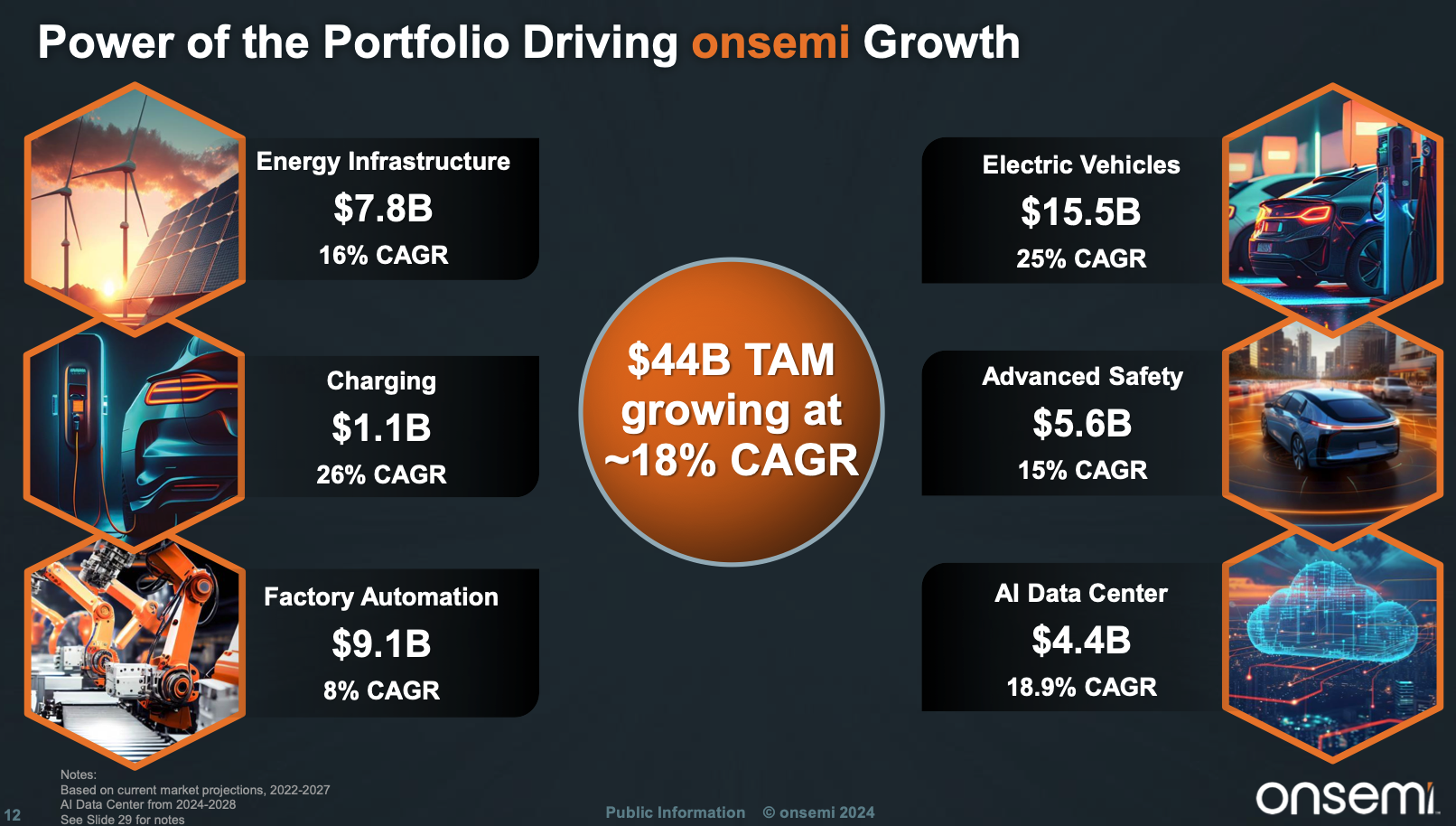

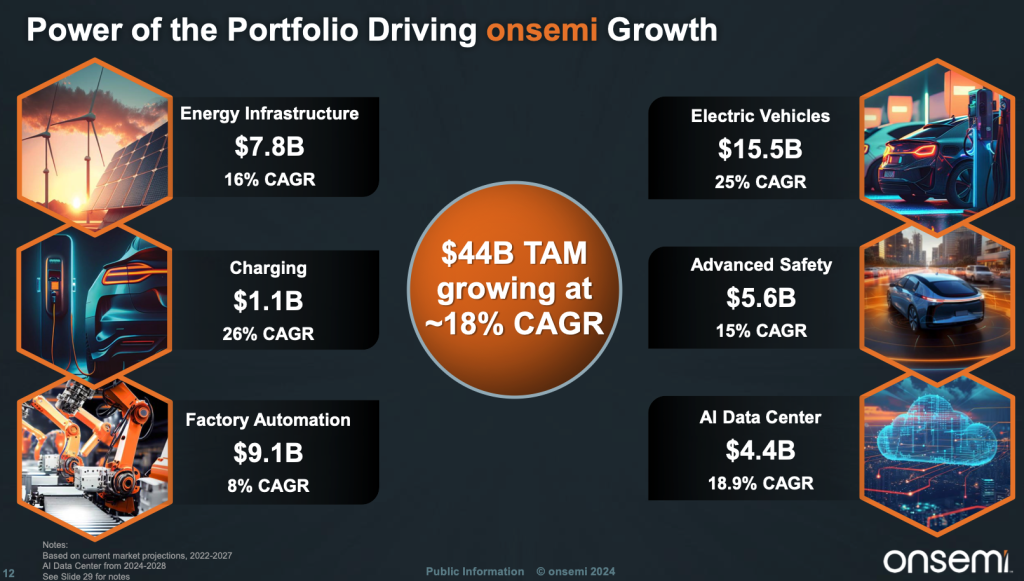

onsemi’s $44B Opportunity: Analyzing Growth Potential Across Strategic Markets

The semiconductor industry is undergoing a massive transformation, driven by trends in electrification, automation, and artificial intelligence. onsemi has positioned itself well to capitalize on these trends, with a diversified portfolio targeting high-growth markets that represent a combined Total Addressable Market (TAM) of $44B, growing at an impressive 18% CAGR.

Current Revenue Base and Market Performance

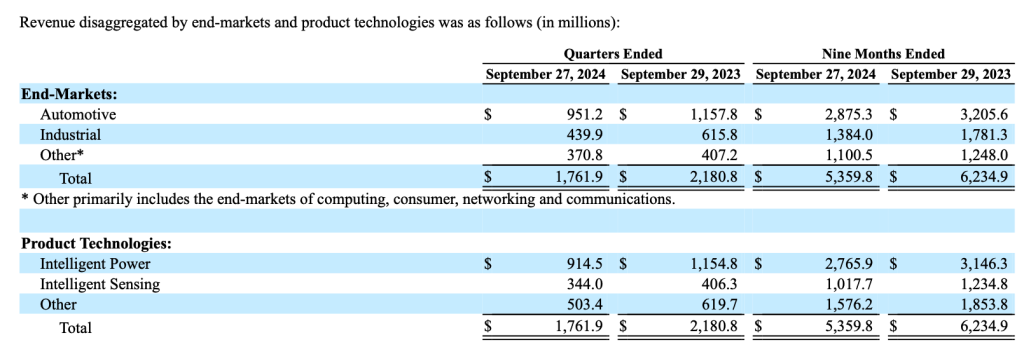

Based on Q3 2024 financial results, onsemi’s current revenue structure provides important context for future growth potential:

End-Market Revenue Distribution (Q3 2024):

- Automotive: $951.2M (54% of revenue)

- Industrial: $439.9M (25% of revenue)

- Other (Computing, Consumer, etc.): $370.8M (21% of revenue)

Total Quarterly Revenue: $1,761.9M

Product Technology Split:

- Intelligent Power: $914.5M (52% of revenue)

- Intelligent Sensing: $344.0M (19% of revenue)

- Other: $503.4M (29% of revenue)

Year-over-year comparison shows a market adjustment from Q3 2023 ($2,180.8M), reflecting current semiconductor industry cycles. However, this positions the company well for future growth as markets recover.

Current Market Leadership

onsemi’s strong market position is evidenced by their leadership across key segments:

- ADAS: Dominant 68% market share

- Industrial Sensing: 27% market share

- Silicon Power: #2 market position with growing share

- Automotive/Industrial Sensing: #1 position

- Silicon Carbide: Growing at 2x market rate

Breaking Down onset Total Adressable Market

Electric Vehicles ($15.5B TAM, 25% CAGR)

Currently contributing significantly to the $951.2M automotive revenue, this segment shows strong growth potential. Their current leadership in Silicon Carbide (growing 2x the market rate) and vertically integrated manufacturing capabilities suggest they could capture 25-30% of this market. This is supported by their:

- Vertically integrated manufacturing at scale

- Industry-leading innovative device and packaging technologies

- Strong position in ADAS with 68% market share

Factory Automation ($9.1B TAM, 8% CAGR)

With a 27% market share in industrial sensing and leadership in machine vision, onsemi is well-positioned to grow from their current $439.9M quarterly industrial revenue. Their intelligent sensing solutions and power management capabilities support a continued strong position in this market.

Energy Infrastructure ($7.8B TAM, 16% CAGR)

onsemi’s #2 position in Silicon Power (IGBT, FET) and their expanding BOM coverage make them a strong player in this segment. Their strategic exit from price-sensitive markets indicates a focus on high-margin opportunities.

Advanced Safety ($5.6B TAM, 15% CAGR)

With an impressive 68% market share in ADAS and leadership in automotive sensing, onsemi could maintain or expand their dominant position in this segment. Their 8MP ramping capability with ~2.5x ASP uplift indicates continued innovation.

AI Data Center ($4.4B TAM, 18.9% CAGR)

Their Power ICs business, which targets a $14B TAM with >70% gross margins, positions them well in this segment. Their focus on optimizing system costs with gate drivers and controllers supports potential market share gains.

Charging Infrastructure ($1.1B TAM, 26% CAGR)

Leveraging their silicon carbide technology and power solutions expertise, onsemi is well-positioned in this high-growth segment.

Market Capture Analysis

Based on current quarterly revenue of $1.76B ($7B annualized run rate) and their strong market positions:

- Conservative scenario: 20% of total TAM = $8.8B (26% growth from current run rate)

- Moderate scenario: 25% of total TAM = $11B (57% growth from current run rate)

- Optimistic scenario: 30% of total TAM = $13.2B (89% growth from current run rate)

These estimates are supported by:

- Current Revenue Base: Demonstrated ability to generate significant revenue across key segments

- Market Leadership: Strong positions in key markets

- Product Mix: Balanced portfolio between Intelligent Power and Sensing solutions

- End-Market Diversity: Strong presence in both automotive and industrial sectors

Growth Strategy and Revenue Expansion

The path from current revenue levels ($7B annualized) to capturing a larger share of the $44B TAM involves:

- Expanding silicon carbide penetration as part of the automotive expansion.

- Expanding 27% market share in industrial sensing by developing new applications and use cases

- Expanding sensing solutions ($344.0M quarterly) and nvesting in next-generation technologies

Execution Strategy

onsemi’s approach to capturing this TAM includes:

- Intelligent Power Solutions: Enabling customers to exceed range targets while reducing system costs through unparalleled efficiency

- Intelligent Sensing Solutions: Offering proprietary features for demanding use cases

- Manufacturing Excellence: Vertically integrated manufacturing at scale

- Premium Market Focus: Strategic exit from price-sensitive markets to focus on high-margin opportunities

Why if projections foreseen high growth, onsemi is currently reporting negative growth yoy?

Despite onsemi’s strong market position and significant growth opportunities across strategic markets, the company is currently experiencing negative revenue growth due to several factors:

- Cyclical Nature of the Semiconductor Industry: The semiconductor industry is known for its cyclical nature, with periods of high demand followed by downturns. onsemi is currently navigating through a softer demand environment, which is impacting its revenue growth.

- Market Softness: CEO Hassane El-Khoury has acknowledged that the company is starting to see “pockets of softness” in the market. This softness is likely due to broader economic factors, including high interest rates, which can impact demand across various sectors.

- Inventory Corrections: The automotive sector, which is a significant market for onsemi, has been going through an inventory correction phase. Auto manufacturers had previously invested in excess inventory after the chip shortage, and are now working through that inventory, leading to reduced demand for new chips.

- Geopolitical Tensions: Growing tensions between the U.S. and China, including restrictions on semiconductor exports to China, are impacting onsemi’s revenue. In 2022, nearly a third of the company’s revenue came from China.

- Strategic Portfolio Management: onsemi has been strategically exiting from price-sensitive markets to focus on higher-margin opportunities. While this strategy may lead to better profitability in the long term, it can result in short-term revenue declines.

- Macroeconomic Factors: High interest rates and economic uncertainties are affecting overall demand, particularly in consumer-oriented markets.

It’s important to note that despite the current negative revenue growth, onsemi’s recent Q3 2024 results actually exceeded expectations, with revenue of $1,761.9 million, which was a slight increase from Q2 2024. However, this still represents a decrease from Q3 2023, indicating the ongoing challenges in the market. The company’s focus on high-growth markets like electric vehicles, factory automation, and AI data centers positions it well for future growth once the current market softness subsides. onsemi’s strategic transformation under CEO Hassane El-Khoury, including its focus on vertical integration and Silicon Carbide technology, is designed to capture market share in these growing sectors over the long term

Challenges and Considerations

- Market Cyclicality: As evidenced by the Q3 2024 vs. Q3 2023 revenue comparison, semiconductor markets can be cyclical

- Competition: Despite strong market positions, maintaining share requires continued innovation

- Execution Risk: Scaling manufacturing and maintaining quality at higher volumes

- Customer Concentration: Managing relationships while expanding market share

- Margin Maintenance: Balancing growth with profitability as markets evolve

Conclusion

Given onsemi’s demonstrated market leadership and strong technological positions, capturing 25% of the $44B TAM appears achievable, representing significant growth from current revenue levels. Their current dominant positions in key markets (68% in ADAS, 27% in Industrial) and strategic focus on premium segments support this potential capture rate. Success will depend on:

- Maintaining technological leadership in Silicon Carbide and sensing

- Executing on manufacturing scale-up

- Maintaining high margins while growing market share

- Successfully navigating market cycles

The company’s focus on intelligent power and sensing solutions, combined with their strategic positioning in high-growth markets, provides a strong foundation for capturing a significant portion of the available TAM.

Note: Financial data sourced from onsemi’s Q3 2024 10Q filing. Market share data and positioning information from onsemi public information (2024). TAM projections based on 2022-2027 market projections, with AI Data Center projections for 2024-2028.

Forward-looking statements are not guarantees of future performance and involve risks and uncertainties that may cause actual results to differ materially from those anticipated or projected. This analysis represents the author’s interpretation of publicly available information at the time of writing. The scenarios presented in this analysis are hypothetical and may not consider all factors that could impact onsemi’s future performance. Actual results may vary significantly from the projections presented.