How Artificial Intelligence Will Transform America by 2030

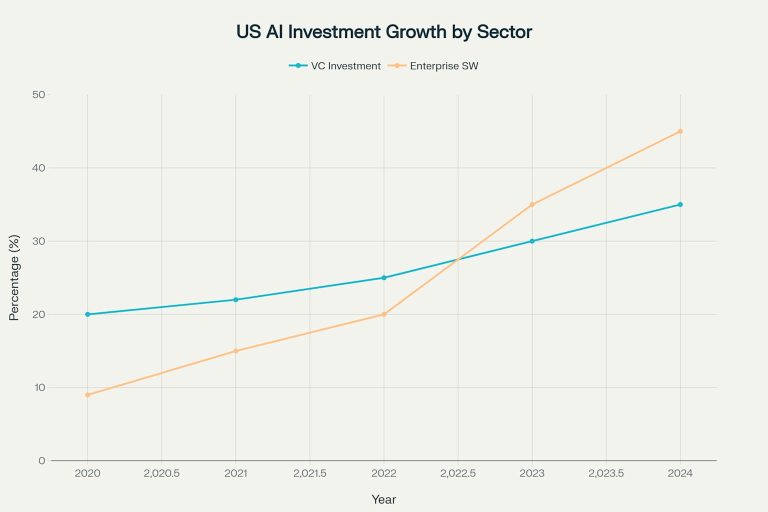

The United States stands at the precipice of an artificial intelligence revolution that will fundamentally reshape the economy, workforce, and society over the next three to five years. With AI investments surging and new policies removing regulatory barriers, America is positioning itself to maintain global AI dominance while navigating unprecedented technological transformation. Economic Impact: Trillions…