Using Google Gemini for Financial Industry Analysis

Welcome to the first post of our brand-new series: AI for Financial Analysis! In this journey, we’ll explore how cutting-edge Artificial Intelligence, particularly Large Language Models (LLMs) like Google’s Gemini, can become powerful assistants in your financial analysis toolkit. Gone are the days of exclusively manual data sifting; AI can now help us process information, identify patterns, and generate initial insights at an unprecedented speed.

Our goal for today is to demonstrate how you can begin to understand an industry with AI, specifically using Google Gemini for industry analysis. We’ll look at how to prompt Gemini effectively for both broad overviews and specific niche industry AI analysis. This is your LLM financial analysis intro – let’s begin!

What is Industry Analysis? A Quick Refresher

Before diving into AI, let’s briefly define industry analysis. It’s the process of evaluating the broader economic and business environment in which companies operate. Key goals include understanding:

- Market Size and Growth: How big is the industry, and what are its growth prospects?

- Key Trends: What technological, regulatory, consumer, or economic trends are shaping the industry? This could be anything from the rise of sustainable aviation fuel (SAF) producers to shifts in consumer preferences impacting traditional sectors.

- Major Players & Market Share: Who are the dominant companies, and what are their strategic focus areas?

- Competitive Forces: How intense is competition? What are the barriers to entry? (Frameworks like Porter’s Five Forces are often used here).

- Opportunities and Risks: What are the potential upsides and downsides for companies in this sector, including emerging risks like supply chain vulnerabilities?

A solid industry analysis provides the context needed before assessing individual companies.

How Gemini Can Assist in Your Industry Analysis Workflow

Google Gemini, with its advanced natural language understanding and generation capabilities, can be a valuable starting point for AI market research. Here’s how it can help:

- Summarizing Reports and Articles: Feed Gemini lengthy industry reports (e.g., a market outlook for the global robotics sector) or news articles, and ask for concise summaries.

- Identifying Trends from Text: Provide Gemini with a collection of texts and ask it to identify recurring themes or emerging trends, such as the adoption rate of AI in agricultural technology (AgriTech).

- Answering Specific Questions: Ask direct questions, like “What are the primary drivers of growth in the space tourism industry as of early 2025?” or “What are the main regulatory challenges for decentralized finance (DeFi) platforms in Southeast Asia?”

- Generating Initial Frameworks: Gemini can help draft initial frameworks like a SWOT analysis for an industry, for example, assessing the strengths of the telehealth market post-pandemic.

- Brainstorming & Idea Generation: Use it to brainstorm potential disruptive factors, such as the impact of quantum computing on pharmaceutical research.

Prompting Gemini for Industry Insights (Example Prompts)

Effective prompting is key. Here are some Gemini prompts finance examples:

1. Summarizing Recent Industry News: Prompt: “Summarize the top 5 most impactful news articles concerning the global cultured meat industry published since January 2025. For each, identify the key event and its potential implications.”

2. Identifying Key Trends (Specify Date Sensitivity): Prompt (General Knowledge): “Based on your knowledge up to your last update, identify 3-5 major strategic trends currently shaping the wearable technology market for healthcare applications as of May 2025.”

3. Listing Major Players and Their Focus: Prompt: “List the top 3-4 key companies specializing in carbon capture and storage (CCS) technology globally. Briefly describe their primary technological approach and recent partnerships as of early 2025.”

4. Generating a Draft SWOT Analysis: Prompt: “Generate a draft SWOT analysis for the direct-to-consumer (DTC) personalized supplement industry, considering developments in 2024 and early 2025. Focus on industry-level factors.”

5. Assessing AI Impact on a Traditional Industry: Prompt: “Analyze the potential disruptive impact of AI-powered diagnostic tools on the traditional radiology services industry. What are the key opportunities and threats for existing players over the next 5 years, as of May 2025?”

Tips for Better Prompts:

- Be Specific: More context yields better results.

- Define the Persona/Role: “Act as a market research analyst specializing in…”

- Specify the Format: “Provide in bullet points,” “Create a table.”

- Set a Timeframe: Crucial for financial data, e.g., “as of Q2 2025.”

Interpreting Outputs & CRUCIAL Limitations

Using Gemini for Gemini industry analysis can be a great time-saver, but it’s absolutely critical to understand its limitations:

- Potential for Hallucinations/Inaccuracies: LLMs can generate plausible but incorrect information. Always verify critical data points against reputable primary sources like company filings, reports from established firms (e.g., McKinsey, Deloitte), or official government statistics.

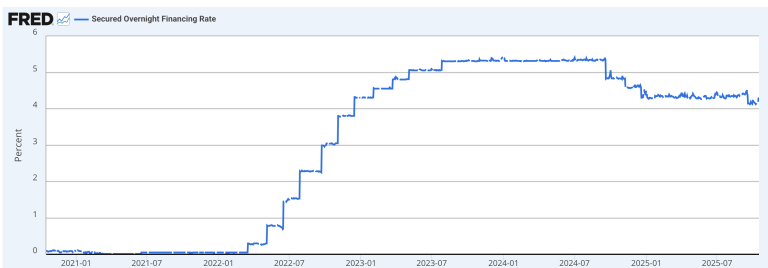

- Data Freshness & Knowledge Cutoff: While some Gemini models access real-time information, others have knowledge cutoffs. As of May 2025, clarify your model’s capabilities. This validation is especially crucial when performing AI market research for niche or frontier markets, such as assessing the growth drivers for sustainable packaging solutions in emerging economies, where public data might be less structured.

- Lack of Deep Context & Nuance: Gemini processes text; it doesn’t understand finance like a seasoned analyst. It might miss subtle nuances or the true significance of certain events, especially in complex regulatory environments.

- Bias in Training Data: LLMs learn from vast datasets, which can reflect existing biases. This might influence how information is presented. Be mindful of this, especially when researching sensitive topics.

- No Original Research: Gemini synthesizes existing information. It cannot conduct primary research.

- Surface-Level Analysis: For deep dives, like a detailed Porter’s Five Forces analysis for the global battery recycling industry, Gemini can provide a draft, but it will likely require significant expert refinement.

Think of Gemini as a highly capable research assistant, not a replacement for your analytical skills and judgment.Use it to accelerate information gathering, get initial summaries, and draft frameworks, but always apply critical thinking and validate findings.

Conclusion: Gemini as a Starting Point for Industry Understanding

Google Gemini offers exciting possibilities for analysts looking to understand an industry with AI, whether it’s a broad sector or a specific niche. Its ability to quickly summarize information and identify textual trends makes it a valuable tool for initial AI market research. By crafting effective Gemini prompts finance focused, you can significantly speed up the early stages of industry analysis.

However, always remember the limitations. The outputs need critical review, validation against primary sources, and integration with your own expertise. In our next post, we’ll move from the broader industry view to focusing on individual companies, exploring how Gemini can assist with Company-Specific Financial Analysis.