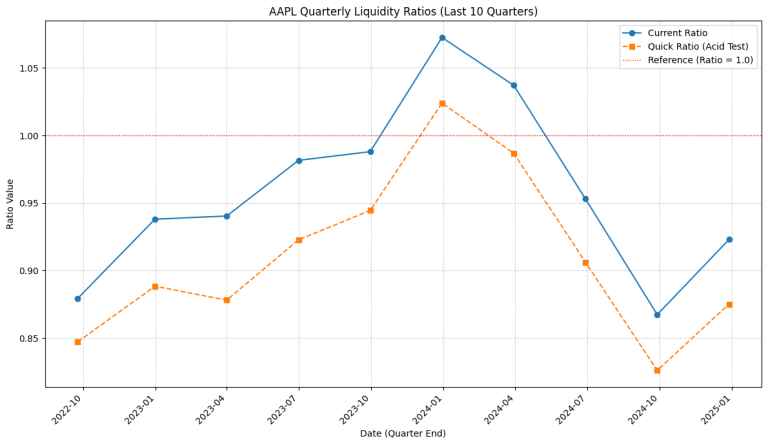

4. Python for Fundamental Analysis: Analyze Liquidity Ratios with Python

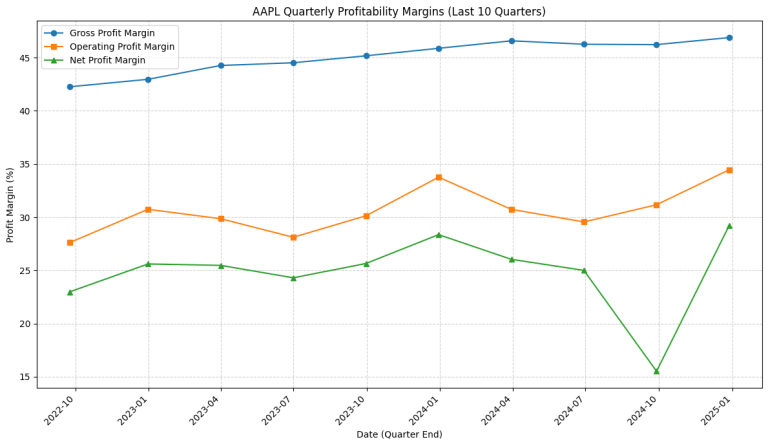

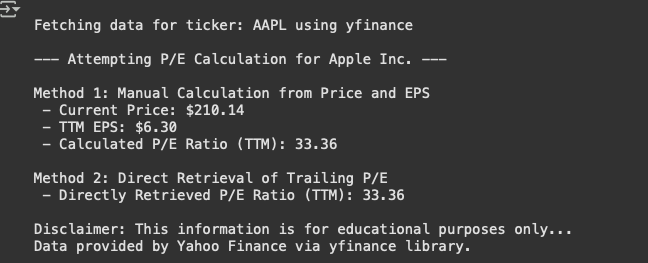

Welcome back to the Python for Finance series! In our previous posts, we’ve fetched specific metrics like P/E (Post 1), retrieved full financial statements (Post 2), and visualized profitability trends (Post 3). Now, we shift our focus from profitability to another critical aspect of fundamental analysis: Liquidity. Liquidity refers to a company’s ability to meet its short-term financial…