Safe Haven Assets Right Now: Protecting Your Portfolio When Equities, USD & Treasuries Fall

The current investment landscape presents a unique and challenging puzzle for investors. We’re navigating a period marked by significant equity market downturns, heightened market volatility 2025, and persistent economic uncertainty often amplified by geopolitical tensions. However, what makes this moment particularly complex is the unusual weakness observed in assets traditionally considered pillars of stability: the US Dollar (USD) and US Treasuries. This article explores safe haven assets right now, offering portfolio protection strategies for investors seeking stability when conventional options falter.

The Current Dilemma: When Traditional Havens Wobble

Typically, during times of market stress, investors flock to the perceived safety of the USD and US government debt. Yet, as of April 2025, this dynamic appears disrupted. Several factors contribute to this shift:

- Falling Equities: Global stock markets continue to face pressure, driving the need for portfolio protection.

- Weakening USD: The US Dollar, often a primary refuge, has shown signs of weakness against several major currencies. Concerns surrounding the impact of tariffs on USD, ongoing policy uncertainty, and shifts in global trade flows are potential contributing factors.

- Tepid Treasuries: While US Treasuries might offer some stability compared to equities, their appeal as a prime safe haven has diminished. Factors like persistent inflation concerns, the potential impact of fiscal policies, and potentially stabilizing but uninspiring yields mean they aren’t providing the robust protection investors usually expect. Recent trends show some institutional investors reducing USD exposure, further highlighting this shift.

- Tariff Troubles: Recent implementations or threats of significant tariffs have added another layer of complexity, potentially impacting global growth forecasts, inflation expectations, and currency valuations, particularly the USD.

This confluence of factors leaves many investors asking: assets down what to buy? Where can capital be sheltered effectively when equities, the dollar, and treasuries are underperforming?

What Makes an Asset a “Safe Haven”? (And How Python Can Help Assess It)

Before exploring alternatives, let’s quickly recap the essential characteristics of a safe haven asset:

- Value Retention/Appreciation: Expected to hold its value, or even increase, during periods of market turmoil.

- Low Correlation: Moves independently or inversely to broader equity markets.

- High Liquidity: Can be easily bought or sold without causing significant price fluctuations.

- Fundamental Stability: Backed by perceived economic or political stability (e.g., stable governments, sound fiscal policy).

Python Use Case 1: Analyzing Correlations Understanding correlation is critical. Using Python libraries like yfinance to fetch historical price data and pandas or numpy to calculate correlation matrices can reveal how potential havens behave relative to your equity holdings (e.g., SPY) during specific stress periods.

import yfinance as yf

import pandas as pd

# Example Tickers (Use relevant tickers for your analysis)

tickers = ['SPY', 'GLD', 'FXF', 'FXY', '^TNX'] # SPY (S&P 500), Gold ETF, Swiss Franc ETF, Yen ETF, 10Y Treasury Yield

# Note: ^TNX represents yield, not price; use Treasury bond ETFs like TLT or IEF for price correlation.

# Define relevant period (e.g., last 3 years to capture recent volatility)

start_date = '2022-04-20'

end_date = '2025-04-20' # Using our hypothetical 'today'

data = yf.download(tickers, start=start_date, end=end_date)['Adj Close']

returns = data.pct_change().dropna()

# Calculate correlation matrix

correlation_matrix = returns.corr()

print("Correlation Matrix (Example):\n", correlation_matrix)

# Focus on correlation with SPY

print("\nCorrelation with SPY:\n", correlation_matrix['SPY'])Correlation with SPY as per our Python code using last 3 years of return:

- Ticker FXF 0.106899

- FXY -0.003295

- GLD 0.240939

- SPY 1.000000

- ^TNX -0.057305

Look for assets with low or negative correlation to SPY, especially during simulated past downturns.

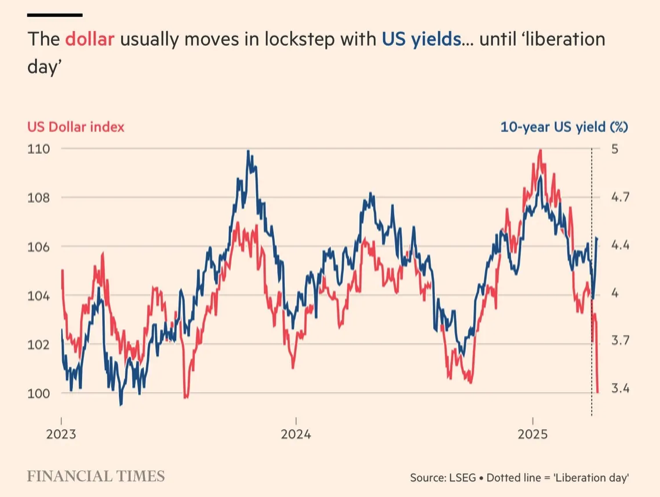

Why Traditional Havens (USD & Treasuries) Falter in April 2025

The current underperformance of the USD and Treasuries stems from a mix of cyclical and potentially structural factors relevant today:

- USD: Concerns about the impact of tariffs on USD valuations are significant. Tariffs can disrupt trade balances, potentially leading to inflationary pressures domestically and reducing foreign demand for the dollar. Coupled with broader economic policy uncertainty and the sheer scale of US debt, confidence in the dollar’s unwavering strength has been tested.

- US Treasuries: While yields may have stabilized somewhat, they might not offer sufficient real returns if inflation remains elevated. Furthermore, the same policy uncertainties and potential economic slowdown impacting the USD also affect the long-term appeal of holding US debt, especially when other sovereign options appear relatively more stable. Investors seek not just stability, but potential resilience, which Treasuries currently struggle to convincingly provide compared to alternative safe haven assets.

Viable Safe Haven Assets Right Now (April 2025)

Given the current challenges, investors need to broaden their search for safe haven assets right now. Here are some key contenders performing relatively well in the current environment:

1. Gold

The yellow metal has strongly reasserted its historical role as a premier safe haven.

- Why it’s working: Gold thrives on uncertainty. It’s seen as a hedge against inflation, currency debasement, geopolitical risk, and systemic financial stress – all factors very much present in April 2025. It has virtually no correlation with equities or bonds.

- Recent Performance: Gold has demonstrated significant strength, with prices notably pushing above the $3,100 per ounce mark earlier in April 2025, reflecting strong investor demand. Gold investment 2025 has proven effective thus far.

- Considerations: Gold pays no yield and can be volatile itself, but its performance during deep crises is historically robust.

2. Cash and Cash Equivalents

Often overlooked, holding a portion of your portfolio in cash (or highly liquid, short-term equivalents like money market funds in stable currencies) is a core defensive strategy.

- Why it’s working: Cash provides ultimate liquidity and preserves capital in nominal terms. It offers optionality – the ability to deploy funds quickly when opportunities arise or markets stabilize. In a scenario where many assets are declining, the stability of cash is valuable.

- Considerations: Inflation erodes the purchasing power of cash over time. It’s a temporary shelter and opportunity fund, not typically a long-term growth asset. Focus on holding cash in fundamentally strong currencies. Consider cash reserves investing as a tactical allocation.

3. Specific Currencies

With the USD showing weakness, other currencies with strong fundamentals are gaining appeal:

- Swiss Franc (CHF): The Swiss Franc CHF safe haven status is well-earned. Switzerland boasts political neutrality, a stable government, a robust financial system, low public debt, and a consistent current account surplus. These factors contribute to its resilience. Recent performance shows modest appreciation against weaker currencies, reflecting capital inflows seeking safety. It remains a prime candidate when looking beyond the USD.

- Japanese Yen (JPY): The Japanese Yen JPY safe haven status stems from Japan’s position as the world’s largest creditor nation, its large current account surplus, and its traditional role as a “funding currency” (often bought back during risk-off periods). While Japan faces its own economic challenges (like demographics and BoJ policy), the Yen often strengthens during global turmoil.

- (Briefly) Euro (EUR): While facing its own regional challenges, the Euro acts as the second most traded currency globally. For investors looking to diversify away from USD exposure, the EUR can serve as an alternative, though its safe-haven characteristics are generally considered less pronounced than CHF or JPY.

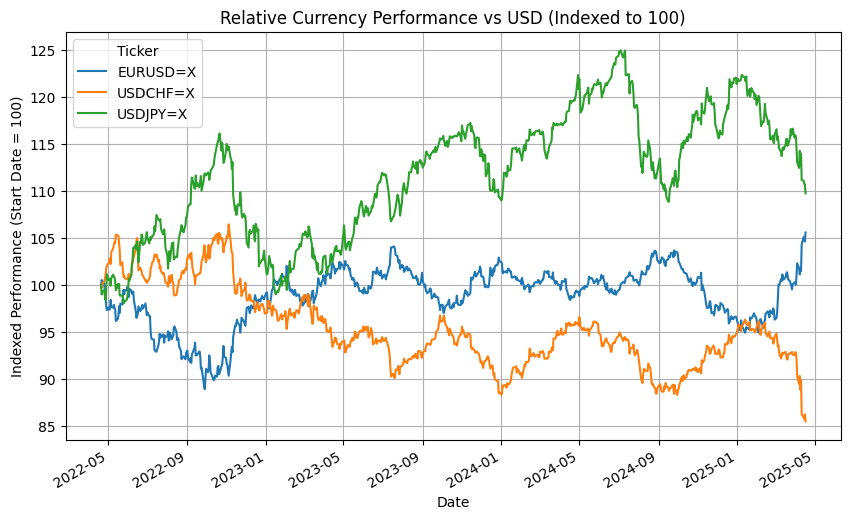

- Python Angle: Fetch historical exchange rate data (e.g., ‘CHFJPY=X’, ‘USDCHF=X’). Analyze volatility and trends. Calculate rolling correlations between currency pairs and equity indices to see how relationships change over time. Below is a Python code that will help us visualize currency strength using relative performance charts:

import yfinance as yf

import pandas as pd

# Example: Fetching and plotting currency data

fx_tickers = ['USDCHF=X', 'USDJPY=X', 'EURUSD=X']

fx_data = yf.download(fx_tickers, start=start_date, end=end_date)['Close']

# Normalize data to compare relative performance

(fx_data / fx_data.iloc[0] * 100).plot(figsize=(10, 6), title='Relative Currency Performance vs #USD (Indexed to 100)')

# Add matplotlib customization for clarity

import matplotlib.pyplot as plt

plt.ylabel('Indexed Performance (Start Date = 100)')

plt.grid(True)

plt.show()As shown in the graph below, and looking only at the last two months (approximately March and April 2025):

- Euro vs USD (EURUSD=X – Blue Line): Shows a distinct upward trend in this period. This means the Euro strengthened against the US Dollar.

- US Dollar vs Swiss Franc (USDCHF=X – Orange Line): Shows a sharp downward trend. This means the US Dollar weakened significantly against the Swiss Franc (or conversely, the CHF strengthened significantly against the USD).

- US Dollar vs Japanese Yen (USDJPY=X – Green Line): Shows a clear downward move from its peak. This means the US Dollar weakened against the Japanese Yen during these two months (or the JPY strengthened against the USD), though the USD still remained much stronger relative to the Yen compared to the start of the chart in 2022.

In summary, during the last two months depicted (approx. March-April 2025), the US Dollar weakened against the Euro, the Swiss Franc, and the Japanese Yen. The weakening was most pronounced against the Swiss Franc.

4. Other Potential Diversifiers (Use with Caution)

While not pure safe havens, some assets might offer diversification benefits but require careful consideration due to higher volatility:

- Defensive Stocks: Shares in sectors like consumer staples, utilities, and healthcare tend to have more stable earnings regardless of the economic cycle. However, they are still equities and can decline in a broad market sell-off.

- Certain Commodities: Beyond gold, some commodities might perform well depending on specific supply/demand dynamics or inflationary pressures, but they carry significant volatility and require expertise.

Portfolio Protection Strategies for Market Volatility 2025

Identifying potential safe havens is only part one. Integrating them effectively requires strategy:

- Diversification: Don’t rely on a single safe haven. Diversify across gold, cash, and fundamentally strong currencies (like CHF and JPY) to spread risk. The goal is to find assets that behave differently under stress.

- Tactical Allocation: Actively adjust your portfolio’s allocation based on changing market conditions and risk assessments. This might mean increasing exposure to alternative safe haven assets during periods of high market volatility 2025 and reducing it when risk appetite returns.

- Correlation Awareness: Understand how your chosen safe havens typically correlate with each other and with your riskier assets (like equities). Aim for low or negative correlation to maximize the diversification benefit.

- Risk Management: Implement risk management tools for your non-safe haven assets. This could include using stop-loss orders to limit potential drawdowns in equity positions.

- Consider Currency of Cash: If holding significant cash, consider diversifying the currencies you hold it in, leaning towards those identified as current safe havens. Protect portfolio from tariffs might involve reducing exposure to currencies most likely affected.

Conclusion: Navigating the Shifting Safe Haven Landscape

The investment climate of April 2025 underscores a crucial point: the safe haven landscape is not static. The unusual weakness in the US Dollar and US Treasuries, potentially exacerbated by tariff policies and broader economic uncertainty, demands a more nuanced approach to portfolio protection strategies.

Investors seeking shelter right now should look beyond the traditional playbook. Gold has strongly reasserted its value, while cash provides essential liquidity and optionality. The Swiss Franc and Japanese Yen stand out as robust currency alternatives due to their strong underlying fundamentals.

Successfully investing during market downturn requires vigilance, adaptability, and a willingness to embrace alternative safe haven assets. By understanding the current dynamics and employing thoughtful diversification and tactical allocation, investors can better position their portfolios to weather the ongoing market volatility 2025.

Disclaimer: This article is for informational purposes only and does not constitute financial, investment, or tax advice. The information provided is general in nature and may not be suitable for your individual circumstances. Market conditions and asset performance can change rapidly. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions.

Disclaimer: This blog post was drafted with the assistance of AI tools and reviewed and edited by the author.