9. Python for Fundamental Analysis: Gauge Market Tone with NLP Sentiment Analysis

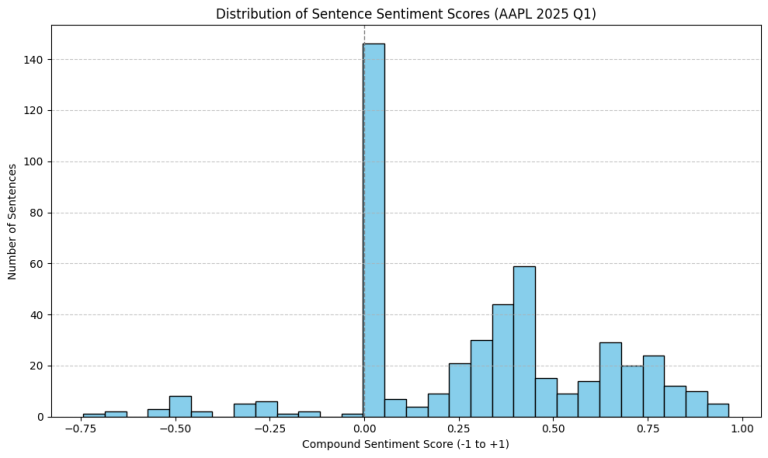

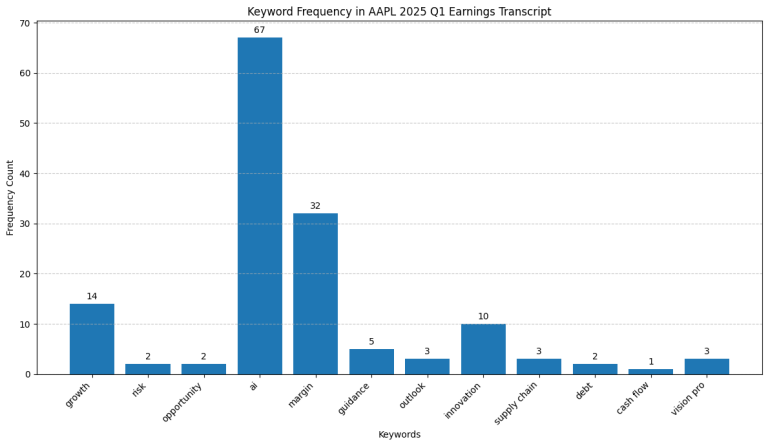

Hello again, and welcome to the eighth installment of the Python for Finance series! We’ve journeyed from basic ratios to complex data retrieval and even dipped our toes into qualitative analysis by fetching earnings call transcripts and doing basic keyword searches. Catch up on the series here: In Post 8, we saw that keyword counts lack nuance…