1. The Earnings Delta Trap – Managing Short Put Assignment Risk

Earnings announcements create the perfect storm for options traders: implied volatility collapses while directional risk explodes. For senior traders managing concentrated positions, this isn’t just about P&L—it’s about survival. The scenario we’ll dissect today represents the #1 cause of unexpected capital calls in professional options portfolios: a low-probability short put that morphs into a high-delta equity surrogate overnight.

The mechanics are deceptively simple. You sell a 25-delta put before earnings, collecting premium from implied volatility that you expect to crush. The position initially behaves like an income trade—minimal directional exposure, positive theta, manageable risk. Then the unexpected happens: the stock gaps down through your strike, implied volatility increases instead of decreasing, and your 25-delta position becomes an 85-delta monster. Your “capped risk” trade now threatens portfolio-level drawdowns.

This is the Delta Trap, and it requires immediate, mathematically precise intervention. As macroption.com explains, delta represents the hedge ratio and directional sensitivity of an option position. When delta shifts from +0.25 to +0.85 post-earnings, your hedge ratio just went from “manageable” to “portfolio-threatening.”

For trading professionals, this isn’t merely about adjusting a position—it’s about dynamically rebalancing risk-weighted assets under liquidity constraints while minimizing information ratio drag. Let’s walk through the exact playbook.

The Scenario: AAPL’s Post-Earnings Delta Explosion

Initial Position Construction

You initiated a pre-earnings income strategy on Apple Inc.:

- Underlying: AAPL @ $180.00 (pre-earnings close)

- Position: Short 1 contract of the $175 strike put (30 days to expiration)

- Initial Delta: +0.25 per share (+25 total position delta)

- Premium Received: $2.50 ($250 total credit)

- Cash-Secured Requirement: $17,500 – $250 = $17,250 (broker rules vary slightly)

- Portfolio Context: $250,000 total NAV → this position = 6.9% capital at risk

Post-Earnings Shock

AAPL misses iPhone shipment guidance. The stock closes at $165.00, down 8.3% overnight:

- New Put Price: $11.00 ($1,100 mark-to-market)

- New Delta: +0.85 per share (+85 total position delta)

- Unrealized Loss: -$850 (-34% of position capital)

- New Greeks: Gamma = -0.03$ per $1 move (per contract), nu = -0.12$ per 1 vol point, theta = +0.08$ per day

Critical Risk Metrics:

- Position Δ: +85 deltas = 5.6% of portfolio NAV in directional exposure ($14,025 notional)

- Gamma risk: A further $1 drop in AAPL adds about +3 deltas (short-gamma acceleration)

- Assignment risk: High probability of finishing ITM given +0.85 delta

- Capital at risk: $14,025 represents 81% of the original cash-secured allocation ($14,025 ÷ $17,250)

This is no longer an options trade—it’s a synthetic long equity position you never intended to own.

Quantifying the Crisis: Dynamic Delta-Adjusted Risk

Before action, calculate your true exposure:

Key Insight: Your position now behaves like long 85 shares. At $14,025, this represents 5.6% of total portfolio in disguised equity risk—breaching typical single-name concentration limits of 2-3% for earnings trades.

Delta hedging is the practice of offsetting directional exposure, but the complexity multiplies when gamma and liquidity change simultaneously in stressed markets.

The Gamma-Aware Delta Neutralization Playbook

Four institutional-grade responses, ranked by capital efficiency and risk profile:

Strategy 1: Immediate Delta Neutralization (The “Surgical Strike”)

Action: Sell 85 shares of AAPL @ $165.00 to achieve Δ-neutral

| Metric | Calculation | Impact |

|---|---|---|

| Gross Exposure | $165 × 85 = $14,025 | 5.6% of portfolio |

| Margin Impact | Variable (broker-dependent; short stock carries margin & borrow fees) | Check HTB rates |

| P&L Impact | No additional loss (freezes delta P&L; option loss remains unrealized) | Arrests directional risk |

| Residual Greeks | Gamma = -0.03$ (option gamma remains), nu = -0.12$ | Vol exposure remains |

Pros: Immediate directional risk elimination; assignment risk persists; maintains vol exposure if IV mean-reverts

Cons: High capital requirement; leaves negative gamma that decays your hedge effectiveness

Strategy 2: Vertical Spread Repair (Defined-Risk Conversion)

Action: Close original position and open a short put vertical:

- Buy back 1x $175P @ $11.00 (-$1,100)

- Sell 1x $160P (45 DTE) @ $4.50 (+$450)

- Buy 1x $155P (45 DTE) @ $2.50 (-$250)

- Net transaction: -$900 realized loss

Resulting Position: Short 1x $160P / Long 1x $155P (short put vertical with $5 width)

- Max Profit: $2.00 credit ($200) if AAPL > $160

- Max Risk: $3.00 ($5 width – $2 credit = $300)

- Residual Δ: ~+20 (vs. +85 original)

- Residual Γ: Small and bounded (materially lower than naked)

- Capital Requirement: $300 (defined risk), vs. $17,250 cash-secured prior

Pros: Reduces delta by 76%; capital requirement drops from $17,250 to $300 (98% reduction); defines max risk at $300 vs. a much larger capped loss on the original short put

Cons: Realizes -$900 loss; limited upside participation

Simpler Alternative – Roll to Single Lower Strike:

- Buy back 1x $175P @ $11.00 (-$1,100)

- Sell 1x $165P (30 DTE) @ $8.00 (+$800)

- Net debit: -$300

- New cash-secured requirement: $16,500 – $800 = $15,700

- New position Δ: ~+60 (30% reduction)

Strategy 3: Put Ratio Backspread (Tail Hedge)

Action: For traders expecting continued downside, convert to a convex structure:

- Close original short 175P

- Open: Long 2x $180P @ $15.00 each (-$3,000) + Short 1x $165P @ $8.00 (+$800)

- Net debit: -$2,200

Resulting Position: Long 2 higher-strike puts, short 1 lower-strike put

Position Greeks:

- Net Δ: ≈ -60 (net long put delta near spot, varies with vol)

- Net Γ: +0.08 (positive gamma profits from gaps)

- Max Loss: $2,200 (net debit) if AAPL ≥ $180 at expiry

- Profit Profile: Below $165, payoff increases by roughly $100 per $1 drop at expiry (net one extra long put)

Pros: Positive gamma hedges tail risk; profits if AAPL continues down

Cons: Higher capital requirement; complex margin; loses money if AAPL stays flat

Strategy 4: Structured Assignment with Single Covered Call

Action: Accept assignment, then:

- Take delivery of 100 shares AAPL @ $175.00 (net cost: $17,500 – $250 = $17,250)

- Sell 1x $170C (30 DTE) @ $3.00

- Net cost basis: $17,250 – $300 = $16,950 ($169.50/share)

P&L Scenarios (cost-basis lens):

- Called @ $170: +$50 (stock gain to $170 call) + $300 (call) = +$350 vs. new basis

- AAPL @ $165 (call expires): -$450 unrealized loss vs. new basis

- AAPL @ $180 (call exercised @ $170): +$50 (stock gain to $170) + $300 = +$350 (capped)

Pros: Transforms position into income-generating equity; reduces breakeven

Cons: Requires 7% NAV in equity; leaves downside open; caps upside

Decision Framework: When to Execute Which Strategy

Liquidity & Transaction Cost Analysis

AAPL Market Conditions (Post-Earnings):

- Options Volume: 87,000 contracts (passes 50k threshold)

- Bid-Ask Spreads: $0.03-$0.05 wide = $3-$5 per contract

- Transaction Cost: $5 / $250k portfolio = 0.2 bps

- Slippage Estimate: $0.02 per contract

Capital Reserve Requirements

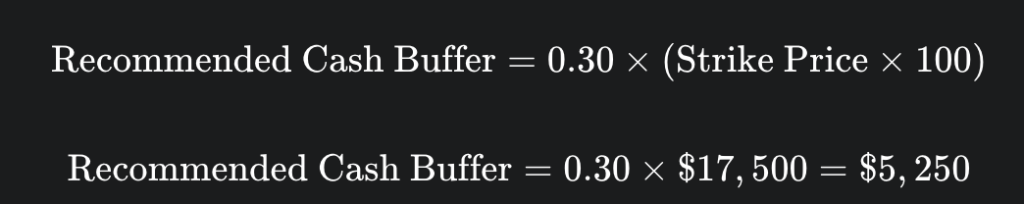

For assignment scenarios:

How it works: Instead of making you set aside the full $17,500, your broker allows you to use leverage. They only require you to have a portion of the total obligation as collateral. This portion is the “margin requirement.”

In your formula: The 0.30 (or 30%) is the margin rate, and the $5,250 is the Required Margin (your “Cash Buffer”).

Key Quantitative Outputs & Recommended Action

Trade-Off Matrix (Final)

| Strategy | Capital / Requirement | P&L Impact (transaction) | Residual Δ (approx) | Residual Γ | Implementation Ease |

|---|---|---|---|---|---|

| 1. Δ-Hedge (short 85 sh) | Gross exposure $14,025; margin & borrow vary | Frozen (no further Δ P&L) | 0 | − (from short put) | High |

| 2. Vertical Repair (short 160/long 155) | Defined risk $300 (=$500−$200 credit) | −$900 realized (to close 175P and open spread) | ≈ +20 | Small (near-zero) | Medium |

| 3. Put Ratio Backspread (long 2×180, short 1×165) | Max loss $2,200 (debit) if AAPL ≥ 180 | −$2,200 debit | ≈ −60 | + (positive) | Low (most complex) |

| 4. Assignment + 1× covered call | $16,950 equity deployed; downside uncapped | Unrealized at acceptance; income via calls | +100 | 0 | Medium |

Potential Action for $250K Portfolio

Optimal Strategy: Vertical Repair (Strategy 2)

- Immediate (T+0): Execute vertical spread repair (Short 160P / Long 155P) for -$900 realized loss

- Reduces delta from +85 to +20 (76% reduction)

- Capital requirement drops from $17,250 to $300 (98% reduction)

- Defines max risk at $300 vs. a much larger capped loss on the original short put

- Day 2-3 (T+1-2): If AAPL drops below $155, close spread for near max loss of $300

- Total loss: -$900 (roll) – $300 (spread) = -$1,200 (4.8 bps of portfolio)

- Reallocate to diversified put-write ETF (e.g., PUTW) to avoid single-name risk

- If AAPL recovers > $160: Let spread expire worthless, keep $200 credit

- Net loss: -$900 + $200 = -$700 (2.8 bps of portfolio)

Rationale:

- Limits single-name risk to 0.12% of NAV (not 5.6%)

- Immediate 98% reduction in capital requirement vs. original $17,250 cash-secured put

- Preserves 30% cash buffer ($75,000) for other opportunities

- Transaction cost: $12 round-trip = 0.5 bps of portfolio

Risk Management Rules for Portfolio-Level Implementation

Universal Constraints (Apply to ALL Earnings Trades):

Max Pre-Trade Delta Band:

Post-Shock Stress Test: If underlying gaps ±8%, does new Delta exceed 4% of NAV?

If YES, position is pre-emptively oversized.

Corrected Sizing Formula:

Ralloc: Maximum risk allocation per trade (e.g., 2.5% = 0.025)

Sfactor: Shock factor = expected adverse move as % of strike (e.g., 10% drop → 1.10)

Where Shock Factor = 3.0 (assumes delta can expand 3× from 0.25 to 0.75)

For AAPL example:

Key Lesson: Your 1-contract trade was 8.3× oversized for earnings risk. Proper sizing would have been 1/8th of a contract—impossible in standard options. Conclusion: Avoid naked short puts on single-name earnings.

Conclusion: Institutionalizing Your Response

The earnings delta trap isn’t a failure of analysis—it’s a failure of position sizing relative to liquidity events. For CFA professionals, the key lesson is quantitative: delta expansion is non-linear under high gamma, and pre-trade stress testing is essential.

The AAPL scenario demonstrates that a 25Δ put can become an 85Δ equity surrogate. The solution isn’t avoiding earnings trades—it’s pre-planning the delta band at which you intervene and maintaining gamma-aware hedging tools ready for immediate deployment.

Next Article Preview: In Article 2, we’ll dissect the “Gamma Bomb” scenario—managing short strangles within 72 hours of expiration when gamma acceleration turns a 16Δ position into a 90Δ freight train during a Fed announcement. We’ll cover the critical difference between delta hedging and delta-gamma hedging that optionalpha.com identifies as essential for stable portfolio management.