Understanding the Dynamics of U.S. Treasury Bonds in the Context of a Rising Deficit

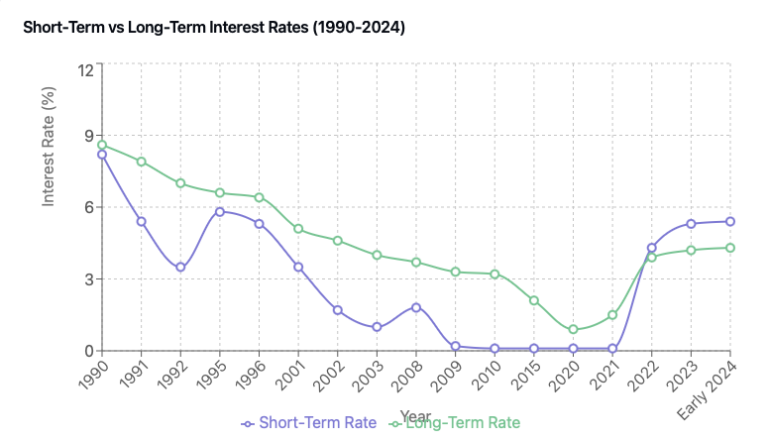

As we navigate the economic landscape in late 2024, a key area of focus for investors is the U.S. Treasury bond market are long-term securities. With increasing concerns about the federal deficit and its implications on interest rates, this article discuss key points about the factors influencing bond rates and the potential strategies employed by…