Decoding the 25/45 Delta-Managed Wheel Strategy

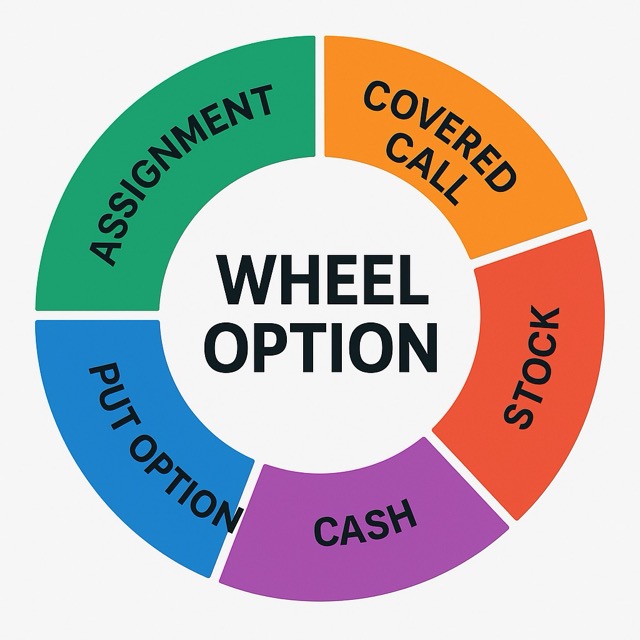

The “Wheel” is one of the most popular options strategies for generating income. At its core, it’s a systematic process: you sell cash-secured puts on a stock you’re willing to own. If you get assigned, you then sell covered calls against those shares.

But as any Wheel trader knows, the real challenge isn’t the “what.” It’s the “when.”

When does a trade go “bad”? When do you manage it? Do you take the loss, or do you “roll” the position, hoping for a comeback?

Many traders use arbitrary rules based on gut feelings or price levels. A more quantitative approach, however, involves using options “Greeks”—specifically, Delta.

Let’s analyze a popular delta-based rule: Sell a 25-delta put, and manage the trade (close or roll) if it hits 45 delta.

How would this perform? What are the hidden risks? And how does it change if you’re trading a stable ETF like SPY versus a high-volatility rocket ship of a stock?

The Entry: Why Sell at 25 Delta?

Selling a 25-delta put is a classic entry point for a reason. Delta is often used as a rough proxy for probability. A 25-delta put is seen as having approximately a 25% chance of expiring in-the-money (ITM) and a 75% chance of expiring worthless.

This strikes a balance: the premium collected is more significant than selling “safer” 10-delta puts, but the risk of assignment is much lower than selling at-the-money (50-delta) puts.

For the low-volatility portion of a portfolio (e.g., SPY), this entry has a built-in structural advantage: the volatility skew.

In plain English, market “fear” means that out-of-the-money puts (used for protection) are in high demand. This demand inflates their implied volatility, making them “overpriced” relative to their true statistical probability of expiring ITM. When you systematically sell 25-delta SPY puts, you are, in effect, acting as the casino. You are selling “overpriced insurance” and collecting a “fear premium” that should, over the long term, provide a statistical edge.

The Trigger: Why 45 Delta is the “Defense” Line

The 45-delta rule is the core of this strategy’s risk management. It’s not just a random number; it’s a proactive gamma-management rule.

Here’s what that means:

- Delta is your position’s “speed.”

- Gamma is its “acceleration”.

As an option gets closer to the 50-delta (at-the-money) mark, its gamma explodes. This means its delta (risk) accelerates wildly. A $1 move in the stock has a much larger impact on your P/L.

Furthermore, gamma risk is highest as you get close to the expiration date. This is the “danger zone” where a small adverse move can turn a manageable position into a certain assignment overnight.

The 45-delta rule is designed to force you to make a defensive decision before this “gamma explosion” happens. It’s a quantitative line in the sand that says, “The position’s risk profile is now accelerating. It’s time to act.”

The Critical Decision: “Close” or “Roll”?

When your 25-delta put is tested and hits 45 delta, you have two choices. This decision fundamentally splits the strategy’s outcome.

Path A: Close the Trade (The “Stop-Loss”) You simply buy to close the put, realize the loss, and free up your capital.

- Pro: This optimizes for capital velocity. Your cash is immediately unbound and can be redeployed into a new 25-delta put.

- Con: This path is extremely vulnerable to whipsaws. In a choppy, sideways market, you can be stopped out repeatedly, only to watch the market reverse. This is the classic “death by a thousand cuts”.

Path B: Roll the Trade (The “Trade Defense”) This is the more common tactic in the Wheel. You “roll” by simultaneously closing your at-risk 45-delta put and selling a new put—usually at a lower strike or further out in time—to collect a net credit.

For example :

- Initial Trade: Sell put for $2.30 credit.

- Trade is Tested: The put is now worth $3.50 (an unrealized loss).

- Roll Execution:

- Buy to Close the old put for a $3.50 debit.

- Sell to Open a new put (further out) for a $4.00 credit.

- Net Result: You collect a $0.50 net credit ($4.00 – $3.50).

- Pro: You have avoided a realized loss and given your trade more time to be right.

- Con: This path collapses capital efficiency. Your capital remains locked up for this new, longer duration, all to fight for a small additional credit.

How This Strategy Impacts Your Portfolio

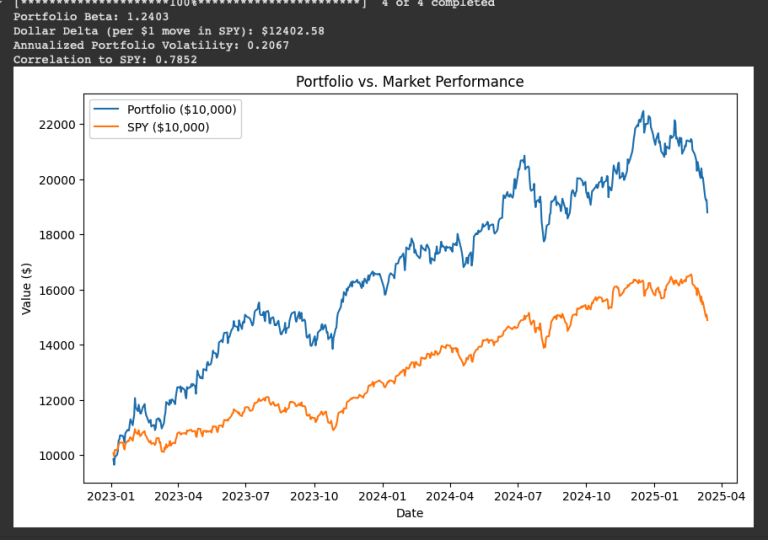

This 25/45 delta protocol creates a very specific, and asymmetric, performance profile.

1. Overall Returns: Bumpy and Asymmetric Assuming you “roll” (Path B) to defend trades, your equity curve will look “bumpy.” It will consist of many small, steady wins from unchallenged puts. But these wins will be punctuated by long, flat periods where your capital is “stuck” in a defensive roll, fighting to get back to breakeven. You are essentially creating “zombie trades” that aren’t losing, but they aren’t winning either—they are just tying up capital.

2. Assignment Risk: Systematically Eliminated This is the strategy’s superpower. The single greatest risk in a simple Wheel strategy is “gamma risk”—holding an at-risk put near expiration and getting assigned unexpectedly.

The 45-delta rule systematically excises this risk. By forcing you to roll out in time the moment a trade is challenged, you ensure you are almost never holding an at-risk (high-delta) put in the high-gamma “danger zone” near expiration.Involuntary assignment becomes exceptionally rare. Assignment only happens if you choose to stop rolling and accept the shares.

3. Capital Efficiency: The Great Trade-Off This is the price you pay for low assignment risk. This strategy runs at two speeds:

- Winners: High capital efficiency. The capital is recycled quickly into the next trade.

- Losers (Rolls): Horrendous capital efficiency. You are keeping a large amount of capital (e.g., $50,000 for one SPY put) locked up for weeks or months, all to collect an extra $50 net credit. You are sacrificing capital velocity for capital preservation.

The Great Divide: Low-Vol (SPY) vs. High-Vol (TSLA)

This strategy does not work the same way on all stocks. Applying a fixed 25/45 delta rule to both SPY and a high-volatility stock is like using the same set of tools to build a watch and build a bridge.

The “Core” (SPY, Low-Volatility):

- Profile: This works. Premiums are modest , but the put skew provides a tailwind.

- Performance: The 25/45 delta “buffer” is wide and meaningful. It takes a significant market pullback to trigger the 45-delta rule. The strategy functions as an infrequent correction-defense protocol. When triggered, you may be in a defensive roll for a long time, but it’s manageable.

The “Satellite” (e.g., TSLA, NVDA, High-Volatility):

- Profile: This is a trap. Premiums are massive and tempting.

- Performance: The 25/45 delta “buffer” is an illusion. On a volatile stock, that gap can be erased in minutes, not weeks. The 45-delta rule is no longer a defensive line; it’s a tripwire.

- This results in a hyperactive whipsaw-management nightmare. You are constantly triggering your management rule, forced to either take “death by a thousand cuts” (Path A) or have 100% of your satellite capital permanently locked in defensive rolls (Path B).

The Verdict: What Are You Really Trading?

The 25/45 delta-managed strategy is not “safer” or “better” in absolute terms. It is a structural trade-off.

- A simple “hold-to-expiration” Wheel trader accepts assignment/gamma risk to avoid whipsaw risk.

- A 25/45 delta-managed trader does the exact opposite.

You are choosing to systematically eliminate assignment and gamma risk. In exchange, you are acceptingheightened whipsaw risk and the guarantee of poor capital efficiency during losing trades.

This can be a robust, professional-grade system for a patient trader on low-volatility, core assets like SPY.

It is, however, a recipe for high-stress over-trading and capital-inefficiency traps when applied to the high-volatility assets it seems most tempting to use it on.

Disclaimer: This article is for informational and educational purposes only. It is not financial advice. The information contained herein is not a recommendation to buy or sell any security. Options trading carries a high level of risk and is not suitable for all investors. Before investing, please consult a licensed professional. Any strategies discussed, including hypothetical examples, are for illustration purposes only and may not be indicative of future results.