S&P 500 Correction: Danger Zone or Buying Opportunity?

Market corrections – typically defined as a 10% drop from recent highs – can be nerve-wracking for investors. Alarm bells ring, headlines turn grim, and the big question looms: Is this the start of a bigger downturn, or is it a temporary dip offering a chance to buy?

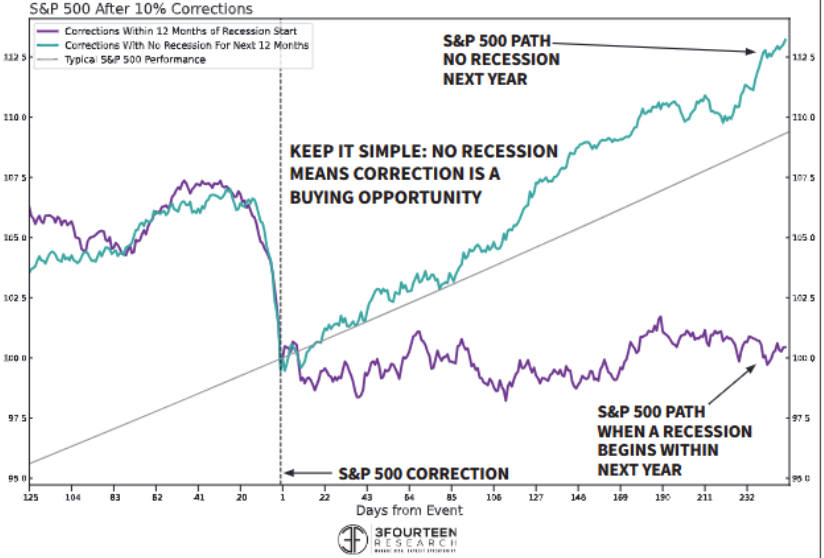

Historical data can offer valuable perspective. The chart below, courtesy of 3Fourteen Research, provides a fascinating look at how the S&P 500 has behaved after a 10% correction, specifically comparing scenarios where a recession followed within 12 months versus those where no recession occurred.

Source: 3fourteenresearch

Decoding the Divergence: The Recession Factor

The chart plots the average path of the S&P 500 in the days following the confirmation of a 10% correction. It highlights two distinct historical patterns:

- Correction Followed by Recession (Purple Line): When a recession began within 12 months of the S&P 500 hitting a 10% correction, the market’s recovery was severely challenged. As the purple line shows, after a potential brief stabilization, the index often struggled, went sideways, or even declined further over the subsequent year (approximately 230+ days shown on the chart). The onset of broader economic weakness acted as a major headwind, preventing a sustained rebound.

- Correction With No Recession Following (Teal Line): The picture is dramatically different when the economy avoids a recession in the year following the correction. The teal line shows that, on average, the 10% correction marked a significant low point. The market then tended to embark on a strong recovery path, often resuming its upward trend and delivering solid positive returns over the next year. The chart explicitly notes this scenario: “KEEP IT SIMPLE: NO RECESSION MEANS CORRECTION IS A BUYING OPPORTUNITY”.

The Key Takeaway: It’s (Mostly) About the Economy

This historical analysis suggests that the imminent economic outlook is a critical factor in determining the market’s trajectory after a significant dip.

- No Recession Ahead? History suggests these corrections are often healthy pauses in a longer-term bull market, shaking out excesses and presenting potentially attractive entry points for investors with a longer time horizon.

- Recession Lurking? If a recession is around the corner, a 10% correction might just be the first step down. The subsequent economic downturn can lead to further earnings pressure and lower stock prices.

Implications for Investors

While history provides context, it doesn’t predict the future. The major challenge, of course, is accurately forecasting whether a recession is imminent at the time of the correction. Economic forecasting is notoriously difficult.

However, this data underscores why investors pay such close attention to economic indicators (like employment, inflation, manufacturing activity, and yield curves) when the market stumbles. Assessing the probability of a recession becomes paramount.

- If the economic data remains robust and suggests continued expansion, a correction might be viewed with less trepidation, aligning with the historical “buying opportunity” scenario.

- If economic indicators are flashing warning signs, a more cautious approach might be warranted, as the correction could precede further declines associated with a recession.

Conclusion

Market corrections are a normal part of investing, but they aren’t all created equal. As the analysis from 3Fourteen Research illustrates, the economic environment that follows is crucial. While a 10% drop in a non-recessionary environment has historically proven to be a buying opportunity, similar corrections preceding a recession have often signaled more pain ahead. Understanding this difference is key to navigating market volatility.

Disclaimer: This article is for informational purposes only and should not be considered investment advice. Past performance is not indicative of future results. Market and economic conditions can change rapidly. The analysis presented is based on historical averages provided by 3Fourteen Research and may not reflect the outcome of any specific market correction. Always consult with a qualified financial advisor before making investment decisions.

Please note: This blog post was drafted with the assistance of AI and has been reviewed and edited by the author.