A Primer on the Biotechnology Sector (GICS 352010): Foundation for Analysis

The Biotechnology sector (GICS 352010) represents the high-risk, high-reward frontier of drug development, characterized by novel modalities and intensive R&D investment. This primer equips financial analysts with the foundational knowledge required to dissect this complex ecosystem.

We analyze the sector’s structure, differentiating between platform and asset-centric models, and detail the core economics defined by high attrition rates (Probability of Success, PoS) and significant capital requirements.

The article provides a deep dive into major therapeutic modalities—including monoclonal antibodies, ADCs, Cell and Gene Therapies (CGT), and RNA therapeutics—focusing on technical risks and manufacturing challenges (CMC). Regulatory pathways (FDA/EMA) and market access dynamics (U.S. Payer mix, IRA implications, HTA frameworks) are detailed, alongside an analysis of biotech capital market cycles. The core of the primer focuses on the risk-adjusted Net Present Value (rNPV) valuation methodology, outlining key assumptions, SOTP frameworks, and common analytical pitfalls. This comprehensive overview serves as an essential reference for rigorous, evidence-based biotechnology analysis.

The biotechnology sector serves as the primary innovation engine within the broader healthcare landscape, distinguished by its focus on translating foundational scientific discoveries into novel therapeutics. While large-cap pharmaceutical companies increasingly rely on mergers and acquisitions or late-stage licensing to supplement internal R&D, biotechnology companies build their entire existence around pushing the frontiers of medical science. This fundamental difference in orientation—innovation over optimization, discovery over development—creates a sector with unique analytical requirements.

Successfully analyzing biotechnology investments demands integration of multiple specialized disciplines. Scientific literacy enables assessment of biological plausibility and mechanism of action. Regulatory expertise informs probability of approval and development timeline estimates. Financial modeling capabilities translate uncertain future outcomes into present valuations. Clinical trial design knowledge reveals which data will prove meaningful and which will disappoint. No single expertise suffices—the sector punishes analysts who attempt to evaluate companies through a purely financial, purely scientific, or purely clinical lens.

1.1 Defining Biotechnology: Scope and Business Models

Industry Classification

Biotechnology, classified under GICS code 352010, encompasses companies primarily engaged in the research, development, manufacturing, and marketing of products based on genetic analysis and genetic engineering [S&P Global, Global Industry Classification Standard (GICS) Methodology, 2024]. This definition centers on the manipulation of living organisms or their components to produce therapeutics, distinguishing biotech from traditional pharmaceutical chemistry and from medical device or diagnostic companies.

Strategic Archetypes: Platforms Versus Assets

Biotechnology business models organize around two fundamental strategic approaches, each creating distinct value propositions and risk profiles.

- Platform-Centric Companies: Building the Innovation Engine

Platform companies develop proprietary enabling technologies that can generate multiple drug candidates rather than focusing on individual therapeutic programs. Examples include gene editing systems like CRISPR/Cas9, RNA delivery vehicles such as lipid nanoparticles, or antibody discovery engines that can identify therapeutic antibodies across diverse targets. The platform itself—the repeatable technology—constitutes the core asset.

Value creation in platform models derives from multiple sources. Scalability determines whether the platform can efficiently generate numerous high-quality candidates or faces bottlenecks that limit productivity. Validation through business development and licensing partnerships provides external validation of platform value and generates non-dilutive capital through upfront payments, milestones, and royalties. Intellectual property strength protects the platform from competition and enables attractive partnership economics. The efficiency of candidate generation—how quickly and reliably the platform produces clinical-stage assets—ultimately determines whether the platform model creates more value than pursuing individual assets independently.

Platform companies face the challenge of demonstrating value before clinical validation of multiple programs. Investors must assess technology potential based on preclinical data, mechanism plausibility, and management’s articulation of the platform vision. However, successful platforms that achieve clinical validation across multiple programs can create exceptional value, as each new program leverages proven technology with reduced risk.

- Asset-Centric Development Companies: Concentrated Execution

In contrast, asset-centric development companies (DevCos) concentrate resources on developing one or a small number of specific drug candidates. Company value ties directly to the clinical and commercial success of the lead asset, creating highly binary risk profiles. A single Phase 3 failure can destroy most of the company’s value, while success can deliver exceptional returns.

Value drivers for DevCos are straightforward but demanding. Clinical data quality determines whether the asset advances or fails at each stage. Total addressable market size bounds the potential commercial opportunity. Competitive landscape assessment reveals whether the asset offers differentiation versus existing therapies and anticipated pipeline competition. Regulatory pathway clarity influences development timelines, costs, and approval probability.

Asset-centric models offer focus and clarity—investors can understand exactly what they’re investing in and when binary outcomes will resolve. However, this concentration creates vulnerability. Unlike platform companies that can absorb individual program failures across a portfolio of opportunities, DevCos typically cannot survive lead asset failure without radical restructuring or acquisition.

The Evolving Therapeutic Toolkit: Modality Landscape

The therapeutic landscape has expanded dramatically beyond traditional drug classes, creating a diverse array of modalities with distinct characteristics, development considerations, and commercial profiles.

- Small Molecules: The Traditional Foundation

Small molecules—chemically synthesized compounds with low molecular weight—represent the traditional foundation of drug development. Their advantages include oral bioavailability, enabling convenient patient administration, and well-established manufacturing processes refined over decades. However, small molecules face increasing competitive pressure and limited ability to target certain protein classes, particularly intracellular targets and protein-protein interactions that lack traditional binding pockets.

- Biologics: The Protein Revolution

Biologics encompass large, complex molecules produced by or derived from living organisms, including proteins and antibodies [FDA, What Are “Biologics” Questions and Answers, 2018]. These sophisticated therapeutics generally exhibit high target specificity, enabling precise intervention in disease pathways with potentially fewer off-target effects. However, biologics typically require injection or infusion administration, face complex and expensive manufacturing processes collectively termed chemistry, manufacturing, and controls (CMC), and often encounter immunogenicity challenges where patients develop anti-drug antibodies that neutralize efficacy.

- The Modern Advanced Modality Arsenal

Recent decades have witnessed the emergence of several sophisticated therapeutic approaches that expand medicine’s reach into previously intractable diseases.

Monoclonal antibodies (mAbs) and their derivatives have become workhorses of modern therapeutics. Standard mAbs target single disease-relevant proteins with high specificity. Bispecific antibodies (BsAbs) simultaneously bind two different targets, enabling novel mechanisms such as T-cell engagers that bridge immune cells and tumor cells. Antibody-drug conjugates (ADCs) link targeting antibodies to cytotoxic payloads, delivering chemotherapy specifically to diseased cells while sparing healthy tissue—combining the precision of antibodies with the potent cell-killing capacity of traditional chemotherapy.

Cell and gene therapy (CGT) represents perhaps the most transformative frontier. Gene therapy introduces or modifies genetic material to treat disease, typically using viral vectors such as adeno-associated virus (AAV) or lentivirus to deliver therapeutic genes. Cell therapy involves transferring intact, living cells into patients, with CAR-T therapies—which engineer a patient’s own T cells to target cancer—demonstrating proof of concept for cellular medicine. These approaches offer potential for durable, potentially curative outcomes from one-time treatments, fundamentally altering the treatment paradigm for genetic diseases and certain cancers.

RNA therapeutics exploit RNA molecules to modulate gene expression without permanently altering DNA. Antisense oligonucleotides (ASOs) and small interfering RNA (siRNA) reduce expression of disease-causing genes, while messenger RNA (mRNA) provides instructions for cells to produce therapeutic proteins. The COVID-19 pandemic validated mRNA technology at global scale, accelerating investment and development across numerous other diseases.

Gene editing technologies, particularly CRISPR/Cas9, enable precise modification of DNA sequences, offering the potential to correct genetic mutations at their source. Unlike traditional gene therapy that adds functional genes, gene editing can repair, delete, or modify specific genetic sequences with unprecedented precision.

This expanding modality toolkit creates both opportunity and complexity. Each modality carries distinct development risks, manufacturing requirements, regulatory considerations, and commercial characteristics. Investors must develop modality-specific expertise while maintaining sufficient breadth to assess competitive dynamics across therapeutic approaches targeting similar diseases. The analyst who masters these distinctions gains significant advantage in evaluating programs and anticipating which approaches will succeed in specific therapeutic contexts.

1.2 GICS Taxonomy

The Global Industry Classification Standard (GICS) provides a hierarchical framework for classifying companies.

- Sector (35): Health Care

- Industry Group (3520): Pharmaceuticals, Biotechnology & Life Sciences

- Industry (352010): Biotechnology

Boundaries and Distinctions

- Biotechnology (352010) vs. Pharmaceuticals (352020): The distinction is often based on size, R&D intensity, and modality focus, though large-cap biotechs behave similarly to pharma.

- Biotechnology (352010) vs. Life Sciences Tools & Services (352030): Tools companies provide the enabling technologies and services (like CROs and CDMOs) used by biotech and pharma.

| Hierarchy | GICS Code | Name | Notes / Examples |

|---|---|---|---|

| Sector | 35 | Health Care | Top-level GICS sector |

| Industry Group | 3510 | Health Care Equipment & Services | Providers, managed care, equipment/supplies |

| Industry Group | 3520 | Pharmaceuticals, Biotechnology & Life Sciences | Therapeutics and enabling tools/services |

| Industry | 352010 | Biotechnology | Therapeutics using biological processes/genetic engineering |

| Industry | 352020 | Pharmaceuticals | Primarily small-molecule drug manufacturers (plus some biologics) |

| Industry | 352030 | Life Sciences Tools & Services | CROs, CDMOs, instruments, reagents, research services |

| Sub-Industry | 35201010 | Biotechnology | Sub-industry under 352010 (classification used by indices/ETFs) |

Caption: The hierarchical structure of the GICS Health Care Sector. Source: S&P Global GICS Methodology, 2024.

1.3 Sector Footprint

The biotechnology sector is heavily concentrated in the U.S., particularly on the NASDAQ exchange.

- Index Weights and ETFs: Biotechnology is tracked primarily through:

- iShares Biotechnology ETF (IBB): Market-cap weighted, concentrating exposure in large-cap, established biotechs.

- SPDR S&P Biotech ETF (XBI): Equal-weighted, providing broader exposure to small- and mid-cap (SMID) development-stage companies. XBI is often used as the benchmark for the health of the broader biotech ecosystem.

- Number of Issuers: Fluctuates with IPO windows and M&A cycles. As of early 2024, there were over 600 publicly traded biotech companies in the U.S. [Evaluate Pharma, Biotech in 2024, Jan 2024].

- Financial Profile: The sector is characterized by a barbell distribution: a few large, profitable companies and a majority of pre-revenue development-stage companies (DevCos).

1.4 Why Biotech Matters

- Innovation Externality to Pharma: Biotechnology is the primary source of novel mechanisms of action (MoA). Large pharmaceutical companies rely heavily on acquiring or licensing assets originated by smaller biotechs. Over 60% of new molecular entities (NMEs) approved by the FDA originate in smaller companies. [IQVIA Institute, The Changing Landscape of Research and Development, April 2022].

- rNPV Leverage: Biotechnology valuation is highly sensitive to clinical and regulatory catalysts. A positive Phase 3 readout can shift the Probability of Success (PoS) assumption in a risk-adjusted Net Present Value (rNPV) model dramatically, leading to binary shifts in equity value.

- Policy Sensitivity: The sector is highly exposed to regulatory (FDA standards) and political shifts (drug pricing legislation, e.g., the Inflation Reduction Act of 2022), and intellectual property law.

2. Core Economics of Biotech

The fundamental economic challenge defining biotechnology lies in managing the collision between high costs, extreme risk, and finite capital resources. Drug development demands hundreds of millions to billions of dollars invested over a decade or more, with the majority of programs ultimately failing. This creates a unique financial dynamic: companies must continuously raise capital to fund development programs whose success remains uncertain until late-stage clinical data emerges, yet the capital markets that provide funding fluctuate based on factors often unrelated to individual program merit.

Understanding biotechnology economics requires recognizing drug development as a process of sequential risk reduction. Each clinical stage generates data that either validates the therapeutic hypothesis—justifying continued investment and reducing uncertainty—or reveals flaws that terminate the program. This staged progression creates discrete value inflection points where probabilities of success shift dramatically based on new information, driving the sector’s characteristic volatility.

2.1 The Development Funnel: Sequential Risk Resolution

Drug development proceeds through a well-defined sequence of stages, each designed to answer specific questions about safety, efficacy, and manufacturability. This progression—often visualized as a funnel narrowing from many early-stage candidates to the few that achieve approval—reflects systematic attrition as programs fail to meet increasingly stringent requirements.

Discovery and Preclinical Development: Establishing Biological Foundation

The journey begins with discovery research, where scientists identify biological targets implicated in disease pathology and design molecules capable of modulating those targets therapeutically. Lead optimization refines initial candidates to improve potency, selectivity, and drug-like properties. Extensive preclinical testing in vitro (in cells and biochemical assays) and in vivo (in animal models) generates the foundational safety and efficacy data required before human testing can commence.

This phase culminates in filing an Investigational New Drug (IND) application with the FDA in the United States, or equivalent submissions to regulatory authorities internationally. The IND package presents preclinical safety data, manufacturing information, and proposed clinical trial protocols. FDA approval of the IND—typically granted within 30 days absent significant concerns—permits the critical transition from laboratory research to human clinical trials.

- Phase 1: First Proof of Safety in Humans

Phase 1 trials mark the first administration of an investigational drug to humans, typically conducted in small cohorts of healthy volunteers (except in oncology, where patients with advanced disease participate given the toxicity of most cancer therapies). The primary objective centers on safety assessment: identifying adverse events, determining tolerability, and establishing the maximum tolerated dose (MTD)—the highest dose that can be administered without unacceptable toxicity.

Phase 1 also generates the first human pharmacokinetic (PK) data, measuring how the body absorbs, distributes, metabolizes, and excretes the drug. These PK parameters inform dosing regimens for subsequent trials. While Phase 1 typically does not aim to demonstrate efficacy, any signals of clinical activity generate excitement and can substantially impact valuations despite the small sample sizes and early stage.

- Phase 2: Validating the Therapeutic Hypothesis

Phase 2 trials transition from healthy volunteers to patients with the target disease, aiming to provide preliminary evidence of efficacy—proof-of-concept (PoC) that the drug actually works in humans—while continuing to assess safety in the target population. These trials employ smaller sample sizes than Phase 3, typically enrolling dozens to a few hundred patients, and often use biomarkers or surrogate endpoints that provide faster readouts than definitive clinical outcomes.

The quality of Phase 2 data critically influences whether programs advance to the expensive pivotal stage. Well-designed Phase 2 trials that demonstrate clear efficacy signals with acceptable safety substantially de-risk Phase 3 execution. Conversely, marginal Phase 2 results—statistically positive but with small effect sizes or concerning safety signals—often lead to Phase 3 failures despite technically “positive” Phase 2 outcomes.

The End-of-Phase-2 (EoP2) meeting with the FDA represents a crucial regulatory interaction. Companies present their Phase 2 data and proposed Phase 3 trial designs, seeking FDA agreement on endpoints, patient population, trial size, and success criteria. Achieving clear FDA alignment at the EoP2 meeting substantially reduces the risk that pivotal trials will fail due to design flaws or endpoint disputes, making this often-overlooked regulatory milestone highly consequential for development risk.

- Phase 3: Definitive Evidence for Approval

Phase 3 trials are large-scale randomized controlled trials (RCTs) designed to provide definitive evidence of safety and efficacy sufficient for regulatory approval. These “pivotal” trials typically enroll hundreds to thousands of patients, compare the investigational drug against placebo or active comparators, and measure clinically meaningful endpoints over extended treatment periods. The statistical rigor, sample size, and duration make Phase 3 trials the most expensive stage of development, often consuming hundreds of millions of dollars per program.

Phase 3 represents the highest-stakes binary event in drug development. Success—meeting the primary endpoint with statistical significance and acceptable safety—typically enables regulatory filing and drives substantial valuation appreciation. Failure destroys years of investment and often renders the program unviable, particularly if the failure reflects fundamental issues with efficacy rather than correctable trial design flaws.

- Regulatory Review: The Path to Approval

Following successful Phase 3 trials, companies compile comprehensive data packages into either a New Drug Application (NDA) for small molecules or Biologics License Application (BLA) for biologics. These submissions present all clinical, preclinical, and manufacturing data, arguing that the benefit-risk profile justifies approval for the proposed indication.

The FDA assigns a PDUFA (Prescription Drug User Fee Act) date establishing the target decision deadline, typically ten months after filing for standard review or six months for priority review granted to therapies addressing serious conditions with evidence of significant improvement over available therapies. The PDUFA date becomes a known catalyst, creating a defined timeline for the binary approval decision that will determine whether years of development culminate in commercial success or regulatory rejection.

This staged progression—from preclinical through Phase 1, 2, 3, and regulatory review—creates the fundamental structure of biotechnology value creation. Understanding what each stage proves, what risks it retires, and what uncertainties persist enables sophisticated assessment of where programs stand on the risk-reward spectrum and how upcoming data readouts will shift probabilities of ultimate success.

Probability of Success (PoS)

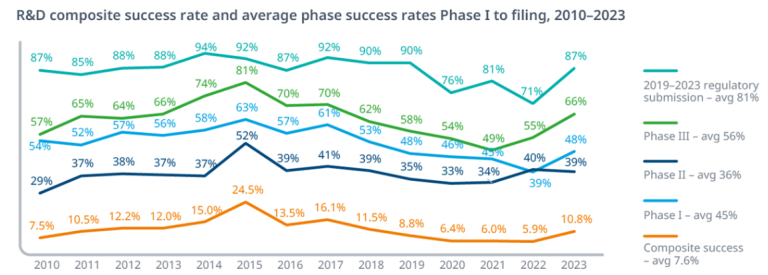

Attrition rates are high. The most critical metric in biotech analysis is the Probability of Success (PoS), also known as the Likelihood of Approval (LoA).

Historical data consistently shows that the majority of drug candidates fail. According to a major study covering 2011-2020:

- The overall LoA from Phase 1 to FDA approval was 7.9%.

- Phase 2 is the largest hurdle, with only around 30% of candidates advancing to Phase 3. This reflects the difficulty of demonstrating efficacy in patients.

[Wong, CH et al., Estimation of clinical trial success rates and related parameters, Biostatistics, 2022 (Based on BIO/Informa/QLS data)].

Exhibit 2.1: Clinical Development Success Rates (2011-2020)

| Phase Transition | Overall Success Rate (%) |

|---|---|

| Phase 1 to Phase 2 | 52.0% |

| Phase 2 to Phase 3 | 28.9% |

| Phase 3 to Submission | 57.8% |

| Submission to Approval | 90.0% |

| Overall (Phase 1 to Approval) | 7.9% |

Caption: Historical probability of transitioning between clinical development phases across all therapeutic areas. Source: Wong et al., Biostatistics, 2022.

PoS Varies Significantly by Therapeutic Area (TA) and Modality:

- Oncology historically has the lowest overall PoS (~5.3%).

- Hematology (~23.9%) tends to have higher success rates.

- Rare diseases often exhibit higher PoS (~17.0%). [Wong et al., 2022].

Analysts must use TA-specific PoS estimates in valuation models.

Cycle Times

Drug development is lengthy. The average time from Phase 1 initiation to approval is approximately 9 years. [Wong et al., 2022].

2.2 Capital Model

Biotechnology is capital intensive. Developing a successful drug can cost, on a fully loaded and risk-adjusted basis, upwards of $2.5 billion. [Wouters, OJ et al., Estimated Research and Development Investment Needed to Bring a New Medicine to Market, 2009-2018, JAMA, 2020].

Key Financial Metrics for DevCos

- Cash Runway (Months): (Current Cash + Equivalents + Marketable Securities) / (Quarterly Cash Burn Rate). A runway <12 months typically signals imminent financing needs.

- Cash Burn Rate: Net Cash Used in Operating Activities (GAAP).

OPEX Split

- Research & Development (R&D): Includes clinical trial costs, manufacturing (CMC), and personnel. R&D is expensed as incurred under GAAP.

- General & Administrative (G&A): Includes executive salaries, legal/IP costs, and (pre-launch) commercial planning.

Outsourcing: CDMO/CRO Reliance

Most SMID biotechs rely heavily on outsourcing.

- Contract Development and Manufacturing Organizations (CDMOs): Provide drug substance and drug product manufacturing.

- Contract Research Organizations (CROs): Manage the execution of clinical trials.

Revenue Structures: Partnerships (BD&L)

DevCos often partner with larger firms to fund development. Deals include upfront payments, contingent milestone payments, and royalties on net sales.

Priority Review Vouchers (PRVs)

A PRV is a transferable asset awarded by the FDA for approval of drugs for certain rare pediatric or tropical diseases. It entitles the holder to a 6-month Priority Review for a subsequent application. PRVs can be sold; the market price has historically ranged from $80M to $120M. [FDA, Priority Review Voucher Programs, 2024].

2.3 Dilution Mechanics

Given the high cash burn, DevCos must frequently raise capital, leading to shareholder dilution.

Equity Financing

- Follow-On (FO) Offerings / Secondaries: Public companies selling newly issued shares, often after positive clinical data.

- At-The-Market (ATM) Facilities: Allows a company to sell shares gradually into the open market.

Debt and Alternatives

- Convertible Bonds: Debt that can be converted into equity.

- Royalty Monetization: Selling a future royalty stream for upfront cash.

Key Considerations

- Cash vs. Non-Cash Charges: Analysts must distinguish between cash expenses and non-cash charges. Stock-based compensation (SBC) is a significant non-cash expense that impacts GAAP profitability but not short-term cash burn.

2.4 Value Drivers

The value of a biotech asset is driven by:

- MoA Novelty and Target Risk: Is the mechanism validated? High novelty offers greater upside but carries higher biological risk.

- Clinical Data Quality: Robustness of efficacy data (magnitude, durability) and the safety/tolerability profile.

- CMC / Manufacturability: The ability to manufacture the product consistently, at scale, and with acceptable COGS. A major risk factor for complex modalities.

- Payer / Access Hurdles: Likelihood of securing favorable reimbursement.

- KOL and Guideline Adoption: Endorsement by Key Opinion Leaders (KOLs) and inclusion in clinical practice guidelines are critical for establishing a new Standard of Care (SoC).

2.5 Regulatory Leverage: Expedited Programs

Regulatory agencies offer programs to accelerate development and review of drugs addressing unmet needs. [Source: FDA, Expedited Programs for Serious Conditions – Drugs and Biologics, Guidance for Industry, 2014].

- Fast Track Designation (FTD): Benefits include eligibility for Rolling Review and increased FDA interaction.

- Breakthrough Therapy Designation (BTD): Requires preliminary clinical evidence indicating substantial improvement over available therapy. Includes intensive FDA guidance.

- Regenerative Medicine Advanced Therapy (RMAT) Designation: Specific to cell and gene therapies, similar criteria to BTD.

- Priority Review (PR): FDA aims to take action within 6 months (vs. 10 months standard).

- Accelerated Approval (AA): Allows approval based on a surrogate endpoint “reasonably likely to predict clinical benefit.”

Confirmatory Trial Risk

Accelerated Approval requires post-marketing Phase 4 studies (Confirmatory Trials) to verify the clinical benefit. If the trial fails, the FDA can withdraw the approval.

3) Regulatory Pathways & Evidence Standards

The U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) are the two most critical regulatory bodies globally.

3.1 U.S. IND → NDA/BLA Basics

The process begins with the IND (Investigational New Drug application) application. The culmination is the submission of an NDA (New Drug Application) (regulated by CDER) or a BLA (Biologics License Application) (regulated by CDER (Center for Drug Evaluation and Research) or CBER(Center for Biologics Evaluation and Research)). CDER is a branch of the FDA responsible for regulating pharmaceutical drugs while CBER is a branch of the FDA responsible for regulating biological products.

Pivotal Trial Design

Phase 3 trials must be “adequate and well-controlled”.

- Superiority vs. Non-Inferiority (NI):

- Superiority: Designed to show the new drug is statistically significantly better than the comparator (placebo or Standard of care SoC).

- Non-Inferiority (NI): Designed to show the new drug is not worse than the active comparator by more than a predefined margin.

Endpoints

The choice of endpoint is critical and must be agreed upon with the FDA.

- Clinical Benefit Endpoints: Direct measures of how a patient feels, functions, or survives.

- Overall Survival (OS): The gold standard in oncology. Time from randomization to death from any cause.

- Surrogate Biomarkers: Laboratory measures or physical signs used as a substitute for clinical benefit.

- Progression-Free Survival (PFS): Time from randomization to disease progression or death.

- Objective Response Rate (ORR): Percentage of patients whose tumor shrinks by a predefined amount. Often used for Accelerated Approval.

[FDA, Clinical Trial Endpoints for the Approval of Cancer Drugs and Biologics, Guidance for Industry, 2018].

Advisory Committees (AdComs)

The FDA often convenes independent expert panels (AdComs) to review data and provide recommendations on approval. AdCom meetings are public and represent significant binary events.

3.2 EMA/UK Parallels

The EU uses a centralized procedure coordinated by the EMA. The Committee for Medicinal Products for Human Use (CHMP) provides the scientific opinion.

- Conditional Marketing Authorisation (CMA): Similar to FDA’s Accelerated Approval.

- PRIME (PRIority MEdicines) Scheme: Similar to FDA’s Breakthrough Designation. [EMA, PRIME: Priority Medicines, 2024].

In the UK, the Medicines and Healthcare products Regulatory Agency (MHRA) is the regulator.

Health Technology Assessment (HTA)

In Europe, regulatory approval is separate from reimbursement decisions. HTA bodies evaluate the clinical and economic value of new drugs.

- UK (NICE): The National Institute for Health and Care Excellence uses cost-effectiveness analysis (Incremental Cost-Effectiveness Ratio, ICER), measured in cost per Quality-Adjusted Life Year (QALY) gained. Typical threshold: £20,000-£30,000 per QALY.

- Germany (G-BA/IQWiG): The Federal Joint Committee (G-BA) assesses the “added benefit” compared to the appropriate comparator. This determines the price negotiated under the AMNOG process.

- France (HAS): Assesses clinical benefit (SMR) and improvement (ASMR) to inform pricing.

3.3 Safety/Risk Management

- Risk Evaluation and Mitigation Strategies (REMS): Required for drugs with serious safety concerns. REMS can include specialized prescriber training or restricted distribution. [FDA, REMS, 2024].

- Black-Box Warnings (Boxed Warnings): The strongest safety warning on a drug label.

- Post-Marketing Commitments (PMCs) and Requirements (PMRs): Studies conducted after approval.

3.4 CMC (CBER/CDER)

Chemistry, Manufacturing, and Controls (CMC) ensures the drug product is manufactured consistently and meets quality standards. CMC is a frequent source of regulatory delays (Complete Response Letters, CRLs).

- Comparability: When manufacturing processes change (e.g., scaling up), the sponsor must demonstrate the product remains comparable.

- Potency Assays: Critical for biologics/CGT to measure biological activity.

- Viral Vector Manufacturing (CGT): Manufacturing AAV or Lentiviral vectors at scale is challenging (low yields, high costs, capacity constraints).

- CRISPR Off-Target Testing (Gene Editing): Assessing the risk of unintended genetic modifications. [FDA, Human Genome Editing, Draft Guidance for Industry, 2022].

- GMP Compliance: FDA inspections of manufacturing facilities (Pre-Approval Inspections) are required.

4) Modalities Deep Dive

Understanding different therapeutic modalities is essential for assessing technical risk, manufacturing complexity, and commercial potential.

4.1 Monoclonal Antibodies, Immuno-Oncology, and Antibody-Drug Conjugates

Immuno-Oncology (IO) Therapeutics

The IO landscape centers on two main antibody approaches. Checkpoint inhibitors (CPIs) are monoclonal antibodies that target key immune regulatory pathways, particularly PD-1/PD-L1 and CTLA-4. While this class has reached maturity, it remains highly competitive.

Bispecific antibodies (BsAbs) represent a newer strategy, designed to bind two different targets simultaneously. T-cell engagers, for example, bridge tumor cells and immune cells to enhance anti-tumor responses. However, these potent immune activators carry notable safety risks, including cytokine release syndrome (CRS) and immune effector cell-associated neurotoxicity syndrome (ICANS).

Antibody-Drug Conjugates (ADCs)

ADCs merge the precise targeting of monoclonal antibodies with the cytotoxic power of chemotherapy. Current development efforts focus on optimizing two critical components: the linker (which determines when and where the payload is released) and the payload itself (the cytotoxic drug). The drug-to-antibody ratio (DAR) serves as a key parameter for balancing efficacy and safety.

ADCs face distinct challenges. Off-target toxicity remains a concern, along with payload-specific adverse effects such as ocular toxicity and interstitial lung disease (ILD). Additionally, manufacturing complexity is heightened because ADC production requires expertise in both biologic antibody production and high-potency chemical synthesis.

General Monoclonal Antibody Considerations

Across all monoclonal antibody platforms, immunogenicity presents a universal risk. Patients may develop anti-drug antibodies (ADAs) that can neutralize therapeutic efficacy or trigger infusion-related reactions (ISRs).

4.2 Cell & Gene Therapy (CGT)

Cell and gene therapies represent a paradigm shift in medicine, offering the potential for durable and potentially curative treatments through one-time interventions.

Gene Therapy: In Vivo Approaches

In vivo gene therapy delivers genetic material directly into the patient’s body, primarily through viral vectors. Adeno-associated virus (AAV) has emerged as the most common delivery vehicle. These non-integrating vectors are favored for their safety profile, though their packaging capacity is limited to approximately 4.7 kilobases of genetic material. Lentiviral vectors, which integrate into the host genome, are used primarily in ex vivo applications where cells are modified outside the body before reinfusion.

Gene Editing Technologies

Precision gene editing platforms like CRISPR/Cas9 enable targeted modification of DNA sequences. However, these powerful tools carry inherent risks: off-target editing can affect unintended genomic locations, on-target edits may produce unexpected outcomes, and mosaicism—where not all cells receive the intended edit—can limit therapeutic efficacy.

Critical Challenges in CGT Development

Durability of therapeutic effect remains a fundamental uncertainty. Unlike traditional therapies, CGTs promise long-lasting or permanent benefits, but this requires extensive long-term follow-up (LTFU) studies to validate.

Dosing and immunogenicity present complex hurdles, particularly for AAV-based therapies. High vector doses can trigger serious toxicity, while pre-existing neutralizing antibodies (NAbs) against AAV—common in the general population—may exclude patients from treatment entirely. Redosing, should the initial therapy wane, faces significant immunological barriers.

Manufacturing represents a critical bottleneck for the field. The complexity of CGT production demands solutions for scalability, cost reduction, and robust analytical characterization. Delivery efficiency, especially to challenging targets like the central nervous system (CNS), remains an active area of innovation.

Economic Considerations: One-and-Done Pricing

The transformative potential of CGTs comes with price tags often exceeding several million dollars per patient, creating substantial challenges for healthcare payers. To address this, the industry is pioneering innovative reimbursement models. Outcomes-based contracts and value-based agreements (VBAs) tie payment to therapeutic success through mechanisms such as annuity payments spread over multiple years or milestone-based payments contingent on sustained patient response.

4.3 RNA Therapeutics

RNA-based therapies offer a unique approach to disease treatment by modulating gene expression without permanently altering DNA. This class encompasses two primary strategies with distinct mechanisms of action.

Small interfering RNA (siRNA) and antisense oligonucleotides (ASOs) work by binding to target messenger RNA (mRNA), either triggering its degradation (gene knockdown) or modulating RNA splicing to alter protein production. In contrast, messenger RNA (mRNA) therapies function as genetic instructions, directing cells to produce therapeutic proteins directly.

The Delivery Challenge

Delivery remains the defining challenge for RNA therapeutics. Lipid nanoparticles (LNPs) have emerged as the leading delivery system for mRNA and siRNA, though they predominantly target the liver. For liver-directed therapies, conjugate technologies such as GalNAc (N-acetylgalactosamine) offer highly efficient delivery of siRNA and ASO molecules. However, efficient extrahepatic delivery—reaching tissues beyond the liver—represents a major unsolved hurdle that limits the therapeutic potential of these modalities.

Manufacturing presents its own complexities, requiring specialized processes for producing chemically modified oligonucleotides or mRNA, as well as precise LNP formulation techniques that demand rigorous quality control.

4.4 Small Molecules

Despite the rise of biologics, small molecule drugs remain indispensable in the therapeutic arsenal. Their advantages include oral bioavailability, which enables convenient patient administration, and generally lower manufacturing costs compared to complex biologics.

Kinase inhibitors represent a major success story, constituting a dominant class of targeted oncology therapeutics. More recently, targeted protein degraders such as PROTACs (proteolysis-targeting chimeras) have emerged as a sophisticated approach that hijacks the cell’s own protein degradation machinery to eliminate disease-causing proteins.

However, small molecules face a distinct commercial challenge: generic competition. The regulatory landscape further complicates planning, as the Inflation Reduction Act (IRA) subjects small molecules to Medicare price negotiation significantly earlier than biologics—nine years post-approval versus thirteen years for biologics. This compressed exclusivity window fundamentally impacts the economic calculus for small molecule development.

4.5 Companion Diagnostics

The intersection of diagnostics and therapeutics has become increasingly critical in modern drug development. Companion diagnostics (CDx) are tests specifically required for the safe and effective use of a corresponding therapeutic product, typically by identifying patients most likely to benefit or those at risk for adverse events.

This creates a codependence that significantly impacts development strategy. Drug developers must often pursue parallel development and regulatory approval of both the therapeutic and its companion diagnostic, adding complexity, cost, and timeline considerations to the overall program. The CDx becomes an integral component of the drug’s label, making its successful development essential to the therapeutic’s commercial viability.

5) Market Access, Pricing & Reimbursement

Beyond demonstrating safety, efficacy, and manufacturing capability, pharmaceutical products face what industry experts call the “fourth hurdle”: securing market access and reimbursement. Without favorable coverage and payment terms, even highly effective therapies may fail commercially.

5.1 The U.S. Payer Landscape

The U.S. healthcare system operates as a fragmented ecosystem of public and private payers, each with distinct reimbursement mechanisms and constraints.

Medicare: The Dominant Public Payer

Medicare structures drug coverage through two primary pathways. Part B, the medical benefit, covers physician-administered drugs—typically infused or injected therapies delivered in clinical settings. Reimbursement follows a formula based on the Average Sales Price (ASP) plus a 6% add-on (ASP+6%), which compensates providers for acquisition and handling costs. Part D, the pharmacy benefit, covers self-administered medications that patients take at home, primarily oral therapies.

The Inflation Reduction Act: A Paradigm Shift

The Inflation Reduction Act (IRA) of 2022 fundamentally reshaped the Medicare landscape with three major provisions. First, Medicare gained authority to negotiate prices directly for selected high-expenditure drugs, ending decades of statutorily prohibited price negotiation. Second, inflation rebates now penalize manufacturers whose price increases outpace inflation, constraining annual pricing flexibility. Third, the Part D redesign caps annual out-of-pocket costs for beneficiaries while simultaneously restructuring liability for catastrophic coverage. This shifts significantly more financial responsibility onto manufacturers, creating new pressure on product economics.

Medicaid: The “Best Price” Constraint

Medicaid operates under the “best price” rule, which mandates that manufacturers provide Medicaid the lowest price offered to virtually any other purchaser. This creates a complex web of pricing interdependencies, as discounts offered to one customer can trigger mandatory rebates to Medicaid, potentially eroding margins across the entire business.

Commercial Payers and Market Dynamics

The commercial insurance market adds additional layers of complexity. The 340B Drug Pricing Program requires manufacturers to provide substantial discounts to eligible healthcare organizations serving vulnerable populations, though the program has expanded controversially in recent years.

Copay assistance programs represent a common manufacturer strategy to reduce patient out-of-pocket costs and improve adherence. However, many payers have implemented “copay accumulator” programs that prevent manufacturer assistance from counting toward patient deductibles, effectively neutralizing these programs and creating affordability barriers for patients.

5.2 Commercial Dynamics

Manufacturers negotiate with PBMs and insurers for formulary placement.

- PBMs: Intermediaries negotiating drug prices. The top 3 PBMs control ~80% of the market. [Drug Channels Institute, The 2024 Economic Report on U.S. Pharmacies and Pharmacy Benefit Managers, 2024].

- Gross-to-Net (GTN) Bubble: The difference between the list price (WAC) and the net price realized after all discounts and rebates. GTN discounts often reach 40-60%+ in competitive classes.

Utilization Management (UM)

- Prior Authorization (PA): Requires payer approval before dispensing.

- Step Therapy (“Fail First”): Requires patients to fail on preferred (cheaper) alternatives first.

5.3 International Pricing and Reimbursement

Markets outside the United States generally achieve significantly lower drug prices through centralized negotiation and formalized health technology assessment (HTA) processes. These mechanisms create a fundamentally different pricing environment compared to the fragmented U.S. system.

International Reference Pricing: The Global Interconnection

International reference pricing (IRP) creates a web of interdependencies across global markets. Many countries establish their drug prices by referencing a basket of prices from other nations, meaning that a price concession in one market can cascade into mandatory price reductions elsewhere. This makes launch sequencing and pricing strategy across geographies a high-stakes exercise in balancing market access against price erosion.

Health Technology Assessment in Europe

European markets employ rigorous HTA frameworks to determine reimbursement and pricing. Bodies such as the National Institute for Health and Care Excellence (NICE) in the UK assess cost-effectiveness using metrics like incremental cost-effectiveness ratios (ICER) and quality-adjusted life years (QALYs). Germany’s Federal Joint Committee (G-BA) conducts added benefit assessments to quantify therapeutic value relative to existing standards of care. As detailed in Section 3.2, these assessments directly determine market access and acceptable pricing levels, making robust health economics data essential from early development.

Japan’s Controlled Pricing System

Japan’s National Health Insurance (NHI) system operates with centralized price setting and mandates regular price revisions. Unlike Western markets where launch prices may remain relatively stable, Japanese prices face periodic downward adjustments, creating unique forecasting and planning challenges for manufacturers.

5.4 Pricing Dynamics: Disease Prevalence and Market Economics

The economic logic of drug pricing diverges sharply based on disease prevalence and patient population size.

Common Diseases: Volume and Competition

For diseases affecting large populations, pricing faces natural constraints from competitive dynamics and budget impact considerations. Payers scrutinize therapies treating hundreds of thousands or millions of patients, as even modest per-patient costs can create substantial aggregate budget burdens. Competition within therapeutic classes further pressures prices toward cost-effectiveness thresholds.

Rare and Orphan Diseases: The Small Population Premium

In contrast, rare and orphan diseases—affecting small patient populations—can sustain exceptionally high prices, often exceeding $200,000 annually per patient. The economic rationale follows from spreading fixed development costs across limited patient numbers. Regulatory frameworks reinforce this model through orphan drug exclusivity provisions: seven years in the United States and ten years in the European Union. These extended market protection periods enable manufacturers to recoup investments while treating small populations, though they also generate ongoing debate about pricing sustainability and healthcare equity.

This pricing dichotomy fundamentally shapes development strategy, making orphan diseases particularly attractive from a commercial perspective despite their limited epidemiology.

6) Capital Markets & Industry Cycles

The biotechnology sector exhibits pronounced cyclicality, driven by shifting investor sentiment, macroeconomic conditions, and waves of technological innovation. Understanding these cycles is essential for timing investment decisions and assessing risk.

6.1 The Biotech Equity Cycle

High-Beta Growth Characteristics

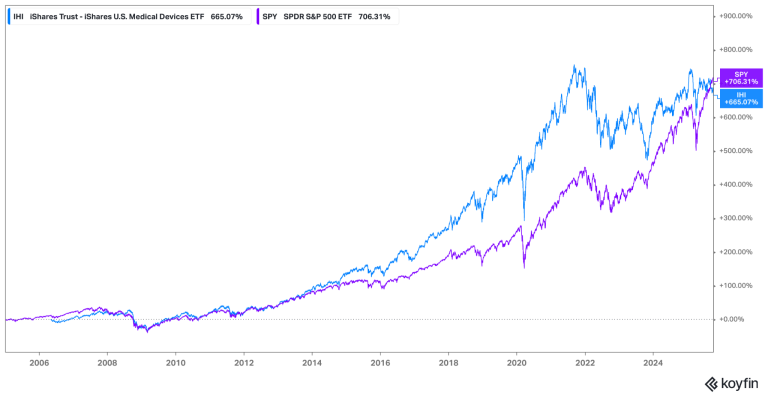

Biotechnology, particularly small- and mid-cap stocks tracked by indices like the XBI, functions as a high-beta growth sector. In “risk-on” market environments, biotech stocks amplify broader market movements, delivering outsized gains. Conversely, during risk-off periods, they suffer disproportionate declines as investors flee to safety.

Interest Rate Sensitivity: The Long-Duration Challenge

Biotech companies represent long-duration assets with cash flows heavily weighted toward the distant future. This makes valuations acutely sensitive to interest rate changes. When rates rise, the discount rates applied to future cash flows increase proportionally, reducing net present value (NPV) calculations and compressing valuations. This mathematical reality explains why biotech often underperforms dramatically in rising rate environments.

Capital Formation Windows

The ability to raise capital through initial public offerings (IPOs) and follow-on offerings fluctuates cyclically. “Open windows” emerge during periods of strong XBI performance and low market volatility (as measured by the VIX). During closed windows, companies—even those with promising pipelines—may find capital markets effectively inaccessible, forcing difficult decisions around cash runway and development priorities.

Innovation-Driven Enthusiasm

Periodic waves of excitement around breakthrough technologies can drive substantial sector inflows. Historical examples include the genomics revolution, the emergence of checkpoint inhibitors, and more recently, gene editing platforms like CRISPR. These innovation cycles create opportunities but also risks of excessive valuation during peak enthusiasm.

6.2 The M&A and Business Development Pendulum

Mergers and acquisitions (M&A) and business development and licensing (BD&L) represent critical drivers of returns in biotechnology, functioning as the sector’s primary liquidity mechanism for investors in smaller companies.

The Strategic Imperative: Patent Cliffs

Large pharmaceutical companies face a structural dependence on external innovation. As blockbuster drugs approach loss of exclusivity (LOE) and confront generic competition, these companies must continuously replenish their pipelines. Acquisitions and licensing deals provide the most reliable mechanism for accessing late-stage assets and innovative platforms.

Transaction Structures

Deal types vary based on strategic objectives. Bolt-on acquisitions target single assets or companies with late-stage products ready for commercialization, offering relatively predictable integration and near-term revenue contribution. Platform acquisitions represent more strategic bets, securing access to entire technology platforms—such as a novel drug delivery system or a new therapeutic modality—that can generate multiple future products.

Bridging Valuation Gaps

Deal structures often employ mechanisms to bridge disagreements between buyers and sellers about future value. Contingent Value Rights (CVRs) provide payments to shareholders if specific future milestones—such as regulatory approvals or sales targets—are achieved. However, CVRs present valuation challenges due to their contingent nature and often trade at significant discounts to their theoretical maximum value.

In partnerships and licensing deals, “biobucks”—the headline total potential deal value—can reach billions of dollars. However, sophisticated analysis requires risk-adjusting these figures, as milestone payments depend on successful achievement of development and commercial objectives that carry substantial uncertainty.

6.3 Alternative Financing: The Royalty Ecosystem

Beyond traditional equity and debt, specialized financing structures have emerged to address biotech’s unique capital needs.

Royalty aggregators purchase existing royalty streams from academic institutions, inventors, or early investors, providing immediate liquidity in exchange for future revenue rights. More recently, “synthetic royalties” or revenue-interest financings allow companies to monetize specific assets before approval by selling a percentage of future revenues. These structures provide non-dilutive capital but at the cost of reduced future economics.

6.4 Investor Pitfalls: Read-Throughs and Event Clustering

The Read-Through Trap

A common analytical error involves extrapolating clinical trial results from one company directly to competitors—the “read-through.” While superficially similar programs may appear comparable, differences in molecular design, patient population selection, trial endpoints, or dosing regimens frequently lead to divergent outcomes. Successful investors recognize that each program carries independent risk and avoid mechanical read-throughs without careful analysis of distinguishing factors.

Managing Event Clustering

Major medical conferences such as the American Society of Clinical Oncology (ASCO) and the American Society of Hematology (ASH) serve as key venues for clinical data presentations, often driving significant price movements across multiple companies within days. Similarly, regulatory events—particularly Advisory Committee (AdCom) meetings and Prescription Drug User Fee Act (PDUFA) decision dates—cluster around predictable timelines, creating periods of concentrated volatility.

Investors must manage portfolio exposure around these clustered events, as concentrated risk in a single therapeutic area or regulatory pathway can create correlated outcomes that undermine diversification.

7) Valuation Playbook for Biotech

Biotechnology valuation centers on the risk-adjusted net present value (rNPV) model, which forms the analytical foundation for assessing individual drug programs. For companies with multiple assets, analysts employ a sum-of-the-parts (SOTP) approach, valuing each program independently and aggregating the results.

7.1 Risk-Adjusted NPV Methodology

The rNPV framework calculates the present value of future cash flows generated by a drug program, explicitly adjusted for the probability that the program will successfully navigate clinical development and regulatory approval. This probability adjustment distinguishes biotech valuation from traditional discounted cash flow analysis.

The Core Formula

The rNPV calculation follows this structure:

rNPV = PoS × Σ [(CFt) / (1 + WACC)^t]

Where the probability of success (PoS) scales all future cash flows, and each year’s cash flow (CFt) is discounted back to present value using the weighted average cost of capital (WACC) raised to the power of the time period (t).

Building the Model: Critical Inputs

Constructing a robust rNPV model requires carefully estimating numerous interdependent assumptions, each carrying significant uncertainty.

- Market Opportunity and Commercial Assumptions

The foundation begins with defining the addressable market through rigorous epidemiological analysis. Analysts must identify the target patient population, considering factors such as disease prevalence, diagnosis rates, treatment eligibility, and current standard of care penetration.

Market share and penetration estimates follow, projecting the drug’s competitive positioning at peak market adoption. This requires assessing differentiation versus existing therapies, anticipated competition from pipeline products, and realistic prescriber adoption patterns. The launch curve models the trajectory from initial approval to peak sales, typically spanning 5-10 years depending on therapeutic area and commercial complexity.

Pricing assumptions must account for both the wholesale acquisition cost (WAC)—the list price—and the gross-to-net (GTN) discount percentage. The GTN adjustment captures mandatory rebates, contractual discounts to payers, patient assistance programs, and other price concessions. In the current environment, GTN adjustments of 40-60% are common, though they vary significantly by therapeutic area and payer mix.

Finally, the loss of exclusivity (LOE) timing and subsequent revenue decay curve model the patent cliff. Upon LOE, generic or biosimilar competition typically erodes revenues by 80-90% within 12-24 months for small molecules, though biologics may experience more gradual erosion.

- Cost Structure

Cost of goods sold (COGS) reflects manufacturing expenses as a percentage of revenue, varying dramatically by modality. Small molecules typically carry COGS of 10-20%, while complex biologics may reach 25-35%, and cell and gene therapies can exceed 50% given their manufacturing complexity.

Sales, general, and administrative (SG&A) expenses capture the costs of commercialization, including sales force deployment, marketing campaigns, and medical affairs activities. For specialty products, SG&A might represent 20-30% of revenues, while broad primary care launches can exceed 40%.

Research and development (R&D) costs include both the risk-adjusted cost to complete current development programs and ongoing R&D to support lifecycle management, line extensions, and label expansions post-launch.

- Financial and Structural Considerations

Tax rate assumptions and the value of net operating losses (NOLs) significantly impact valuation. Many biotechnology companies accumulate substantial NOLs during development, which can shield early profits from taxation, effectively increasing after-tax cash flows during the initial commercial years.

The discount rate—expressed as the weighted average cost of capital (WACC)—reflects the risk-adjusted return required by investors. Commercial-stage companies with approved products typically warrant WACCs of 10-12%, while development-stage companies face higher rates of 12-15% or more, reflecting greater uncertainty and risk.

- The Defining Variable: Probability of Success

Among all inputs, the probability of success (PoS) stands as the most critical and contentious assumption. As detailed in Section 2.1, PoS estimates vary widely by indication, phase of development, and program-specific factors. Small variations in PoS assumptions can swing valuations by hundreds of millions of dollars, making rigorous, evidence-based PoS estimation essential to credible analysis.

The art of biotech valuation lies in balancing optimism about a drug’s potential with realistic assessment of the substantial risks that must be overcome before that potential can be realized.

7.2 Portfolio Valuation: The Sum-of-the-Parts Approach

Companies with multiple drug programs or commercial products require a sum-of-the-parts (SOTP) valuation methodology. Rather than attempting to value the entire company as a single entity, analysts separately value each component and aggregate them to derive total enterprise value.

Constructing Enterprise Value

The SOTP framework builds enterprise value (EV) by systematically accounting for all value-generating assets within the company’s portfolio.

The foundation consists of inline products—already-approved and commercialized drugs generating current revenues. Each inline product receives its own rNPV calculation, projecting future cash flows until loss of exclusivity and subsequent generic erosion. These valuations typically carry higher certainty and lower discount rates given their commercial validation.

Pipeline programs in clinical development contribute the next layer of value. Each program undergoes independent rNPV analysis with probability of success adjustments appropriate to its development stage.

The aggregate pipeline value represents the sum of these risk-adjusted program valuations, though analysts must remain vigilant for potential portfolio-level correlations that could concentrate risk.

Beyond Individual Assets

Several additional value components warrant consideration depending on the company’s specific circumstances.

Platform value applies when a company possesses proprietary technology—such as a novel drug delivery system, unique manufacturing capability, or discovery engine—that can generate multiple future products beyond those currently in development. Valuing platforms requires estimating the probability-weighted value of future programs that might emerge, typically employing option value frameworks or conservative NPV assumptions.

Milestone payments and royalty streams from out-licensed assets or past partnerships contribute contractually defined cash flows. These require careful analysis of the triggering events, payment structures, and associated probabilities, though their contractual nature generally makes them more predictable than internal pipeline programs.

Priority Review Vouchers (PRVs), earned through approval of drugs for rare pediatric diseases or neglected tropical diseases, carry tangible value as tradeable assets. Recent PRV transactions have established a market value range, though this fluctuates with regulatory policy and the broader biotech funding environment.

Accounting for Corporate Costs

Enterprise value must be reduced by the present value of ongoing corporate overhead—the G&A expenses required to maintain the corporate structure that aren’t captured in individual program P&Ls. This includes executive compensation, public company costs, corporate facilities, and unallocated support functions.

The Bridge to Equity Value

The final step translates enterprise value into equity value by adjusting for the company’s net cash position:

Equity Value = Enterprise Value + Net Cash

Where net cash equals cash and marketable securities minus total debt obligations. Companies with substantial cash balances see equity value exceed enterprise value, while those carrying debt face a reduction. This net cash adjustment is particularly significant in biotech, where cash runway directly determines a company’s ability to fund development programs to value-inflecting milestones without dilutive financing.

The resulting equity value provides the theoretical fair value for the company’s entire equity capitalization, which can then be compared to market capitalization to assess relative valuation.

7.3 Validation Through Market Comparables

Risk-adjusted NPV models, despite their analytical rigor, require validation against market-based benchmarks. Relying solely on bottom-up modeling without cross-checking against observable market data can lead to valuations detached from investor reality.

Trading Multiples for Commercial Assets

For companies with approved products or late-stage assets nearing commercialization, enterprise value-to-sales (EV/Sales) multiples provide a useful sanity check. Forward EV/Sales ratios—using projected revenues 12-24 months ahead—allow comparison across companies at similar commercial stages. These multiples vary significantly by growth rate, profitability, and therapeutic area, but clusters typically emerge within comparable peer groups.

For late-stage pipeline assets approaching approval, a common heuristic values programs at 3-5 times projected peak sales, adjusted for risk and time to market. While crude, this rule of thumb reflects historical patterns in how markets value near-commercial assets and provides a rapid cross-check against detailed rNPV outputs.

Learning from Precedent Transactions

Precedent transaction analysis examines historical M&A deals and licensing agreements for comparable assets, providing market-validated benchmarks. By analyzing what acquirers actually paid for similar programs—accounting for stage of development, indication, and deal structure—analysts gain insight into market pricing conventions. However, transaction comparables require careful adjustment for deal-specific factors such as strategic rationale, competitive bidding dynamics, and the acquiring company’s specific needs.

7.4 Embracing Uncertainty: Sensitivity and Scenario Analysis

Given the inherent uncertainty in biotech valuation, responsible analysis requires explicitly modeling a range of potential outcomes rather than relying on a single point estimate.

Scenario Construction

Scenario analysis defines distinct cases—typically Base, Bear, and Bull—each reflecting internally consistent sets of assumptions. The Base case represents the most probable outcome based on balanced assumptions. The Bear case models disappointing but plausible scenarios, such as narrower label indications, deeper pricing pressure, or slower market adoption. The Bull case captures upside potential from favorable outcomes like broader indications, faster penetration, or additional lifecycle opportunities.

Presenting valuations across these scenarios acknowledges uncertainty while providing a framework for understanding the range of potential outcomes and their probabilities.

Visualizing Sensitivity with Tornado Charts

Tornado charts offer powerful visualization of how individual assumptions drive valuation outcomes. By varying each key input—probability of success, peak market share, pricing, discount rate—while holding others constant, analysts identify which variables exert the greatest influence on rNPV. The resulting chart displays sensitivity in rank order, with the most impactful variables appearing at the top.

This analysis reveals where additional diligence would most improve conviction, guides risk management strategies, and helps investors understand which future events will most significantly move valuations.

7.5 Avoiding Common Valuation Pitfalls

Even experienced analysts fall prey to recurring errors in biotech valuation. Recognizing these pitfalls improves analytical discipline and prevents systematic bias.

Probability of Success Inflation

The most prevalent error involves unrealistic probability of success assumptions. Analysts often anchor on a company’s optimistic projections without sufficient skepticism, or fail to adjust base rates for program-specific risk factors. Overstating PoS by even 10-20 percentage points can inflate valuations by hundreds of millions of dollars, creating a false sense of value that market reality eventually corrects.

Market Access Naïveté

Assuming frictionless market adoption ignores the substantial hurdles that drugs face post-approval. Payer resistance manifests through formulary restrictions, step therapy requirements, and prior authorization barriers that slow adoption curves. Deep gross-to-net discounts required to secure access erode realized pricing. Models that assume rapid uptake to peak market share without accounting for these real-world constraints systematically overstate commercial potential.

Manufacturing Complexity Blindness

Chemistry, manufacturing, and controls (CMC) risks frequently receive insufficient attention in early-stage valuations. Complex modalities—particularly cell and gene therapies or antibody-drug conjugates—face substantial manufacturing scale-up risk, supply chain vulnerabilities, and cost structures that can fundamentally alter program economics. Underestimating COGS or ignoring manufacturing feasibility risk leads to overly optimistic projections.

Commercial Infrastructure Underestimation

Successfully launching a drug requires substantial commercial infrastructure investment. Sales force deployment, market access teams, medical affairs organizations, and marketing campaigns demand significant SG&A spending that scales with the breadth of prescriber and patient populations. Models that apply generic SG&A assumptions without considering therapeutic area-specific requirements or the company’s existing capabilities tend to understate the true cost of commercialization.

Global Pricing Assumptions

Projecting U.S. pricing globally represents a fundamental error. Ex-U.S. markets achieve prices typically 30-70% below U.S. levels due to government price controls, health technology assessment requirements, and international reference pricing dynamics. Failing to apply appropriate regional price adjustments dramatically overstates total addressable market value.

The Dilution Oversight

Finally, many valuations ignore future dilution from equity financing required to fund development. Pre-revenue biotechnology companies regularly raise capital through offerings that dilute existing shareholders. Sophisticated valuation incorporates expected future financing needs, dilution from these raises, and their impact on per-share value. Ignoring this reality presents an artificially optimistic picture for current equity holders.

Avoiding these pitfalls requires disciplined assumptions, conservative base cases, and constant reality-checking against both clinical data and market dynamics.

8. Therapeutic Area Snapshots

Understanding the strategic landscape of major therapeutic areas provides essential context for evaluating individual programs. Each therapeutic area exhibits distinct competitive dynamics, regulatory pathways, clinical development challenges, and commercial considerations that fundamentally shape program economics and risk profiles.

8.1 Oncology: The Innovation Epicenter

Oncology commands the largest share of both R&D investment and global pharmaceutical market size, driven by high unmet medical need, rapid scientific innovation, and willingness from payers and patients to embrace novel therapies. The global oncology market is projected to exceed $350 billion by 2027, reflecting both expanding treatment options and growing patient populations [IQVIA Institute, Global Oncology Trends 2023, May 2023].

Standard of Care Evolution

Immuno-oncology has fundamentally reshaped cancer treatment, with PD-1 and PD-L1 checkpoint inhibitors now serving as backbone therapy for many solid tumors. These agents have moved from late-line salvage treatments to first-line standards, often in combination regimens. This evolution creates both opportunity—as novel agents seek to combine with IO—and challenge, as new entrants must demonstrate incremental benefit over an increasingly effective standard of care.

Emerging Therapeutic Frontiers

Three major trends are reshaping the competitive landscape. IO combination strategies dominate clinical development, seeking to overcome resistance mechanisms through multi-pronged immune activation. Antibody-drug conjugates (ADCs) have rapidly emerged as a major therapeutic class, offering the targeting precision of antibodies with the potent cell-killing capacity of cytotoxic payloads. Cell therapies, particularly CAR-T products, have established proof of concept in hematologic malignancies and now pursue the considerably more challenging solid tumor setting.

Regulatory and Clinical Considerations

Overall survival (OS) remains the gold standard endpoint, providing unambiguous evidence of clinical benefit. However, the FDA frequently grants Accelerated Approval based on progression-free survival (PFS) or objective response rate (ORR) for drugs addressing high unmet need. This creates significant confirmatory risk—companies must subsequently validate the surrogate endpoint benefit with OS data in confirmatory trials, and failure to do so can result in withdrawal of approval, destroying commercial value despite initial market access.

8.2 Immunology and Inflammation: Established Market Disruption

The immunology and inflammation (I&I) therapeutic area encompasses chronic diseases such as rheumatoid arthritis, psoriasis, inflammatory bowel disease, and other immune-mediated conditions. This large, established market has been characterized by high biologic utilization and intense competition among mechanism classes.

The Anti-TNF Era and Its Disruption

For two decades, anti-TNF biologics dominated I&I treatment, led by blockbusters like Humira. However, the market is experiencing fundamental disruption from two directions. Mechanistically, newer biologic classes targeting specific interleukins—particularly IL-17 and IL-23 inhibitors—offer improved efficacy or safety profiles for certain indications, gradually capturing share through “IL-class laddering” as physicians optimize patient-specific therapy selection. JAK inhibitors provide oral bioavailability advantages but face ongoing safety scrutiny following FDA warnings about cardiovascular and malignancy risks.

Novel mechanisms continue to emerge, including FcRn inhibitors that reduce pathogenic antibody levels, representing entirely new approaches to autoimmune disease management.

The second major disruption comes from biosimilars. The entry of multiple biosimilar competitors for major anti-TNFs, most notably Humira, has dramatically reshaped market economics, accelerating price erosion and forcing incumbent manufacturers to defend share through rebating and contracting strategies.

Commercial Realities

Payers manage the I&I category intensively given its large patient populations and chronic treatment duration. Significant rebates drive gross-to-net discounts exceeding 50% in many cases, compressing realized revenues far below list prices. Prior authorization requirements, step therapy protocols, and formulary positioning create substantial market access friction that shapes launch curves and peak share potential.

8.3 Rare and Genetic Diseases: The High-Price, High-Innovation Frontier

Rare diseases—affecting small patient populations—represent a strategically attractive therapeutic area characterized by high unmet need, premium pricing, and increasing focus on potentially curative therapies. Orphan drug sales are projected to reach $268 billion by 2028, reflecting both the proliferation of approved rare disease therapies and their substantial per-patient pricing [Evaluate Vantage, Orphan Drug Report 2023, 2023].

Technological Convergence

Three transformative technology platforms are converging on rare genetic diseases. Gene therapy, predominantly using AAV vectors, can potentially correct genetic defects with a single treatment. Gene editing technologies like CRISPR offer even more precise genetic modification. RNA therapeutics, including antisense oligonucleotides and siRNA, provide a third modality for modulating disease-causing genes. This technological diversity creates competitive dynamics where multiple approaches may target the same rare disease, each with distinct risk-benefit profiles.

Unique Development Challenges

Patient identification represents a fundamental hurdle. Many rare diseases suffer from diagnostic delays, small dispersed patient populations, and limited natural history data. Enrolling adequately powered clinical trials can take years and require global recruitment efforts.

Manufacturing complexity, particularly for cell and gene therapies, creates both technical risk and cost structure challenges. Autologous cell therapies require patient-specific manufacturing, while gene therapy vector production faces yield and quality challenges that constrain commercial scalability.

Perhaps most critically, durability of effect remains uncertain for many one-time genetic medicines. Long-term follow-up data extending 5-10 years or more is essential to validate claims of durable benefit, yet this evidence lags years behind initial approval.

Payer Dynamics

Payers have demonstrated willingness to reimburse premium prices for rare diseases, recognizing small budget impact and high unmet need. However, multi-million dollar one-time treatments are testing this willingness and prompting evolution toward value-based agreements (VBAs). These innovative contracting structures tie payment to long-term outcomes, addressing payer concerns about durability while providing manufacturers with pathways to appropriate reimbursement.

8.4 Neurology: Biological Complexity Meets Clinical Challenge

Neurology has historically proven among the most challenging therapeutic areas, reflecting fundamental biological obstacles and clinical development difficulties. The blood-brain barrier restricts drug delivery to the central nervous system. Disease biology often remains incompletely understood. Clinical endpoints frequently rely on subjective functional scales rather than objective biomarkers. High placebo response rates, particularly in pain and neurodegenerative conditions, obscure true treatment effects.

Alzheimer’s Disease: A Landscape in Transition

Alzheimer’s disease exemplifies both the challenges and recent progress in neurology. After decades of failures, anti-amyloid antibodies have finally demonstrated modest clinical benefit, securing FDA approvals despite significant controversy about benefit-risk balance. The field is now pursuing second-generation approaches, including tau-targeting therapies and combination strategies addressing multiple pathological pathways simultaneously.

Beyond Alzheimer’s, genetically defined neurological diseases—where specific genetic mutations drive disease—offer more tractable targets. Clear genetic causality, measurable biomarkers, and well-defined patient populations improve development probability of success compared to complex neurodegenerative conditions.

Clinical and Commercial Hurdles

High placebo response rates in many neurological conditions necessitate larger trial sizes and longer duration to achieve statistical significance, increasing development costs and timelines. Reliance on subjective functional scales, such as cognitive assessments or quality-of-life instruments, introduces measurement variability and regulatory skepticism.

Payer posture in neurology remains conservative. Clear demonstration of functional improvement—not just biomarker changes—is required for reimbursement. The controversial Alzheimer’s antibody approvals have intensified payer scrutiny, with CMS imposing restrictive coverage policies that limit real-world access despite FDA approval.

8.5 Metabolic and Cardio-Renal: Large Markets, Transformative Innovation

Metabolic and cardiovascular-renal diseases affect enormous patient populations, creating markets where even modest improvements in standard of care generate substantial value. Type 2 diabetes, obesity, heart failure, and chronic kidney disease represent interconnected conditions often sharing common pathological mechanisms.

The GLP-1 Revolution

GLP-1 receptor agonists have revolutionized metabolic disease treatment, transforming both type 2 diabetes and obesity management. These agents demonstrate not only glucose control and weight loss but also cardiovascular and renal protective effects validated in cardiovascular outcomes trials (CVOTs). The success has triggered intense competition for next-generation incretin therapies, including oral formulations, longer-acting compounds, and multi-agonists targeting GLP-1 plus additional pathways like GIP or glucagon.

Payer Economics and Evidence Requirements

The large prevalent populations affected by metabolic diseases create significant budget impact concerns for payers. Diabetes treatment faces substantial gross-to-net pressure as payers negotiate aggressive rebates to manage costs. Coverage for obesity medications is evolving, with many payers historically excluding weight loss drugs but now reconsidering given the magnitude of health benefits demonstrated in recent trials.