Consumer Sentiment: When Americans Stop Believing in Tomorrow

Imagine if you could measure the collective mood of 330 million Americans about their financial future, boil it down to a single number, and use that to predict when the economy might tank. Sounds like science fiction, right? Well, welcome to the University of Michigan Consumer Sentiment Index—arguably one of the most underappreciated crystal balls in economic forecasting.

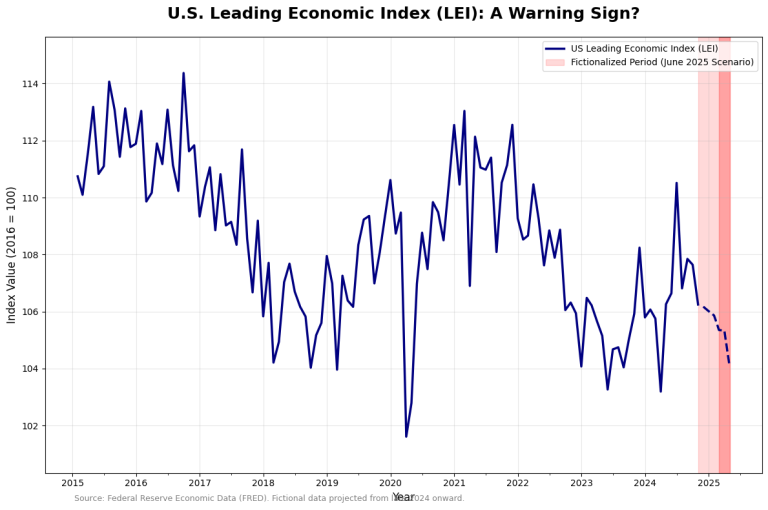

And right now, that crystal ball is showing some pretty dark clouds. The latest reading of 52.2 for May 2025 isn’t just low—it’s near-record-low territory that historically screams “recession incoming.” To put this in perspective, the only time consumer sentiment has been lower was during the COVID-19 pandemic and the 2008 financial crisis. Yikes.

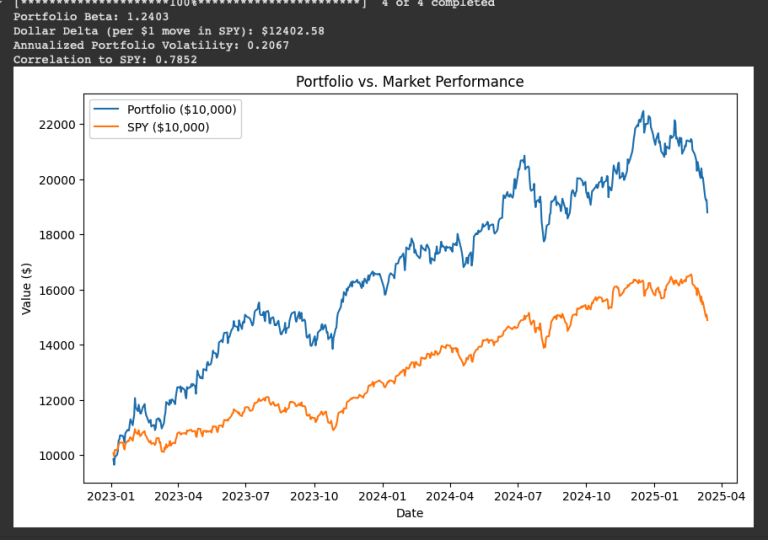

But here’s what makes this particularly fascinating for us Python finance nerds: consumer sentiment isn’t just a feel-good metric. It’s a leading indicator that often predicts consumer spending patterns, stock market movements, and economic cycles months before they show up in official statistics. And if you know how to code it up properly, you can potentially get ahead of the curve while everyone else is still wondering why their portfolios are suddenly bleeding red.

The Psychology Behind the Numbers

Let’s start with the basics: what exactly is consumer sentiment? Think of it as a monthly mood ring for the American economy. The University of Michigan surveys about 500 randomly selected households each month, asking them questions like “Do you think now is a good time to buy a house?” and “How do you expect your financial situation to change over the next year?”

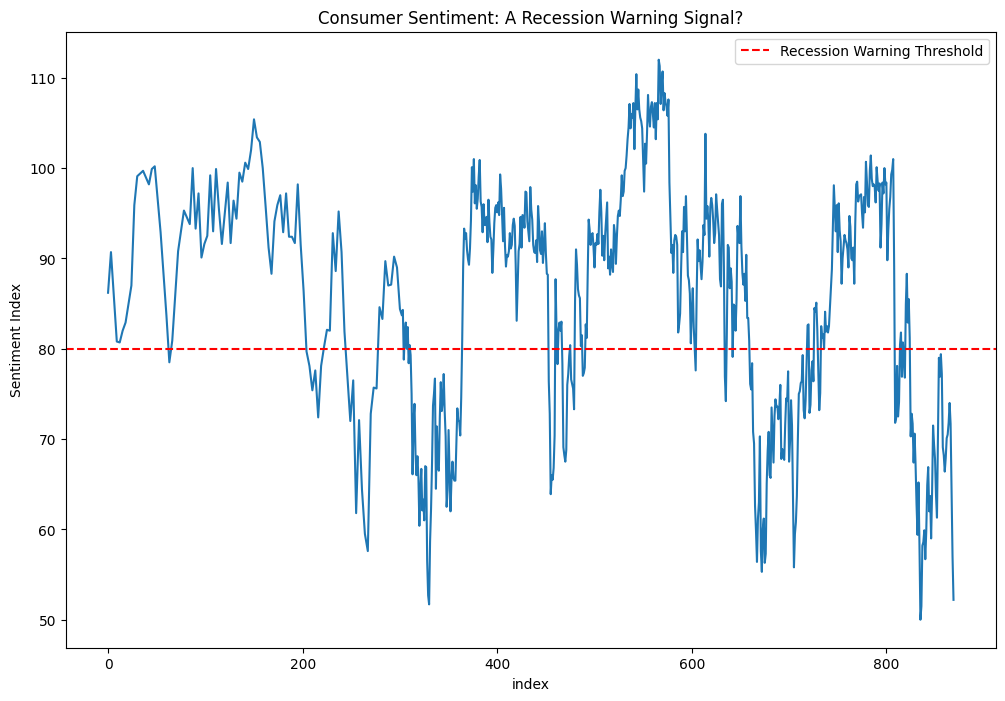

The answers get crunched into a single index where 100 represents the baseline from 1966. Historically, readings above 80 suggest Americans are feeling pretty good about their economic prospects, while anything below 80 starts raising recession warning flags. Our current reading of 52.2? That’s in the “Houston, we have a serious problem” territory.

What makes this particularly alarming is the trajectory. We’ve watched sentiment plummet from 71.7 in January 2025 to today’s dismal reading—a drop of more than 27% in just five months. That’s not a gentle decline; that’s consumers falling off an economic cliff in terms of confidence.

Tariffs: The Confidence Killer

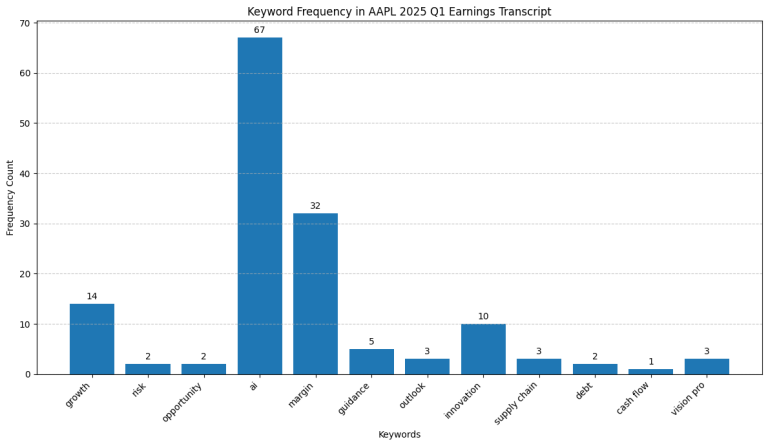

Here’s where things get interesting (and by interesting, I mean terrifying). Nearly three-quarters of survey respondents are spontaneously mentioning tariffs when asked about economic conditions—up from 60% in April. When economists say “spontaneously,” they mean people are bringing up tariffs without being prompted. That’s like having 75% of people at a party start complaining about the same thing without anyone asking.

The reason? Tariff uncertainty is creating a perfect storm of economic anxiety. Businesses don’t know what their costs will be next quarter, consumers don’t know if their morning coffee will cost 20% more next month, and everyone’s collectively throwing their hands up and saying, “I give up trying to predict anything.”

Joanne Hsu, the director of the Consumer Sentiment survey, put it perfectly: “Tariff uncertainty continues to dominate consumers’ thinking about the economy.” When trade policy becomes the main topic of conversation at grocery stores and dinner tables, you know something fundamental has shifted in how people view their economic future.

The Python Approach to Tracking Sentiment

Now, let’s get our hands dirty with some code. Tracking consumer sentiment through Python gives you several advantages: you can automate alerts for significant changes, correlate sentiment with market movements, and build predictive models that incorporate psychological factors along with traditional economic indicators.

# Accessing Consumer Sentiment Data

import yfinance as yf

import pandas as pd

import matplotlib.pyplot as plt

import seaborn as sns

# Method 1: Using FRED API for University of Michigan Consumer Sentiment

import pyfredapi as pf

sentiment_data = pf.get_series(series_id="UMCSENT", api_key="your_api_key")

# Visualization with Seaborn

plt.figure(figsize=(12, 8))

sns.lineplot(data=sentiment_data.reset_index(), x='index', y='value')

plt.title("Consumer Sentiment: A Recession Warning Signal?")

plt.axhline(y=80, color='red', linestyle='--', label='Recession Warning Threshold')

plt.ylabel("Sentiment Index")

plt.legend()

plt.show()

# Calculate year-over-year change

yoy_change = ((sentiment_data.iloc[-1] - sentiment_data.iloc[-12]) / sentiment_data.iloc[-12]) * 100

print(f"Year-over-year change: {yoy_change:.1f}%")

What’s particularly useful about this approach is that you can set up automated alerts for significant sentiment shifts. I typically watch for:

- Monthly drops exceeding 5 points: Suggests something major happened

- Readings below 60: Time to get defensive with investments

- Three consecutive months of decline: Usually precedes broader economic weakness

The beauty of the FRED API is that it includes not just the headline number, but also the sub-components: current conditions vs. future expectations. Right now, the expectations component (47.9) is particularly weak, suggesting Americans aren’t just unhappy with today—they’re genuinely worried about tomorrow.

The Correlation Game: Sentiment vs. Reality

Here’s where consumer sentiment gets really interesting: it’s both a predictor and a driver of economic activity. When people feel pessimistic about the future, they stop spending money on discretionary items. And since consumer spending represents about 70% of U.S. GDP, what people think will happen often becomes what actually does happen.

The current sentiment reading of 52.2 historically correlates with significant market volatility and economic slowdowns. During the 2008 financial crisis, sentiment bottomed out around 55. In 2022, when inflation was running rampant, it hit 50.0—the previous record low. We’re essentially in the same neighborhood as these major economic disruptions.

The Recovery That Almost Was

Here’s a fascinating subplot to the current sentiment story: there was actually a brief recovery attempt in late May 2025. After hitting 50.8 in the preliminary reading, sentiment was revised upward to 52.2 following the announcement of a temporary pause on some China tariffs.

Stephanie Guichard from the Conference Board noted that “the rebound was already visible before the May 12 US-China trade deal but gained momentum afterwards.” However, this minor improvement was offset by declining current personal finances stemming from stagnating incomes throughout May.

This gives us a crucial insight: consumer sentiment is extremely sensitive to policy announcements and geopolitical developments. For Python traders and analysts, this means incorporating news sentiment analysis and policy tracking into your models could provide an additional edge.

What Low Sentiment Means for Your Investments

When consumer sentiment drops to these levels, history suggests several investment implications:

Defensive Sectors Outperform: Utilities, consumer staples, and healthcare typically hold up better when consumers are pessimistic. Retailers and luxury goods companies? Not so much.

Interest Rate Sensitivity: Low sentiment often pressures the Federal Reserve to consider more accommodative policies. The current environment of high sentiment pessimism combined with tariff-driven inflation creates a particularly complex challenge for policymakers.

Volatility Increases: Markets tend to be more reactive and volatile when underlying sentiment is weak. Options strategies and hedging become more valuable.

Consumer Discretionary Pain: When people are worried about the future, they stop buying things they don’t need. This hits everything from restaurants to retailers to travel companies.

The Bottom Line: Sentiment as Strategy

The current consumer sentiment reading of 52.2 isn’t just a number—it’s a warning signal that American consumers have fundamentally lost faith in their economic future. Whether that pessimism proves justified or becomes a self-fulfilling prophecy remains to be seen, but history suggests taking it seriously.

For Python-equipped financial analysts and investors, this creates both challenges and opportunities. The challenge is navigating an environment where traditional economic relationships might not hold (what happens when tariff policy changes daily?). The opportunity is using code to track these sentiment shifts in real-time and position portfolios accordingly.

The key insight here is that consumer sentiment isn’t just measuring economic conditions—it’s measuring the psychology that drives economic conditions. And in a world where confidence can evaporate as quickly as a badly-worded presidential tweet, having your finger on the pulse of American sentiment isn’t just useful; it’s essential.

Set up your alerts, automate your tracking, and remember: in the game of economic forecasting, sometimes the most important data isn’t about what’s happening—it’s about what people think is going to happen. And right now, Americans think something not-so-great is coming.

The post is for informational purposes only and does not constitute financial advice. You should not construe any such information or other material as legal, tax, investment, financial, or other advice.