The Dollar and Yields: Understanding the Divergence in the last weeks

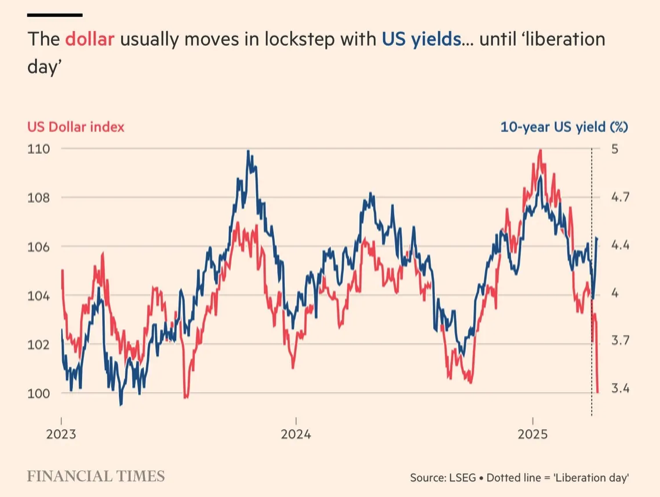

For years, investors and market watchers relied on a simple rule of thumb: when US Treasury yields rise, the US Dollar (USD) tends to strengthen. It makes intuitive sense – higher returns attract foreign capital, increasing demand for dollars. As the chart below illustrates, this relationship held reasonably well through 2023 and 2024.

However, recent market action, particularly around what some commentators dubbed “Liberation Day” in early April 2025, has thrown this reliable correlation into question. We’ve seen US yields climb, yet the dollar hasn’t followed in lockstep, even weakening significantly at times. What’s driving this unusual divergence between US yields and the USD?

Caption: The US Dollar Index (Red) and 10-year US Treasury Yield (Blue) often move together, but a divergence appeared around early 2025. Source: LSEG via Financial Times

Why Yields and the Dollar Usually Dance Together

Normally, the connection is straightforward:

- Higher Yields Attract Capital: When US Treasury bonds offer higher interest rates (yields) compared to other countries, global investors are incentivized to buy them.

- Demand for Dollars: To purchase these US assets, investors need to buy US dollars.

- Stronger Dollar: This increased demand for USD pushes its value higher against other currencies (often measured by the US Dollar Index, or DXY) (Source: usmart Singapore, Investing.com).

Conversely, falling US yields typically make the dollar less attractive, leading to its depreciation. This positive correlation has been a cornerstone of forex market analysis for a long time (Source: EFG International).

Signs of a Split: When the Music Changed

Look closely at the chart towards 2025. While both lines still show volatility, the tight correlation starts to vanish. Leading up to and following the period marked “Liberation Day” (referring to major US tariff announcements around April 2nd, 2025), the divergence became pronounced as seen in the chart above. 10-year yields pushed higher, touching levels around 4.5% and beyond (Source: Lipper Alpha Insight), but the Dollar Index initially stumbled before recovering some ground, not mirroring the sharp ascent in yields.

Why the Divergence? Unpacking the Key Drivers

Several complex factors are colliding to break the traditional link:

- The “Liberation Day” Tariff Shock: On April 2, 2025, the US administration announced sweeping new tariffs – a baseline 10% on most imports, plus significant reciprocal tariffs on specific countries (Source: Julius Baer, CEPR). Economic theory might suggest tariffs strengthen the home currency, but the opposite happened initially (Source: EFG International). The USD weakened sharply against major G10 currencies like the Euro, Yen, and Swiss Franc immediately following the announcement (Source: CEPR, Julius Baer).

- Global Economic Fears Trump Yields: The tariff news sparked significant fear about a global trade war, potential damage to global growth, and even a US recession. This risk-off sentiment didn’t automatically translate into a stronger safe-haven dollar. Instead, concerns about the source of the instability (US trade policy) may have weighed on the currency.

- Shifting Investor Confidence & Portfolio Flows: Some analysts suggest the aggressive trade stance potentially undermined international investors’ confidence in the US’s economic stability and reliability (Source: EFG International). This could be leading to portfolio rebalancing away from US assets, particularly equities, driving dollar weakness despite higher yields. Evidence points towards flows into other safe havens like the Swiss Franc and Japanese Yen (Source: Saxo Bank).

- Complex Reasons for High Yields: Yields haven’t just risen on strong growth expectations. Recent turbulence has been driven by:

- Inflation Worries: Persistent inflation, potentially exacerbated by tariffs, keeps pressure on yields.

- Treasury Supply: The US continues to issue substantial amounts of debt, requiring higher yields to attract buyers.

- Technical Factors: Unwinding of leveraged trades (like “basis trades”) and potential selling by foreign holders added to selling pressure on bonds, pushing yields up (Source: NAB, Lipper Alpha Insight).

- Market Liquidity: Concerns about market capacity to absorb new debt issuance have also played a role (Source: T. Rowe Price). The dollar seems less responsive when yield rises are driven by these less positive factors, rather than pure economic strength.

- Federal Reserve Policy Uncertainty: The Fed faces a tricky balancing act. Tariffs could fuel inflation and slow growth (stagflation risk). This makes the path for interest rate cuts highly uncertain. While markets might anticipate eventual cuts (which could weaken the dollar), the Fed may hold off due to inflation risks, creating conflicting signals for the currency.

What Does This Mean for Investors?

The breakdown of the traditional yield-dollar relationship introduces significant uncertainty:

- Hedging Complexity: Currency hedging strategies based on interest rate differentials become less reliable.

- Asset Allocation: The drivers behind yield moves matter more than ever. Yields rising due to inflation or supply concerns have different implications for equities and risk assets than yields rising due to strong growth.

- Dollar’s Role: Some question whether these policy shifts could impact the dollar’s long-term status as the world’s primary reserve currency.

Conclusion: A New Market Regime?

The divergence between US yields and the dollar highlights a complex interplay of trade policy shocks, shifting global economic concerns, technical market factors, and central bank uncertainty. The simple days of “higher yields = stronger dollar” appear to be on pause, perhaps even over. Investors now need to dig deeper into the reasons behind market moves, as the old correlations can no longer be taken for granted in this evolving landscape.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Market conditions are subject to change. Readers should consult with a qualified financial advisor before making any investment decisions.

This article was generated by an AI language model and reviewed by a human editor.