Waymo’s Progress, Prospects, and Alphabet’s Other Bets

Waymo, formerly known as the Google Self-Driving Car Project, has evolved into a leading autonomous driving technology company under the umbrella of Alphabet Inc. This report delves into its recent progress, growth prospects for 2025, and compares it with other Alphabet “other bets” to identify which has higher potential outside Waymo, providing a detailed overview for stakeholders and interested parties.

Ownership Structure

Waymo is not directly owned by Google; instead, it is a subsidiary of Alphabet Inc., which also owns Google and other ventures. This corporate structure was established when Waymo was spun out from Google in December 2016, allowing it to operate as an independent entity while leveraging Alphabet’s resources. This arrangement is crucial for understanding its financial and strategic independence, as evidenced by its recent funding rounds not involving Google directly but Alphabet and other investors (Waymo – Crunchbase Company Profile & Funding).

Recent Progress and Operational Expansion

Waymo’s progress in 2024 has been marked by significant operational expansions and technological advancements. The company currently offers commercial robotaxi services in three major U.S. cities: Phoenix, San Francisco, and Los Angeles. In 2024, it expanded its service areas in these cities, including providing curbside service at Phoenix Sky Harbor International Airport and initiating fully autonomous freeway operations in Phoenix and San Francisco. This expansion has led to a tenfold increase in paid weekly trips, reaching over 150,000 by the end of 2024, as noted in their year-in-review blog post (Scaling Waymo One safely across four cities this year).

Technologically, Waymo introduced the 6th-generation Waymo Driver, optimized for cost and enhanced capabilities, which is a testament to its commitment to improving safety and efficiency. The company’s focus on integrating large language models with visual language models, as mentioned by co-CEO Tekedra Mawakana at CES 2025, aims to create a robust, multi-modal system for perception, planning, and prediction, further solidifying its technological edge (Three key takeaways from the Waymo co-CEO’s CES 2025 keynote).

Growth Prospects for 2025

Looking ahead to 2025, Waymo’s growth prospects appear robust, driven by ambitious expansion plans and continued technological development. The company plans to launch its Waymo One service in Austin, Texas, and Atlanta, Georgia, as part of its expanded partnership with Uber, with testing already underway in these cities. Additionally, it aims to expand to Miami, as indicated by recent testing activities and community discussions on platforms like Reddit (r/waymo on Reddit: What are Waymo’s 2025 expansion plans?).

A more extensive initiative for 2025 involves testing its autonomous driving technology in over 10 new cities, starting with Las Vegas and San Diego. This testing phase, as reported by Engadget and USA Today, will involve sending a limited fleet of vehicles to each city, manually driven by trained specialists to collect data on regional driving habits, weather patterns, and urban complexities (Waymo to test its driverless system in ten new cities in 2025, Alphabet’s Waymo to test its autonomous driving technology in over 10 new cities). This approach is part of Waymo’s strategy to challenge its system in diverse environments, potentially paving the way for future commercial launches.

Community and industry insights suggest expectations of significant scaling, with targets like 1 million rides per week and 8-10 million miles driven weekly by Christmas 2025, as discussed on Reddit (r/waymo on Reddit: Scaling and expansion in 2025). This scaling will likely require additional vehicles, such as Zeekrs or Jags, to meet demand, indicating a focus on fleet expansion and operational efficiency.

Below is a table summarizing Waymo’s current and planned operational cities for 2025:

| City | Status in 2025 |

|---|---|

| Phoenix | Commercial operation, expanded service |

| San Francisco | Commercial operation, expanded service |

| Los Angeles | Commercial operation, expanded service |

| Austin, Texas | Planned launch |

| Atlanta, Georgia | Planned launch |

| Miami, Florida | Testing, paid rides in 2026 |

| Las Vegas, Nevada | Testing phase, starting in 2025 |

| San Diego, California | Testing phase, starting in 2025 |

| 8 additional cities | Testing phase, to be announced |

Financial Backing and Challenges

Financially, Waymo closed a $5.6 billion Series C funding round in October 2024, led by Alphabet and joined by prominent investors such as Andreessen Horowitz, Fidelity, and Silver Lake. This round boosted Waymo’s valuation to over $45 billion, as reported by TechCrunch (Waymo’s latest funding round boosts it to a $45B valuation | TechCrunch). This significant investment, following a previous $5 billion commitment from Alphabet in June 2024, underscores the confidence in Waymo’s business model and its potential for scalability.

Challenges include public perception, as seen in incidents of vandalism in San Francisco, and the need for robust bad-weather models for expansion into snowy or flooded cities like Chicago or Miami, as discussed in community forums. Regulatory approvals, especially in new cities, will also be crucial, given the California Public Utilities Commission’s role in overseeing autonomous vehicle operations (Waymo – Latest waymo , Information & Updates – Auto -ET Auto).

Comparative Analysis and Competitive Landscape

Waymo’s position as a leader in the autonomous vehicle space is reinforced by its extensive testing (over 7.1 million miles driven with only 3 crashes involving injuries in 2023, as per Wikipedia) and its ability to navigate regulatory landscapes, especially compared to competitors like Cruise, which faced setbacks in 2023. The company’s strategy of partnering with vehicle manufacturers like Jaguar and Volvo, rather than building its own cars, allows it to focus on technology development, giving it an edge over competitors like Tesla, which relies solely on camera-based systems (Waymo – Wikipedia).

Alphabet’s Other Bets and Potential Outside Waymo

Alphabet’s “other bets” refer to its various subsidiaries and projects that are not part of its core Google business, including Waymo, Verily, Wing, DeepMind, Intrinsic, and others. These bets are designed as moonshot projects with potential to open new industries, as outlined in financial reports (Alphabet “Other Bets”: In Search Of Google’s Hidden Gems). In 2024, Alphabet’s “Other Bets” segment showed a decline in revenue and an increase in losses compared to 2023. The segment reported revenue of $400 million in Q4 2024, down 39% year-over-year from $657 million in Q4 2023.

To identify which other bet has higher potential outside Waymo, we analyze key players:

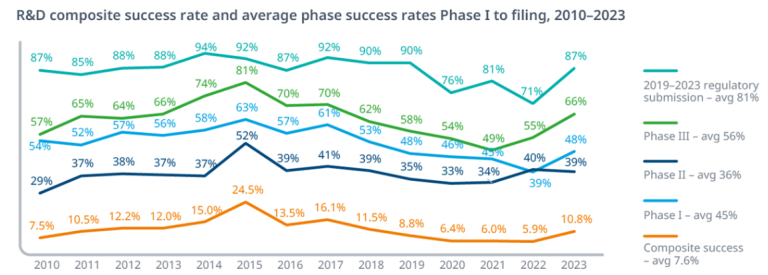

- DeepMind: Focused on AI research, DeepMind has achieved breakthroughs like AlphaFold 3, which predicts molecular structures for drug discovery, and large language models (Google DeepMind and Isomorphic Labs introduce AlphaFold 3 AI model). Its potential lies in transforming multiple industries, with the global AI market projected to reach $1.8 trillion by 2030. However, its direct revenue contribution is less clear, as it’s integrated into Alphabet’s AI efforts.

- Verily: In healthcare, Verily focuses on precision health, with products like the Verily Study Watch and partnerships in genomics. The healthcare market is massive, but its path to profitability and scale may be slower compared to Waymo’s transportation focus.

- Wing: In drone delivery, Wing operates in several locations, conducting millions of deliveries, but faces regulatory challenges and an emerging market, potentially limiting short-term growth compared to Waymo.

- Intrinsic: Focused on industrial robotics, Intrinsic aims to make robots more versatile, but is in early development, with partnerships like Siemens, suggesting long-term potential but less immediate impact.

Given Waymo’s commercial success and $45 billion valuation, its potential in autonomous driving is significant, with the market projected at $2.3 trillion by 2030. However, DeepMind’s broader impact on AI, affecting sectors from healthcare to climate, suggests higher long-term potential outside Waymo’s domain, despite less direct revenue generation. Thus, DeepMind is deemed to have higher potential outside Waymo due to its transformative AI capabilities.

Below is a table comparing Alphabet’s other bets outside Waymo:

| Company | Focus Area | Current Status | Potential Market Size |

|---|---|---|---|

| DeepMind | AI Research | Breakthroughs like AlphaFold 3, integrated into Google products | $1.8 trillion by 2030 (AI market) |

| Verily | Healthcare | Precision health, partnerships in genomics | Massive, but slower growth |

| Wing | Drone Delivery | Operating in several locations, millions of deliveries | Emerging, regulatory challenges |

| Intrinsic | Industrial Robotics | Early development, partnerships like Siemens | Promising, long-term potential |

Conclusion

In summary, Waymo’s progression is marked by significant operational and technological advancements, with strong financial backing and ambitious expansion plans for 2025. Its growth prospects are supported by planned launches in new cities, extensive testing, and increasing ridership, positioning it as a frontrunner in the autonomous driving industry. Stakeholders should monitor its ability to scale operations, navigate regulatory hurdles, and adapt to diverse environmental conditions to fully realize these prospects.

Among Alphabet’s other bets, DeepMind has higher potential outside Waymo due to its transformative work in AI, with applications across multiple sectors and significant long-term impact, despite less direct revenue generation compared to Waymo’s commercial model.