward pressure from QT may re-enter the market in anticipation of a more favorable environment. This can lead to a front-running effect, where investors buy Treasuries to lock in higher yields before they fall further in an expected easing cycle, creating a self-fulfilling prophecy of declining yields.

The Fed has already acknowledged these risks by slowing the pace of its Treasury runoff earlier this year. This move was a clear signal that it intends to approach the “ample but not abundant” level of reserves with extreme caution. The goal is to land the plane softly, stopping the descent before the alarms start blaring. But as the ghost of 2019 reminds us, the runway can appear much shorter and arrive much faster than anyone expects.