Article 2: The Bull Put Spread Delta Cap – Managing SPY/SPX Vertical Spreads

The bull put spread is a staple income strategy: short a lower-delta put, buy a farther OTM put, collect net credit, profit from time decay and upward drift. Yet this seemingly conservative structure harbors a hidden breakpoint. As the underlying declines, the short put’s delta accelerates non-linearly. When it reaches 0.40 delta, the position’s gamma and assignment risk transform it into a structure that increasingly resembles a short put for typical daily moves, while the long wing remains too far to hedge small/medium gaps effectively.

This is the Delta Cap rule: For short-put verticals entered around 25Δ with 30–45 DTE, close or roll when the short put reaches 0.35–0.45Δ or when the spread value hits 2× entry credit, whichever comes first. In elevated VIX regimes or for narrower wings, use the low end of the band (0.35).

Mechanical rules are critical because discretionary decisions fail under stress. The 0.40 delta threshold marks where gamma-induced VaR exposure often jumps materially and long-wing hedge effectiveness can fall to a minority of net gamma.

Core Learning Objectives

- Calculate dynamic delta-weighted risk for bull put spreads as the underlying approaches the short strike

- Evaluate capital efficiency when delta exceeds 0.40 (Reg-T vs. PM margin impact)

- Construct automated exit protocols for SPY (American, physical) and SPX (European, cash) structures

- Quantify the SPX advantage: 1256 tax treatment (US), no assignment risk, and 10× notional efficiency

Strategy Definition & Initial Parameters

Standard Entry Rules (Pre-Trade Checklist)

- Short Put Delta: 0.25 (±0.02) → 30-45 DTE

- Long Put Delta: 0.15 (±0.02) → Same expiration

- Spread Width: This defines the distance between your two strike prices. 10-20 points (SPY). If your short put (0.25Δ) is at the $500 strike, this rule says your long put (0.15Δ) should be at the $490 or $480 strike (a 10 or 20-point width). or 50-100 points (SPX). The S&P 500 index (SPX) is about 10x the value of the SPY ETF. A 10-point width on SPY is proportionally similar to a 100-point width on SPX.

- Net Credit Target: 0.20–0.30× width normal vol; 0.30–0.35 high IV; >0.35 exceptional. For a 10-point wide spread, you should aim to collect at least $2.00 to $3.00 per share (or $200-$300 per contract).

- Max Allocation: 2% of portfolio NAV per spread

Alternative Price Trigger: This is an exit rule for when the trade goes against you. Many desks use dual triggers (Δ or price). Close if spread value ≥ 60–70% of width as a cross-check to the delta rule. Example, on the 10-point spread, 60% is $6.00. If the spread you sold for $2.00 now costs $6.00 to buy back, you close it immediately

Why 0.25/0.15? This configuration starts with net delta ≈ +0.10 (10 share equivalents), giving you a 68% probability of profit at entry while keeping initial directional exposure minimal. As this video on best delta for put spreades demonstrates in their delta selection analysis, this range optimizes the risk/reward curve for income generation.

SPY Case Study: The VIX Spike Break

Initial Position (Day 0)

- Underlying: SPY @ $445.00

- Trade: Short 1x 430P (0.25Δ) @ $4.20 + Long 1x 420P (0.15Δ) @ $2.50

- Net Credit: $1.70 ($170)

- Days to Expiration: 35 DTE

- Max Risk: ($10 width – $1.70 credit) × 100 = $830

- Buying Power Effect: $830 (expect max loss as Reg-T/PM requirement for isolated verticals; portfolio-level offsets may reduce). Buying Power Effect: $830 is your broker telling you: “The most you can possibly lose on this one contract is $830, so we are going to hold that amount from your available funds until the trade is closed.”

Initial Greeks (Net):

- Δ: +0.10 (+10 share deltas)

- Γ: -0.04 per $1 move

- ν: -0.08 per 1 vol point

- θ: +0.12 per day

Portfolio Impact: $830 risk = 0.33% of $250K NAV → within limits.

The Shock (Day 7)

Fed Chair Powell delivers hawkish surprise. VIX jumps from 15 to 28. SPY drops to $432.00 (−2.9%).

New Greeks:

- Short 430P Δ: +0.41 (breached 0.40 threshold)

- Long 420P Δ: −0.24

- Net Δ: +0.17 (17 share deltas)

- Net Γ: −0.09 Δ per $ (2.25 times more acceleration than when we opened the contract)

- Mark-to-Market: Spread now worth $3.40 → Unrealized loss: -$170 (-20% of max risk)

Gap Loss Path (Quantified): A further $1 drop to $431 adds +0.09 deltas (net γ). That’s +9 deltas * 100 shares * $1 = $900 extra notional at risk—compounding losses rapidly. Note that our maximum loss was cap at $830. The “$900 extra notional at risk” does not mean you can lose $900. It’s a theoretical number describing how fast your position’s risk (losses) is accelerating (this is a key concept called Gamma).

Critical Breakpoint Reached: At 0.41 delta, the short put’s gamma is now −0.18 Δ per $, meaning a further $1 drop adds +18 deltas—equivalent to a naked short put for typical moves. The long 420P’s gamma of +0.09 does not hedge this effectively:

- Your Short 430 Put (The Risk): It has a negative gamma of -0.18.

- Your Long 420 Put (The Hedge): It only has a positive gamma of +0.09.

Your hedge is only half as strong as your risk.

For every $1 SPY drops, your short put’s risk accelerates twice as fast as your hedge’s protection can keep up.

This is what your Net Γ: −0.09 truly means.

- (-0.18) from your short put

- +0.09 from your long put

- Net Gamma = -0.09

Because you still have net negative gamma, your position will behave like an unhedged “naked” short put. As the stock price falls, your position’s delta will get more and more positive (from +0.17 to +0.26, then to +0.35, etc.), meaning you are becoming “more long” and losing money faster and faster as the market crashes.

Automated Exit Protocol (Triggered)

Rule: If short put delta ≥ 0.40 at any time, close the spread immediately at market.

Execution:

- Buy back 430P @ $6.80 (-$680)

- Sell 420P @ $3.40 (+$340)

- Net closing cost: -$340

- Total loss: $170 (Credit) – $340 (Exit) = -$170 (-21% of max risk)

Why Not Hold? Staying would require:

- Margin increase: PM requirement jumps toward max loss (4.25× higher) (this applies for accounts with Portfolio Margin accounts (for Reg-T margin stays with the maximum potential loss of 830).

- Assignment risk: Early assignment probability rises as puts go ITM with little time value; still path- and broker-dependent

- Gamma exposure: Net Γ of −0.09 Δ per $ means a $5 gap (a gap is sharp price move that happens between trading sessions (i.e., overnight)) adds +45 deltas—violating your 2% NAV rebalancing band. A $5 gap means that the price never traded at $431, $430, $429, or $428. You had zero opportunity to close your trade or adjust it as the price fell. The position has a Net Γ of −0.09. This means for every $1 SPY falls, your position’s Net Delta increases by 0.09. $5 (the gap) × 0.09 (your gamma) × 100 (shares per contract) = +45 Deltas. By gapping from +17 to +62 deltas, the notional risk of the position has exploded. It is now far too large and concentrated for the portfolio’s safety rules.

Result: By exiting at 0.40 delta, you cap the loss at 6.8 bps of portfolio NAV vs. potential 60+ bps if SPY gapped to $420.

SPX Case Study: The Cash-Settled Advantage

Initial Position (Day 0)

- Underlying: SPX @ 4,450

- Trade: Short 1x 4,300P (0.25Δ) @ $42.00 + Long 1x 4,200P (0.15Δ) @ $25.00

- Net Credit: $17.00 ($1,700)

- Days to Expiration: 35 DTE

- Max Risk: ($100 width – $17 credit) × 100 = $8,300

- Buying Power Effect: $8,300 (expect max loss as Reg-T/PM requirement)

- Tax Treatment: US taxpayers may benefit from 1256 treatment (60% long-term/40% short-term); non-US treatment differs

Key Difference: SPX European-style options cannot be early assigned, eliminating the weekend gap risk that plagues SPY bull put spreads.

The Shock (Day 7)

Same VIX spike, SPX drops to 4,320 (−2.9%).

New Greeks:

- Short 4,300P Δ: +0.41 (breached 0.40 threshold)

- Long 4,200P Δ: −0.24

- Net Δ: +0.17

- Net Γ: −0.09 Δ per $

Automated Exit Protocol (Triggered)

Execution:

- Buy back 4,300P @ $68.00 (-$6,800)

- Sell 4,200P @ $34.00 (+$3,400)

- Net closing cost: -$3,400

- Total loss: $1,700 (Credit) – $3,400 (Exit) = -$1,700

SPX Advantage Analysis:

| Factor | SPY | SPX | Professional Impact |

|---|---|---|---|

| Assignment Risk | Present | Zero (European) | No weekend capital call |

| Tax Efficiency | Short-term only | 1256 treatment (US) | Consult tax advisor; non-US treatment differs |

| Liquidity Differential | 0.03–0.05 wide | 0.10–0.15 wide (10× notional) | Nominal dollars higher; per-notional cost can be competitive given size |

| Notional Efficiency | $4,450 per contract | $44,500 per contract | 10× fewer contracts for same exposure |

| Margin Offset | $830 Reg-T | $8,300 Reg-T | Portfolio margin can reduce requirements materially when offsets apply |

Net Result: SPX often becomes operationally superior as size grows, but liquidity/fees/fills can favor SPY for many.

Decision Framework: SPY vs SPX Selection Criteria

Use SPY If:

- Portfolio size $250K–$500K

- American-style flexibility needed (e.g., early exit on dividend cycles)

- Tight spreads priority

- Physical delivery acceptable

Use SPX If:

- Portfolio size >$500K (or trading 5+ contracts)

- Tax efficiency critical (US taxpayers may benefit from §1256)

- Weekend risk intolerable (no assignment on Friday gaps)

- Cash settlement preferred

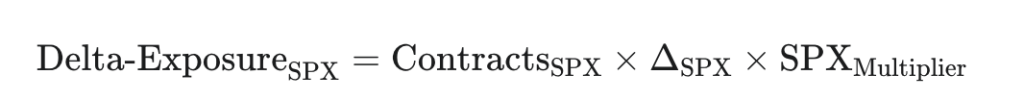

Delta-Notional Scaling Formula: Match Δ-exposure, not raw notional:

Contract multipliers (×100) cancel if both are ×100.

Example: 5-lot SPY spread (Δ=+0.10 each) → ~0.5-lot SPX spread (Δ=+0.10 each) for equivalent exposure.

Portfolio-Level Risk Limits for $250K NAV

Single-Trade Constraints

SPY Bull Put Spread:

- Max Width: 20 points ($2,000 risk)

- Max Contracts: 3 per trade ($6,000 risk = 2.4% NAV)

- DTE Range: 30–45 days

- Delta Exit: 0.40 hard cap

- Price Exit: Spread value ≥ 60–70% of width

SPX Bull Put Spread:

- Max Width: 100 points ($10,000 risk)

- Max Contracts: 1 per trade ($10,000 risk = 4% NAV)

- DTE Range: 30–45 days

- Delta Exit: 0.40 hard cap

Correlation & Concentration Rules

- Max SPY/SPX exposure: 8% of NAV at any time

- Delta band rebalancing: Trigger at ±2% NAV delta shift

- Volatility regime filter: If VIX > 25, reduce size by 50%

Automated Monitoring & Alert System

Real-Time Alerts:

- Primary: Short put delta = 0.38

- Secondary: Short put delta = 0.40 (auto-exit)

- Tertiary: Net position delta = ±2% of NAV

Execution Protocol:

- Alert fires → Trader has 15 minutes to manually exit

- If not executed → System sends IOC order at mid-market + $0.05

- If unfilled after 2 minutes → Convert to market order

Cost of Automation: Average slippage $0.03 per contract = 0.1 bps of portfolio.

Capital Adjustment Example: SPY → SPX Migration

Trigger: When average daily P&L volatility on SPY spreads exceeds 1.5% of NAV for 5 days.

Benefits of Migration:

- Tax savings on $5K annual profit (US): ~$1,150 (1256 treatment)

- Net benefit: +$1,141/year after costs

Jurisdiction & Tax Note (US)

SPX §1256 Treatment:

For US traders, broad-based index options like SPX qualify for 60% long-term/40% short-term capital gains rates regardless of holding period. This can materially reduce tax drag vs. SPY options taxed as ordinary income/short-term gains. Non-US traders should consult local tax law; treatment differs significantly.

Conclusion: Institutionalizing the 0.40 Delta Rule

The 0.40 delta threshold is a policy choice justified by gamma behavior and VaR—not a universal constant. It marks where gamma-induced delta change exceeds typical rebalancing bands.

Key Takeaway: SPY is often optimal for $250K portfolios due to liquidity; SPX becomes superior at scale due to tax efficiency and zero assignment risk. The delta rule applies equally.

Disclaimer: This article is for educational purposes only and does not constitute investment advice. Options trading involves substantial risk and is not suitable for all investors. Past performance is not indicative of future results. Consult a qualified financial advisor and tax professional before implementing any strategies. All examples are hypothetical and for illustrative purposes.