10. Python for Fundamental Analysis: Calculating Free Cash Flow with Python

Welcome to the 10th post in our Python for Finance series! We’ve covered significant ground, from ratios to qualitative analysis. Catch up here:

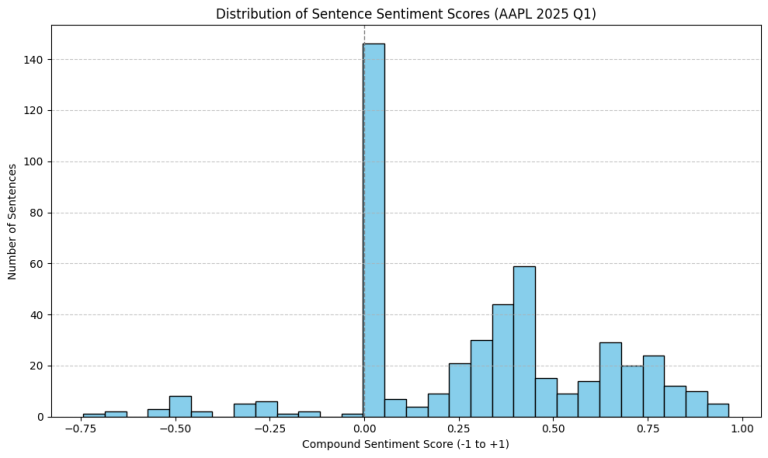

- Post 7: Qualitative Analysis with Earnings Call Transcripts

- Post 8: Sentiment Analysis on Earnings Calls with NLP

- Post 9: Discovering Themes in Earnings Calls with Topic Modeling (Assumed link)

Now, we pivot towards valuation, starting with a cornerstone metric for Discounted Cash Flow (DCF) analysis: Free Cash Flow (FCF).

FCF represents the cash generated by a company after accounting for all operational needs and investments required to maintain its asset base. It’s the cash truly available to be distributed to all capital providers (both debt and equity holders). Understanding and calculating FCF is vital for assessing intrinsic value and financial health.

This post focuses on calculating Free Cash Flow to the Firm (FCFF) using Python, pandas, and data fetched via the Financial Modeling Prep (FMP) API from the Income Statement and Cash Flow Statement.

Understanding Free Cash Flow to the Firm (FCFF)

What is FCFF?

FCFF is the cash flow available to all investors (debt & equity) after operating expenses (including taxes) and necessary investments in working capital and fixed capital (CapEx) are paid. It’s the surplus cash generated by the core business operations.

Why is FCFF Important?

- Valuation Keystone: The foundation for firm-level DCF models. Future projected FCFFs are discounted to estimate current firm value.

- Financial Health: Consistent positive FCFF shows self-sufficiency; negative FCFF might signal reliance on external funding.

- Management Effectiveness: Reflects efficient capital deployment and cash generation from operations.

- Comparability: Allows better comparison between firms with different debt levels.

How is FCFF Calculated?

Several formulas exist. We will use a common method starting from Cash Flow from Operations (CFO):

FCFF = CFO + Interest Expense} * (1 – Tax Rate) – Capital Expenditures (CapEx)

Important Note on CapEx Sign Convention:

- The standard formula subtracts CapEx, assuming CapEx is represented as a positive value indicating an expenditure (cash outflow).

- However, financial data providers like FMP often report Capital Expenditures (

capitalExpenditure) as a negative number on the Cash Flow Statement because it represents a cash outflow. - Therefore, if using FMP, in our Python code implementation below we assume CapEx from FMP is negative for outflows. Always verify the sign convention of your specific data source!

Let’s break down the components needed for our code:

- Cash Flow from Operations (CFO): From Cash Flow Statement (FMP key usually

operatingCashFloworcashFlowFromOperatingActivities). - Capital Expenditures (CapEx): From Cash Flow Statement (FMP key

capitalExpenditure, assumed negative for outflows). - Interest Expense: From Income Statement (FMP key

interestExpense). - Tax Rate: Calculated using Income Statement data:

incomeTaxExpense/incomeBeforeTax. We need to handle cases whereincomeBeforeTaxis zero or negative.

Python Implementation: Calculating FCFF

Let’s implement the CFO-based FCFF calculation using Python.

Installation & API Key: Ensure requests, pandas, and matplotlib are installed (pip install requests pandas matplotlib). Use your FMP API key (replace placeholder or use environment variables).

import requests

import pandas as pd

import matplotlib.pyplot as plt

import numpy as np # For np.nan and potential numeric operations

import os

# --- Configuration ---

# API Key provided by user

API_KEY = "your api key"

# Base URL for FMP API version 3

BASE_URL = "https://financialmodelingprep.com/api/v3"

# --- Parameters ---

TICKER = "AAPL"

NUM_PERIODS = 10 # Number of past quarters to analyze

PERIOD_TYPE = "quarter" # Can be "annual" or "quarter"

# --- Function to Fetch Financial Data ---

# Reusing the function from previous posts

def get_financial_data(url):

""" Fetches data from the FMP API endpoint. """

print(f"Attempting to fetch data from: {url}")

try:

response = requests.get(url, timeout=20) # Increased timeout

response.raise_for_status()

data = response.json()

if isinstance(data, list):

if len(data) > 0:

print(f"Successfully fetched {len(data)} periods of data.")

return data

else:

print(f"Warning: Received empty list from {url}.")

return None

elif isinstance(data, dict) and 'Error Message' in data:

print(f"Error from API at {url}: {data['Error Message']}")

return None

else:

print(f"Warning: Received unexpected data format from {url}. Type: {type(data)}. Data: {str(data)[:200]}...")

return None

except requests.exceptions.RequestException as e:

print(f"Error fetching data from {url}: {e}")

return None

except requests.exceptions.JSONDecodeError as e:

print(f"Error decoding JSON response: {e}\nResponse text: {response.text}")

return None

except Exception as e:

print(f"An unexpected error occurred while fetching {url}: {e}")

return None

# --- Main Execution Logic ---

if __name__ == "__main__":

print(f"\n--- Calculating Free Cash Flow to the Firm (FCFF) for {TICKER} ({NUM_PERIODS} {PERIOD_TYPE}s) ---")

# Construct URLs for quarterly statements

# FMP field names: incomeTaxExpense, incomeBeforeTax, interestExpense

income_url = f"{BASE_URL}/income-statement/{TICKER}?period={PERIOD_TYPE}&limit={NUM_PERIODS}&apikey={API_KEY}"

# FMP field names: operatingCashFlow (or cashFlowFromOperatingActivities), capitalExpenditure

cashflow_url = f"{BASE_URL}/cash-flow-statement/{TICKER}?period={PERIOD_TYPE}&limit={NUM_PERIODS}&apikey={API_KEY}"

# Fetch the financial statement data

print("\nFetching Income Statement data...")

income_data = get_financial_data(income_url)

print("\nFetching Cash Flow Statement data...")

cashflow_data = get_financial_data(cashflow_url)

if income_data and cashflow_data:

df_income = pd.DataFrame(income_data)

df_cashflow = pd.DataFrame(cashflow_data)

print(f"\nIncome Statement DataFrame shape: {df_income.shape}")

print(f"Cash Flow Statement DataFrame shape: {df_cashflow.shape}")

# print(f"Income Statement Columns: {df_income.columns.tolist()}")

# print(f"Cash Flow Statement Columns: {df_cashflow.columns.tolist()}")

# --- Data Cleaning and Preparation ---

# Define required columns and their FMP API names

# Note: FMP might use 'operatingCashFlow' or 'cashFlowFromOperatingActivities'. Check API docs.

# We'll try 'operatingCashFlow' first, then 'cashFlowFromOperatingActivities' as a fallback.

income_cols_map = {

'date': 'date',

'interestExpense': 'interestExpense',

'incomeTaxExpense': 'incomeTaxExpense',

'incomeBeforeTax': 'incomeBeforeTax'

}

cashflow_cols_map = {

'date': 'date',

'operatingCashFlow': 'operatingCashFlow', # Preferred

'capitalExpenditure': 'capitalExpenditure'

}

# Fallback for operating cash flow

alt_cfo_col = 'cashFlowFromOperatingActivities'

# Select and rename columns for Income Statement

cols_to_use_income = [k for k, v in income_cols_map.items() if v in df_income.columns]

if len(cols_to_use_income) != len(income_cols_map):

print(f"Warning: Missing some required columns in Income Statement. Expected: {list(income_cols_map.values())}")

# Identify missing columns

missing_is = [v for k,v in income_cols_map.items() if v not in df_income.columns]

print(f"Missing IS columns: {missing_is}")

df_income_selected = df_income[[income_cols_map[col] for col in cols_to_use_income]].copy()

df_income_selected.rename(columns={v: k for k, v in income_cols_map.items()}, inplace=True)

# Select and rename columns for Cash Flow Statement, handling CFO variations

actual_cfo_col_name_in_df = None

if cashflow_cols_map['operatingCashFlow'] in df_cashflow.columns:

actual_cfo_col_name_in_df = cashflow_cols_map['operatingCashFlow']

elif alt_cfo_col in df_cashflow.columns:

print(f"Using alternative CFO column: '{alt_cfo_col}'")

actual_cfo_col_name_in_df = alt_cfo_col

else:

print(f"Error: Neither '{cashflow_cols_map['operatingCashFlow']}' nor '{alt_cfo_col}' found in Cash Flow Statement.")

df_cashflow = pd.DataFrame() # Halt if no CFO

if not df_cashflow.empty:

temp_cashflow_cols_map = {'date': 'date', 'capitalExpenditure': 'capitalExpenditure'}

if actual_cfo_col_name_in_df:

temp_cashflow_cols_map['operatingCashFlow'] = actual_cfo_col_name_in_df # Use the found CFO column

cols_to_use_cashflow = [k for k, v in temp_cashflow_cols_map.items() if v in df_cashflow.columns]

if len(cols_to_use_cashflow) != len(temp_cashflow_cols_map):

print(f"Warning: Missing some required columns in Cash Flow Statement. Expected: {list(temp_cashflow_cols_map.values())}")

missing_cf = [v for k,v in temp_cashflow_cols_map.items() if v not in df_cashflow.columns]

print(f"Missing CF columns: {missing_cf}")

df_cashflow_selected = df_cashflow[[temp_cashflow_cols_map[col] for col in cols_to_use_cashflow]].copy()

# Rename to standard names used in script

df_cashflow_selected.rename(columns={v: k for k, v in temp_cashflow_cols_map.items()}, inplace=True)

# Proceed if both dataframes have been minimally processed

if 'date' in df_income_selected.columns and not df_cashflow.empty and 'date' in df_cashflow_selected.columns:

# Convert date columns to datetime

df_income_selected['date'] = pd.to_datetime(df_income_selected['date'])

df_cashflow_selected['date'] = pd.to_datetime(df_cashflow_selected['date'])

# Sort by date

df_income_selected.sort_values(by='date', ascending=True, inplace=True)

df_cashflow_selected.sort_values(by='date', ascending=True, inplace=True)

# Convert financial columns to numeric

numeric_cols_is = ['interestExpense', 'incomeTaxExpense', 'incomeBeforeTax']

numeric_cols_cf = ['operatingCashFlow', 'capitalExpenditure']

for col in numeric_cols_is:

if col in df_income_selected.columns:

df_income_selected[col] = pd.to_numeric(df_income_selected[col], errors='coerce')

for col in numeric_cols_cf:

if col in df_cashflow_selected.columns:

df_cashflow_selected[col] = pd.to_numeric(df_cashflow_selected[col], errors='coerce')

# Merge DataFrames

df_merged = pd.merge(df_income_selected, df_cashflow_selected, on='date', how='inner')

print(f"\nMerged DataFrame shape: {df_merged.shape}")

# --- Calculate Tax Rate and FCFF ---

if not df_merged.empty and all(col in df_merged.columns for col in ['incomeTaxExpense', 'incomeBeforeTax', 'operatingCashFlow', 'capitalExpenditure', 'interestExpense']):

# Calculate Tax Rate

# Handle potential division by zero or negative incomeBeforeTax

df_merged['Tax Rate'] = np.where(

(df_merged['incomeBeforeTax'] != 0) & (df_merged['incomeBeforeTax'] > 0) & (df_merged['incomeTaxExpense'] >=0), # Ensure IBT is positive and tax is not negative

df_merged['incomeTaxExpense'] / df_merged['incomeBeforeTax'],

0 # Default to 0 if IBT is zero, negative, or tax is negative with positive IBT (edge case)

)

# Cap tax rate between 0 and 1 (e.g. 0% to 100%)

df_merged['Tax Rate'] = np.clip(df_merged['Tax Rate'], 0, 1)

print("\nCalculated Tax Rates (capped 0-1):")

print(df_merged[['date', 'incomeTaxExpense', 'incomeBeforeTax', 'Tax Rate']].head())

# Calculate FCFF

# FCFF = CFO - CapEx + Interest Expense * (1 - Tax Rate)

# Note: FMP's capitalExpenditure is usually negative (cash outflow), so we add it.

df_merged['FCFF'] = (

df_merged['operatingCashFlow'] +

df_merged['capitalExpenditure'] + # Assuming FMP CapEx is negative for expenditure

df_merged['interestExpense'] * (1 - df_merged['Tax Rate'])

)

# Drop rows where FCFF could not be calculated (due to NaNs in components)

df_final = df_merged.dropna(subset=['FCFF']).copy()

if not df_final.empty:

print(f"\n--- Calculated FCFF ({len(df_final)} {PERIOD_TYPE}s) ---")

print(df_final[['date', 'operatingCashFlow', 'capitalExpenditure', 'interestExpense', 'Tax Rate', 'FCFF']].round(2))

# --- Visualization ---

print("\n--- Generating FCFF Plot ---")

plt.figure(figsize=(12, 6))

plt.bar(df_final['date'].astype(str), df_final['FCFF'], color='skyblue', width=0.8) # Using bar chart

# Or line chart: plt.plot(df_final['date'], df_final['FCFF'], marker='o', linestyle='-')

plt.title(f'{TICKER} Quarterly Free Cash Flow to the Firm (FCFF)')

plt.xlabel(f'{PERIOD_TYPE.capitalize()} End Date')

plt.ylabel('FCFF (in currency of statements)')

plt.xticks(rotation=45, ha='right')

plt.grid(axis='y', linestyle='--', alpha=0.7)

plt.tight_layout()

plt.show()

else:

print("\nDataFrame empty after FCFF calculation. Could not plot.")

else:

print("\nMerged DataFrame is empty or missing essential columns for FCFF calculation.")

else:

print("\nOne or both selected DataFrames are empty. Cannot merge or calculate FCFF.")

else:

print("\nFailed to fetch necessary financial statement data. Cannot calculate FCFF.")

print("\n--- Script Finished ---")

Code Explanation: Step-by-Step

- Imports & Config: Imports

requests,pandas,matplotlib.pyplot,numpy(for robust calculations),os. Sets API key, ticker,NUM_PERIODS,PERIOD_TYPE, and base URL. get_financial_data(url)Function: Reused function to fetch data lists from FMP.- Fetch Financial Data:

- Constructs URLs for quarterly Income Statement and Cash Flow Statement endpoints using the specified

NUM_PERIODS. - Calls

get_financial_datafor both.

- Constructs URLs for quarterly Income Statement and Cash Flow Statement endpoints using the specified

- Data Processing and FCFF Calculation:

- Check & Create DataFrames: Verifies data was fetched for both, creates

df_incomeanddf_cashflow. - Column Selection & Renaming: Defines mappings for required keys (e.g.,

interestExpense,operatingCashFlow,capitalExpenditure). Robustly handles potential variations in the CFO key name (operatingCashFlowvs.cashFlowFromOperatingActivities). Selects and renames columns, warning if any are missing. - Clean & Sort: Converts dates to datetime, sorts DataFrames chronologically, converts financial columns to numeric (

errors='coerce'). - Merge DataFrames: Merges the essential columns from the cleaned income and cash flow DataFrames on the

dateusing aninnerjoin. - Calculate Tax Rate: If the merged DataFrame is valid, it calculates the effective tax rate period by period. It uses

np.wherefor safe division (incomeTaxExpense / incomeBeforeTax), defaulting to 0 if pre-tax income is zero or negative.np.clipensures the calculated rate stays within the logical 0% to 100% range. - Calculate FCFF: Applies the CFO-based formula:

FCFF = operatingCashFlow + interestExpense * (1 - Tax Rate) + capitalExpenditure. Crucially, this code assumescapitalExpenditureprovided by FMP is negative for an outflow and thus ADDS it back. (If your data source provides CapEx as a positive number for an outflow, you would subtract it). - Final Clean: Drops any rows where FCFF calculation resulted in

NaN(due to missing components). - Display FCFF: Prints the final DataFrame showing the date and calculated FCFF values.

- Check & Create DataFrames: Verifies data was fetched for both, creates

- Visualization:

- Creates a bar chart (

plt.bar) showing the quarterly FCFF values over time. A line chart alternative is commented out. - Sets titles, labels, adds a horizontal line at zero, formats the date axis, and displays the plot.

- Creates a bar chart (

- Error Handling: Includes checks for API failures, missing columns, empty DataFrames after merging/cleaning, and calculation errors.

Interpreting FCFF Results

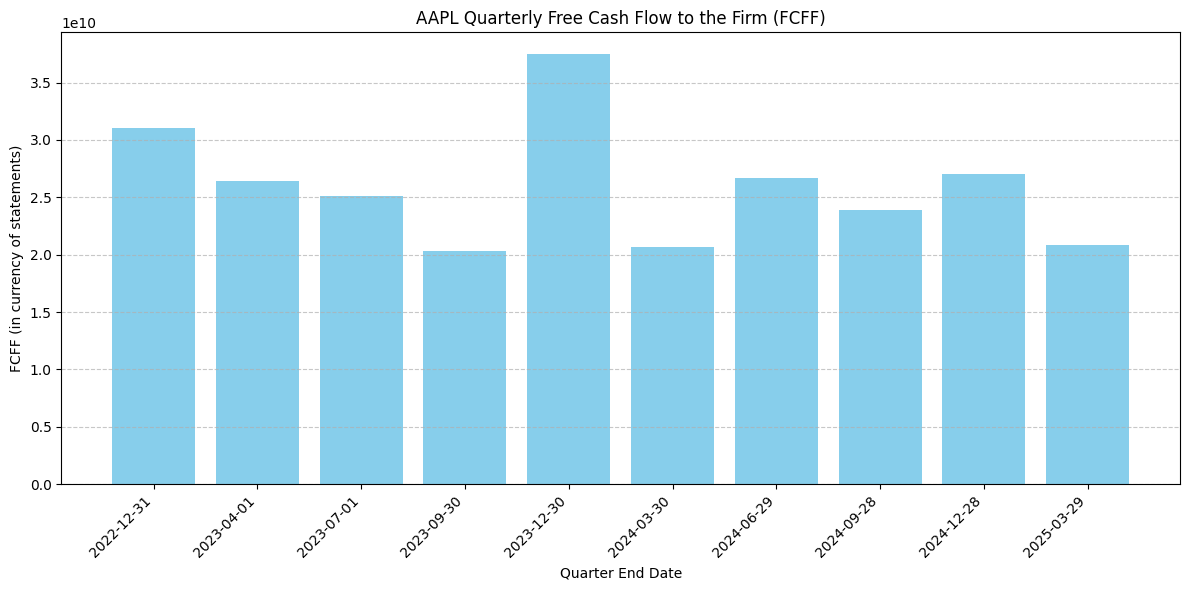

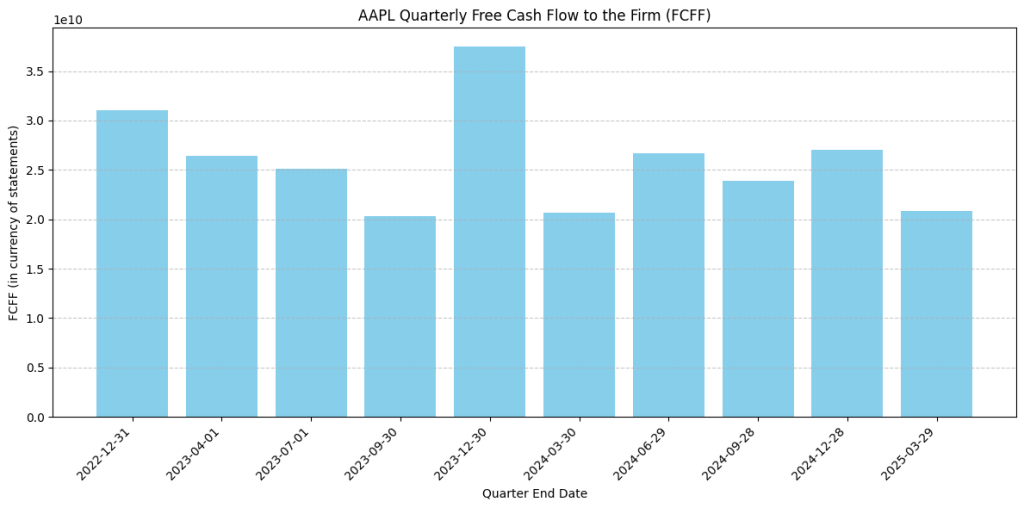

Let’s look at the bar chart generated by our script, showing Apple’s calculated Quarterly Free Cash Flow to the Firm (FCFF) over the 10 quarters ending in early 2025:

The visualization clearly demonstrates Apple’s powerful cash-generating ability, marked by consistent positive FCFF. The significant seasonality, peaking after the holiday quarter, is a key characteristic of its cash flow cycle. This reliable (though seasonal) generation of free cash flow is fundamental to Apple’s ability to fund R&D, pay dividends, buy back shares, and manage its debt – factors crucial for valuation.

Note: The Y axis contains the number in scientific notation, for instance, the number 2.088100e+10 written out fully is 20,881,000,000, which matches the quarterly number reported by Apple for March 2025.

Conclusion: FCF A Key Metric for Intrinsic Value

Calculating Free Cash Flow to the Firm is a fundamental step in understanding a company’s ability to generate value for all its investors. It strips away accounting conventions to focus on the actual cash available after maintaining and growing the business. By automating this calculation with Python, we can efficiently track FCFF trends and gather crucial inputs for more advanced valuation modeling.

Next Steps With FCFF calculated, we are well-positioned to explore Building a Simple DCF Model. Using the historical FCFF to project future FCFFs, determine a discount rate (WACC), and calculate a terminal value to estimate intrinsic firm value.

Stay tuned as we continue our journey into Python-powered financial analysis.

Disclaimer: This blog post is for educational purposes only. Financial data APIs provide data “as is”; always verify critical data from official sources (e.g., SEC filings) before making investment decisions. Ensure compliance with API provider terms of service.