Is Gold Still the Ultimate Safe Haven? A Data-Driven Guide for Investors

Gold has been on a historic run, smashing records and leaving many investors wondering: Is it time to add some shine to my portfolio? For centuries, gold has been the go-to asset in times of trouble. When markets panic, the old wisdom says to buy gold.

But does that wisdom still hold true?

The answer is more complex than a simple “yes” or “no.” Gold’s power as a portfolio protector isn’t a constant; it’s a conditional superpower that depends entirely on the economic environment. It can be a powerful shield, but under the wrong conditions, it becomes dead weight.

This guide breaks down the specific, data-backed regimes when gold works its magic—and when it fails—so you can make smarter decisions.

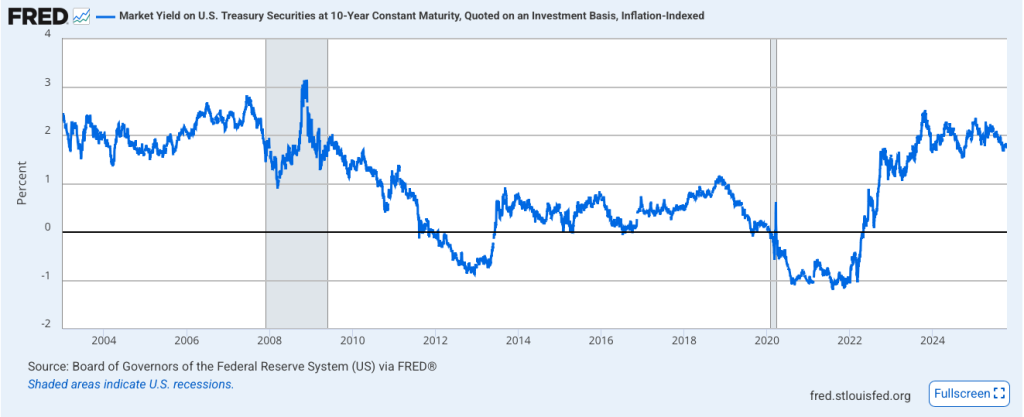

The Golden Rule: It’s All About Real Interest Rates

If you only track one metric to understand gold, make it real interest rates. This is the single most important driver of gold’s price.

A real interest rate is simply the interest you earn from a “risk-free” investment (like a 10-year U.S. Treasury bond) after accounting for inflation.

Here’s the logic: Gold is an asset that pays no dividend or interest. In fact, it costs money to store and insure. Its primary competitor for safe-haven capital is government bonds that do pay interest.

- When real rates are high: Why hold a non-yielding metal when you can get a positive, inflation-adjusted return from a government bond? The “opportunity cost” of holding gold is high, so its price tends to fall.

- When real rates are low or negative: Holding a bond that loses purchasing power to inflation is a losing proposition. Suddenly, gold’s zero yield looks attractive. The opportunity cost of holding gold vanishes, and investors flock to it as a store of value, driving its price up.

This inverse relationship is the most reliable mechanism behind gold’s performance.

Myth-Busting: “Gold Always Hedges Inflation”

This is one of the biggest misconceptions in finance. Gold is an unreliable inflation hedge because its performance depends on the central bank response to that inflation.

Let’s look at two historical examples:

- The 1970s (Success): Inflation was rampant, but central banks were slow to react. Nominal interest rates were lower than inflation, leading to deeply negative real rates. Gold performed spectacularly, soaring from around $40 to $850 per ounce. It wasn’t just hedging inflation; it was reacting to the negative real yields.

- 2022 (Failure): Inflation surged to 40-year highs, but gold’s performance was dismal. Why? The Federal Reserve hiked interest rates aggressively, faster than inflation. This caused real rates to spike from negative territory to well above 1%. The high opportunity cost crushed gold, even as consumer prices soared.

The Takeaway: Gold is not a hedge against rising prices. It is a hedge against falling real interest rates, which often—but not always—accompanies inflation.

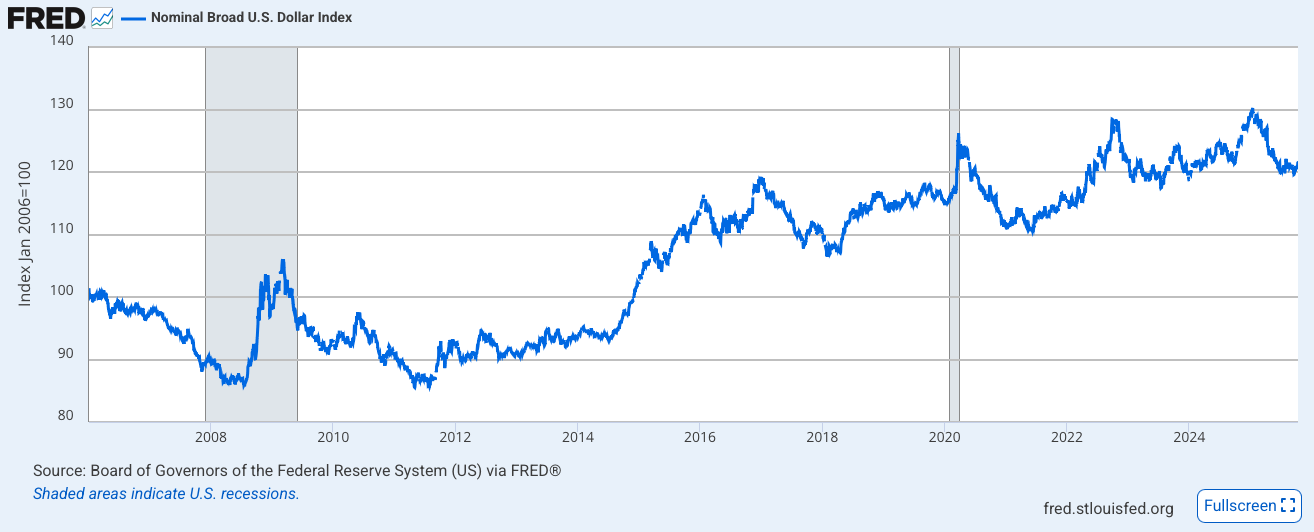

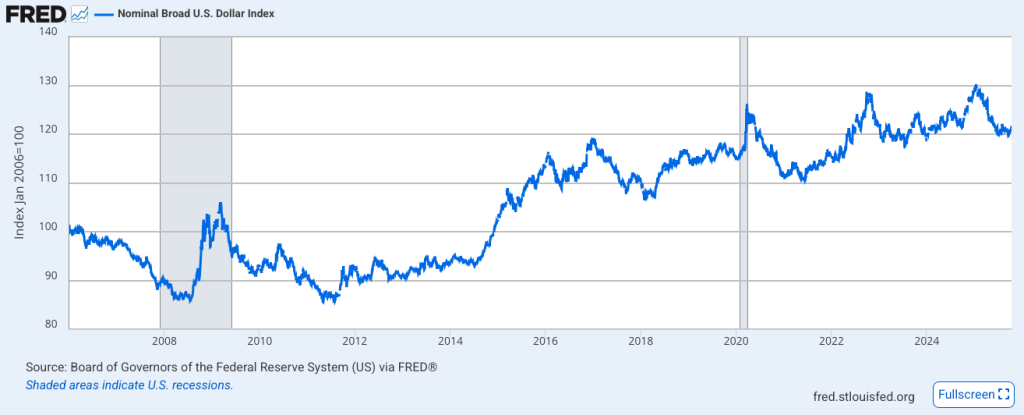

The Dollar’s Dance with Gold

Because gold is priced in U.S. dollars globally, it has a strong inverse relationship with the dollar’s strength.

- A weaker dollar makes gold cheaper for foreign investors, boosting demand. It also signals a potential loss of confidence in the world’s primary reserve currency, prompting diversification into gold.

- A stronger dollar makes gold more expensive for buyers using other currencies and often coincides with higher real rates in the U.S., creating a double headwind for the metal.

In recent years, a new factor has emerged: de-dollarization. Central banks, particularly in emerging markets like China, India, and Turkey, have been aggressively buying gold to diversify their reserves away from the U.S. dollar. This has created a new, steady source of demand that provides a potential floor for gold prices, a structural shift that didn’t exist in previous decades.

A Tale of Two Crises: Savior vs. Source of Cash

Gold’s reputation as a “crisis hedge” is true, but it has a critical nuance. Its performance depends on the type of crisis.

- Solvency Crisis (Gold Shines): In a prolonged crisis where investors fear the collapse of institutions (like the aftermath of the 2008 Lehman Brothers bankruptcy), gold excels. As central banks flood the system with liquidity and cut rates to zero, real yields plummet, and gold’s status as an asset with no counterparty risk makes it the ultimate safe haven.

- Liquidity Crisis (Gold Dips First): In a sudden “dash for cash” panic (like the initial COVID-19 shock in March 2020), gold can temporarily sell off alongside stocks. This is because leveraged investors facing margin calls must sell their most liquid assets to raise cash, and gold is highly liquid. However, this dip is often short-lived. The inevitable central bank response (cutting rates, launching QE) crushes real yields and triggers the next rally in gold.

Does It Actually Work in a Portfolio?

Theory is great, but what about the results? Adding a modest 5-10% allocation of gold to a traditional 60/40 stock and bond portfolio has historically delivered significant risk-reduction benefits.

While it may slightly lower the portfolio’s overall long-term return (equities are the engine of growth), the data shows it materially improves risk-adjusted returns. Most importantly, it has consistently reduced the size of maximum drawdowns during market crashes and improved performance during the worst periods of stock market losses. It acts as a buffer, smoothing the ride without sacrificing much upside.

What to Watch: A Dashboard for Gold Investors

To gauge whether the environment is favorable for gold, keep an eye on these key indicators:

- 10-Year Real Yield (TIPS): The trend here is paramount. Falling yields are bullish; rising yields are bearish. (FRED Ticker: DFII10).

- U.S. Dollar Index (DXY/DTWEXBGS): A sustained downtrend in the dollar is a major tailwind for gold.

- Central Bank Buying: Watch quarterly reports from the World Gold Council. Consistent, heavy buying provides a strong support level.

- Investor Flows: Track the inflows and outflows of major gold ETFs (like GLD and IAU) as a barometer of Western investor sentiment.

The Final Verdict

Gold is not a magic bullet, nor is it a simple hedge against every boogeyman in the market. Its role is nuanced and tactical. It thrives in specific, identifiable conditions—namely, falling real interest rates, a weakening U.S. dollar, and systemic solvency fears.

For the modern investor, gold is best viewed not as a primary engine for growth, but as a strategic diversification tool. A small allocation can provide valuable insurance against specific economic storms, acting as a stabilizing force when traditional assets falter. In an uncertain world, that’s a role worth its weight.