Understanding How the Federal Reserve Manages the Yield Curve

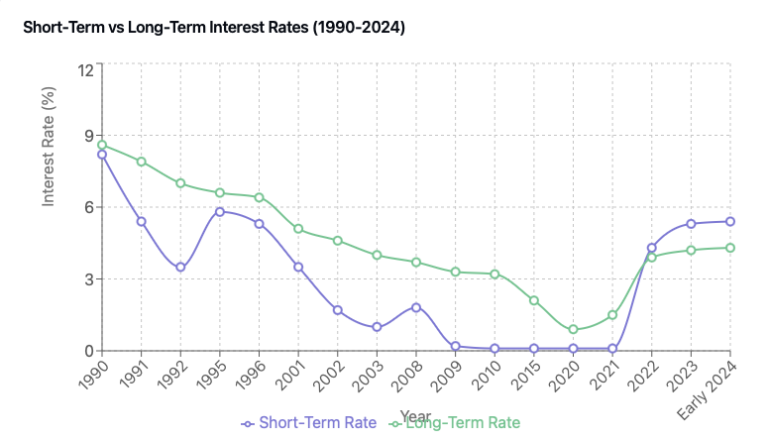

The Federal Reserve’s influence on the yield curve is both powerful and complicated, with different parts of the curve responding differently to monetary policy actions. While the Fed has strong control over short-term rates, its influence diminishes across longer maturities, creating an intricate dynamic that shapes the entire yield curve.

The Fed’s Direct Control: The Short End

At the short end of the yield curve, the Federal Reserve exercises nearly complete control through its federal funds rate target. This rate directly influences other short-term rates like Treasury bills and commercial paper. When the Fed adjusts its target rate, short-term yields typically move in near-perfect correlation.

The Long End: A Different Story

However, the relationship becomes more complex at the longer end of the curve. When the Fed cuts rates, long-term yields often don’t decline by the same magnitude. Several factors explain this phenomenon:

1. Inflation Expectations

Long-term yields incorporate market expectations for future inflation. Even if the Fed cuts rates today, investors might worry that lower rates could fuel future inflation, leading them to demand higher yields on long-term bonds.

2. Term Premium

Investors typically demand extra compensation for holding longer-dated securities due to:

- Greater uncertainty over longer time horizons

- Higher inflation risk

- Reduced liquidity compared to shorter-term instruments

3. Economic Growth Projections

Long-term rates reflect market expectations for future economic growth. If investors believe rate cuts signal stronger future growth, they might sell bonds, pushing yields higher.

The Transmission Mechanism

The Fed influences longer-term rates through several channels:

- Forward Guidance: By communicating future policy intentions, the Fed can influence market expectations and, consequently, longer-term rates.

- Portfolio Balance Channel: Through quantitative easing (QE), the Fed can directly purchase longer-term securities, affecting their yields.

- Signaling Effect: Rate decisions signal the Fed’s economic outlook, influencing market participants’ long-term expectations.

Recent Historical Examples

During the 2020 pandemic response, the Fed cut the federal funds rate by 150 basis points (1.50%), but 10-year Treasury yields fell by only about 100 basis points (1.00%). This differential response illustrates how long-term yields often move less dramatically than short-term rates.

- Federeal Funds Effective rate (source FRED):

- 10 years treasury yield (source FRED):

Market Implications

This varying response across the yield curve has important implications:

- Banks’ net interest margins can be affected differently depending on their asset-liability duration

- Investment strategies need to account for the non-uniform response

- Economic stimulus from rate cuts may work through different channels than traditionally assumed

Conclusion

Understanding that Fed rate changes don’t translate one-for-one across the yield curve is crucial for market participants. The complex interplay of factors affecting long-term rates means that monetary policy transmission is more nuanced than often portrayed.