The Copper Crunch: Why Your Electric Car Dreams Are Getting More Expensive

And other inconvenient truths about the metal that powers our green future

Remember when we all thought going electric would be simple? Buy a Tesla, install some solar panels, pat ourselves on the back for saving the planet. Well, I’ve got some news that might make your eco-friendly wallet a little lighter: we’re running out of the good copper.

Not out out—there’s still plenty of the reddish metal buried in the ground. But the easy-to-get, high-quality stuff that doesn’t cost a fortune to extract? That’s disappearing faster than your phone battery on a busy day.

The Dirty Truth About Clean Energy

Here’s the thing nobody talks about at climate conferences: every wind turbine, every electric vehicle, every solar farm is essentially a copper-eating machine. A single electric car uses about four times more copper than a gas-guzzling SUV. A wind farm? Don’t even get me started—we’re talking tons of the stuff per turbine.

The experts at BHP (you know, the mining giant) are projecting that global copper demand could surge by 70% by 2050. That’s like saying we need to find and dig up the equivalent of about 15 new massive copper mines in the next 25 years. Spoiler alert: we haven’t found them yet.

When Mother Earth Stops Being Generous

I spent way too much time diving into mining company earnings reports (yes, this is what passes for fun in my world), and the story they tell is pretty sobering. The headline that kept jumping out: “declining ore grades.” In plain English? The copper that’s left in the ground is getting harder and more expensive to extract.

Think of it like this: imagine you’re looking for quarters in your couch cushions. At first, you find the easy ones sitting right on top. But eventually, you’re digging deeper, moving more cushions, and finding fewer coins for all that extra effort. That’s essentially what’s happening to copper mining, except instead of couch cushions, we’re talking about moving millions of tons of rock.

Glencore, one of the world’s biggest copper producers, just reported a 30% drop in first-quarter production. Their excuse? Lower ore grades and poor recovery rates at their major mines. Translation: they’re having to work a lot harder to get a lot less copper.

The Numbers Game That’s Costing Us All

Here’s where the math gets brutal. When copper ore quality drops from 0.5% to 0.4%—which might sound like nothing—miners suddenly have to dig up and process 25% more rock to get the same amount of metal. More rock means more diesel fuel for those massive trucks, more electricity for grinding, more water for processing, and ultimately, more money.

Freeport-McMoRan, which runs some of the world’s most efficient mines, is dealing with costs of over $3 per pound at their U.S. operations. Meanwhile, their Indonesian mine is so rich in gold as a byproduct that copper production there actually generates a cash credit of 99 cents per pound. It’s like running a business where some locations print money while others barely break even.

The Real Winners and Losers

Not all mining companies are created equal, and the recent earnings season made that crystal clear. Here’s who’s winning and losing in the copper lottery:

The Champions: Companies like Antofagasta are absolutely crushing it, with cash costs of just $1.12 per pound thanks to hefty gold and molybdenum byproduct credits. It’s like getting paid to throw a party because you can sell the empty bottles for more than the drinks cost.

The Strugglers: First Quantum Minerals lost their crown jewel mine in Panama to political disputes (more on that nightmare later), leaving them with higher-cost operations in Zambia. Their costs jumped to $2.00 per pound, and that’s before accounting for all the headaches.

The Steady Eddies: BHP delivered record copper production from their Chilean operations, proving that sometimes boring, well-run mines beat flashy new projects.

When Politics Meets Pickaxes

If declining ore grades weren’t enough to worry about, there’s the little matter of countries deciding they don’t want foreign mining companies operating on their soil anymore. Panama’s government shut down First Quantum’s Cobre Panamá mine—one of the world’s largest and newest copper operations—over a contract dispute.

Poof. Just like that, over 300,000 tonnes of annual copper production vanished from global supply. It’s like if Apple suddenly decided to stop making iPhones because they didn’t like their manufacturing contracts.

This isn’t an isolated incident. Mining companies are increasingly finding themselves caught between local communities, environmental activists, and governments looking to renegotiate deals or flex their sovereignty muscles. The result? Higher risk premiums, more expensive insurance, and ultimately, more expensive copper.

The $130 Billion Question

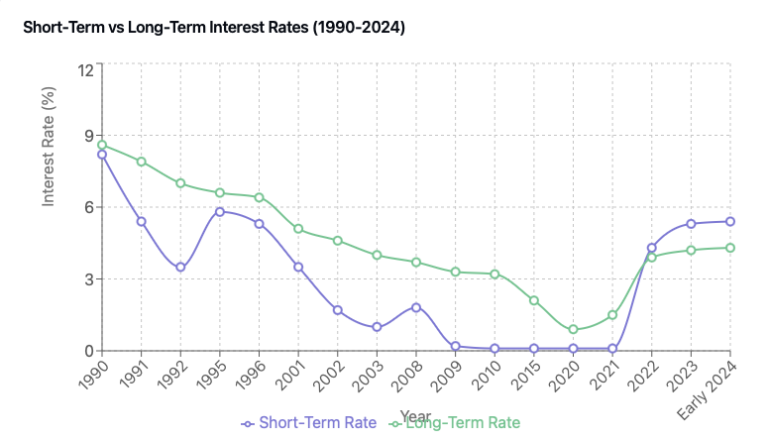

Wood Mackenzie, the energy research firm, estimates that the industry needs to commit $130 billion in new investment over the next decade just to meet basic demand and replace depleting mines. That’s not exactly pocket change—it’s more than the GDP of most countries.

The problem is that most of the easy copper deposits have already been found and mined. What’s left requires digging deeper, in more remote locations, often in countries with questionable political stability. Each new generation of copper mines is inherently more expensive to build and operate than the last.

Goldman Sachs analysts are talking about a “Chilean floor” for copper prices—around $10,500 per tonne by 2026—below which it doesn’t make economic sense to build the mines we desperately need.

Your Electric Future Just Got Pricier

So what does all this mean for regular people trying to buy electric cars, install heat pumps, or just live in a world transitioning to clean energy?

Simply put: get ready to pay more. The era of cheap copper is ending, and since copper is basically the circulatory system of modern technology, higher copper prices eventually show up in the price of everything from air conditioners to charging cables.

For automakers, this is particularly problematic. They’ve made big promises about electric vehicle adoption, but copper represents a significant chunk of an EV’s bill of materials. As copper prices rise, either car prices go up, or profit margins get squeezed. Neither option is great for accelerating the transition to electric transportation.

The Uncomfortable Truth About Green Dreams

Here’s the part that makes climate policy wonks uncomfortable: our renewable energy future is entirely dependent on extracting massive amounts of metals from the ground. We can’t build wind turbines, solar panels, or electric car batteries without mining. Yet environmental and political opposition to new mines continues to grow.

It’s the ultimate catch-22. We want clean energy, but we don’t want the mines needed to build clean energy infrastructure. We want electric cars, but we get upset when copper prices make them more expensive.

The most successful mining companies are already adapting to this new reality. They’re focusing on assets in stable countries, developing innovative extraction technologies, and maximizing the value of byproduct metals. Smart investors are taking note.

What Comes Next

The copper supply crunch isn’t going away anytime soon. If anything, it’s likely to get worse before it gets better. The timeline from discovering a new deposit to producing copper can stretch beyond a decade, meaning supply responses are painfully slow.

In the meantime, expect more consolidation in the mining industry as companies with deep pockets acquire smaller players with promising assets. Expect more investment in copper recycling technologies. And expect higher prices for pretty much everything that contains copper.

The green energy transition isn’t stopping—if anything, it’s accelerating. But it’s going to cost more than we thought, take longer than we hoped, and require some uncomfortable conversations about mining in our own backyards.

The next time someone tells you that renewable energy is getting cheaper every year, remind them that the raw materials certainly aren’t. The copper crunch is real, it’s expensive, and it’s about to make your electric dreams a lot more costly.

Sometimes the most inconvenient truths are hiding in quarterly earnings reports from mining companies. Who knew?