ASML – A Deep Dive Analysis

1. COMPANY OVERVIEW

Company Name: ASML Holding N.V.

Industry: Semiconductor Equipment and Manufacturing Technology

ASML is a leading manufacturer of photolithography systems for the semiconductor industry. Its advanced lithography machines, particularly extreme ultraviolet (EUV) lithography, are essential for producing the most advanced microchips, enabling the ongoing development of smaller, more powerful, and more energy-efficient chips. ASML serves some of the world’s largest technology companies, including Intel, TSMC, and Samsung, who rely on its technology to produce high-performance chips used in everything from smartphones and computers to cars and medical devices.

Core Products and Services:

- EUV Lithography Systems: Pioneering machines that use extreme ultraviolet light to print fine patterns on silicon, enabling advanced semiconductor manufacturing. EUV is crucial for producing the most advanced chips

- Deep Ultraviolet (DUV) Lithography Systems: Used for producing a wide range of microchips in various applications.

- Software and Services: ASML provides software solutions and services for process control, diagnostics, and yield optimization, supporting customers throughout the lifecycle of their lithography systems.

Revenue and Market Position:

ASML holds a unique position as the only supplier of EUV lithography technology, making it a critical player in the semiconductor supply chain. It is among the most valuable technology companies globally by market capitalization, reflecting its essential role in the tech ecosystem and growing demand for advanced semiconductors. ASML derives most of the revenues from the sale of a relatively small number of lithography systems (449 units in 2023 and 345 units in 2022).

2. SEMICONDUCTOR EQUIPMENT INDUSTRY

The semiconductor equipment industry is characterized by a few key dynamics:

- High Concentration: A handful of companies dominate different segments of the market. For example, in lithography, ASML is the clear leader in EUV, while other players like Nikon and Canon compete in older technologies. In other segments like etching and deposition, companies like Lam Research, Applied Materials, and Tokyo Electron hold significant market share.

- Intense Technological Competition: Continuous innovation is key to success in this industry. Companies invest heavily in research and development to improve the performance, precision, and efficiency of their equipment.

- Global Supply Chains: The industry relies on complex global supply chains for components and materials. This interconnectedness can be both a strength and a vulnerability, as disruptions in one part of the chain can impact the entire industry.

ASML’s Position in the semiconductor equipment industry: ASML’s current dominance lies primarily on its EUV technology. However, the landscape is constantly evolving:

- Next-Generation EUV: ASML is already developing next-generation EUV technology with higher numerical aperture (high-NA EUV), promising further advancements in chip manufacturing. This continuous innovation is key to maintaining their leadership position.

- Competing Technologies: While EUV is currently the most advanced lithography technology, other approaches like directed self-assembly (DSA) and nanoimprint lithography are being explored as potential alternatives for specific applications. Whether these technologies will eventually challenge EUV’s dominance remains to be seen.

- Beyond Lithography: ASML is also exploring opportunities beyond traditional lithography, such as metrology and inspection tools, which are essential for quality control in semiconductor manufacturing.

Industry Cycles and Their Impact:

The semiconductor industry is known for its cyclical nature, driven by fluctuations in demand and capacity utilization. Boom and Bust Cycles within the industry are common. Periods of strong demand often lead to capacity expansion, which can eventually result in oversupply and a downturn. These cycles can significantly impact the demand for semiconductor equipment. As the leading supplier of advanced lithography equipment, ASML is exposed to these industry cycles. During downturns, orders for new equipment can decline, impacting ASML’s revenue and profitability. However, ASML’s strong market position and long-term agreements with key customers provide some buffer against these cyclical fluctuations. ASML attempts to mitigate the impact of industry cycles through long-term planning, strategic partnerships, and a focus on continuous innovation.

3. FINANCIAL ANALYSIS

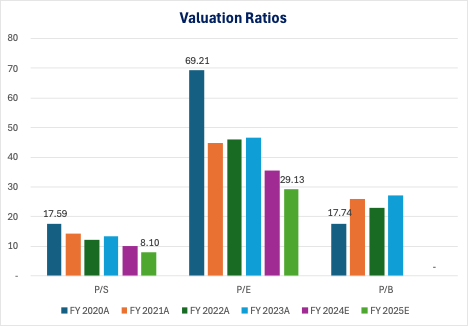

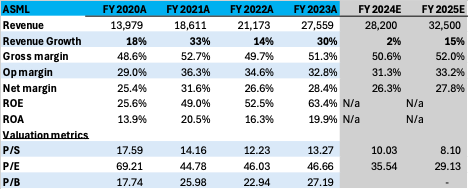

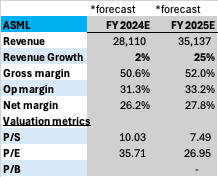

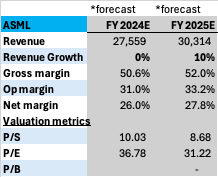

Valuation Metrics

The company’s valuation metrics show interesting trends across P/S, P/E, and P/B ratios. The Price-to-Sales (P/S) ratio has experienced a significant decline from 17.59x in FY2020A to an expected 8.1x in FY2025E, suggesting a more attractive valuation relative to revenue. Similarly, the Price-to-Earnings (P/E) ratio shows a marked decrease from 69.21x in FY2020A to a projected 29.13 in FY2025E, indicating improving earnings efficiency and potentially better value for investors.

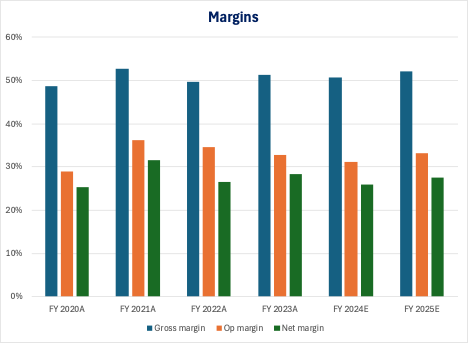

Margin Performance

The margin analysis reveals a pattern of strong gross margins hovering around 50%, demonstrating robust pricing power and cost management:

- Gross margins have maintained stability in the ~50% range throughout the period

- Net margins show a descending trend from historical highs

- The spread between gross and net margins has widened, suggesting increasing operational costs

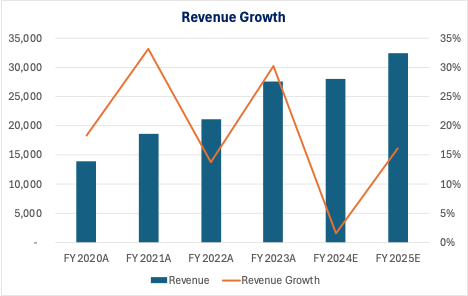

The revenue growth story shows both momentum and moderation:

- Strong historical growth with peak revenue growth of ~32% in FY2021A

- Revenue has maintained an upward trajectory, growing from approximately 15,000 units in FY2020A to projected 32,000+ units in FY2025E

- Growth rates are moderating, with FY2024E showing a temporary slowdown to about 2%

- FY2025E projects a recovery in growth to about 15%, suggesting resilience in the business model

4. MARKET ANALYSIS

The EUV Lithography market presents a compelling growth story, currently valued at USD 9.38 Billion in 2023 and projected to reach USD 40.60 Billion by 2031. This remarkable trajectory represents an impressive CAGR of 20.10% during the forecast period of 2024-2031, highlighting the technology’s critical role in advancing semiconductor manufacturing.

The market’s explosive growth is primarily fueled by the increasing demand for advanced semiconductor nodes, particularly those at 5nm and below. As industries like automotive, data centers, and artificial intelligence continue to evolve, the need for more sophisticated chip manufacturing processes has become super important. This demand is further amplified by government initiatives worldwide that are injecting substantial investments into semiconductor manufacturing capabilities.

In terms of technological advancement, the industry is witnessing significant innovations. The development of High-NA EUV systems represents a major leap forward, while improvements in mask technologies and light source capabilities are enhancing production throughput. These advancements are crucial as the industry pushes the boundaries of semiconductor miniaturization.

Market dynamics are increasingly shaped by emerging technologies and applications. The rise of 5G networks, artificial intelligence, and the explosive growth of electric vehicles are creating new demands for advanced semiconductor manufacturing. The Internet of Things (IoT) ecosystem is another key driver, requiring ever-more sophisticated and efficient chip production processes.

The regulatory environment plays a crucial role in shaping market development. Government support through investments and policies has become increasingly important, while international trade regulations and technology transfer restrictions continue to influence industry dynamics. This regulatory framework is essential in ensuring sustainable growth while maintaining technological leadership and security interests.

The industry is dominated by key players such as:

- ASML (Netherlands)

- Samsung (South Korea)

- Intel Corporation (U.S.)

- TSMC (Taiwan)

- Canon Inc. (Japan)

Competitive Analysis

Based on the EUV lithography market, ASML holds a dominant and unique position with effectively a 100% market share in EUV lithography systems. ASML is the sole manufacturer of EUV lithography machines in the world, making it a monopoly in this specific segment of the semiconductor equipment industry. They are the only company in the world capable of producing these highly complex machines.

Key Competitors:

ASML has established strong relationships with key semiconductor manufacturers like TSMC, Samsung, and Intel, who rely exclusively on ASML’s EUV systems for their most advanced chip production. While ASML dominates the EUV segment, they do compete with companies like Nikon and Canon in other lithography technologies, such as DUV (Deep Ultraviolet) systems.

- For EUV: ASML has no competitors. ASML’s monopoly in EUV technology is the result of decades of R&D and billions in investments. Other companies like Nikon attempted to develop EUV technology but eventually abandoned their efforts due to the technical complexity and resource requirements.

- For DUV (Deep Ultraviolet): ASML competes with Nikon and Canon, though ASML still maintains a dominant position

Background of ASML Competitive Advantages:

ASML began researching EUV technology in 1990, investing over €6 billion in R&D over 17 years. While competitors like Nikon and Canon initially pursued EUV development, they eventually abandoned their efforts due to the immense technical challenges and costs. ASML persevered through several key strategic moves:

- Joining a US-funded consortium that provided crucial early access to EUV research

- Acquiring Cymer for $2.5 billion to accelerate EUV light source development

- Securing strategic investments from Intel, Samsung, and TSMC through the Musketeer Project6

Technical Barriers to Entry. Several factors make it nearly impossible for competitors to challenge ASML’s position:

- The company holds over 16,000 patents related to EUV technology

- ASML has built an intricate network of over 5,100 specialized suppliers, many of whom work exclusively for them

- Each EUV machine contains over 100,000 parts and involves technological complexity. It costs approximately $150-$200 million per unit, creating high barriers to entry for potential competitors. In addition, ASML has established strong relationships with key customers.

While Japanese researchers have recently proposed theoretical alternatives to ASML’s approach, these remain unproven and face significant practical challenges in implementation (source). ASML’s combination of technological expertise, supplier relationships, and decades of experience makes their monopoly in EUV technology virtually unassailable for the foreseeable future.

5. GROWTH DRIVERS & RISKS

Growth Catalysts

ASML sees market expansion driven by secular growth drivers in end markets, such as the energy transition, electrification, and AI, increasing demand for both advanced and mature semiconductors.

The automotive industry is one of the fastest-growing market segments, driven by electrification, autonomy, and the increasing integration of advanced driver-assistance systems (ADAS)

The construction of new semiconductor fabs globally is creating significant demand for ASML’s tools.

Global trends such as generative AI, the energy transition, the electrification of mobility, and the industrial Internet of Things (IoT) are expected to fuel semiconductor growth in the longer term, translating into increased wafer demand at both advanced and mature nodes. And advanced wafers are produced with ASML tools.

Next generation of products

Regarding technology Innovations. ASML is developing High NA EUV systems, expected to be fully operational in customer factories by 2025, further advancing chip manufacturing capabilities. The company is exploring Hyper NA technology with an NA higher than 0.7, which could be relevant for Logic and DRAM applications around 2030. ASML’s product innovation pipeline is robust and forward-looking. The company’s next-generation High-NA EUV systems, particularly the TWINSCAN EXE:5200 system, represents a significant leap forward. This system is expected to enable the development of even smaller and more powerful semiconductor devices, with volume production anticipated to begin in 2025.

Growth outlook:

As per the guidance given by ASML in 2025, ASML expects a reduced growth for 2025 due to normalization of China business (move from around 40% total sales in China in 2024 to a more normal level of around 20%) and slower than anticipated recovery in traditional PC and mobile market. This has lead to a slower ramp of new nodes at certain customers.

ASML expects 2025 revenue to be in the lower half of the 30 and 35 billion range. Still growing sales compared to 2024 but growth will be lower than anticipated.

Risk Assessment

- Supply Chain Vulnerabilities: Critical dependence on key suppliers like Carl Zeiss could create manufacturing bottlenecks. Limited number of suppliers for certain components increases production risk

- Revenue concentration: High customer concentration with TSMC, Samsung, and Intel representing large portions of revenue. Total revenue from the largest customer in 2023 was almost 32% of the company total revenue. And 60% of the revenue came from only two customers. Therefore, if a major customer is lost, ASML revenues will suffer

- Geopolitical tensions and China exposure. ASML Customers in China represented 26.3% of the 2023 total net sales. In Q2 and Q3 2024, 49% of the revenue was coming from China. Currently, due to US and Dutch regulations, is making difficult for ASML to export DUV and EUV machines to China. This will limit the growth impact of the China sales expected to be around 20% of the 2025 total sales as per management guidance in the Q3 2024 earnings call.

- A significant portion of ASML revenue depends on customers in Taiwan and South Korea, which represented 29.3% and 25.2% of our 2023 total net sales, respectively. Political tensions between these countries may affect future revenue from this countries.

6. MANAGEMENT ASSESSMENT

ASML has delivered strong financial performance in recent years, driven by robust demand for its lithography systems, particularly in the EUV segment. However, the company acknowledges the challenges posed by the slower-than-anticipated recovery in certain semiconductor market segments and the potential impact of future export controls.

7. INVESTMENT THESIS

Bull Case:

There is no better bull case than the current demand of semiconductors driven by AI and LLM. Below are some quotes from ASML 20F 2023:

“we need to prepare for the significant number of new semiconductor fabs that are being built. These fabs are spread geographically across the globe – they’re strategically important for our customers and they’re scheduled to take our tools.” The semiconductor industry is expected to double somewhere in the next decade, as compared with today”

“Lithography technology is fundamental to the mass production of microchips. Our holistic approach is based on integrating our lithography systems with a set of products that optimize production and enable affordable shrink.” Using extreme ultraviolet (EUV) light at a wavelength of 13.5 nm, our EUV lithography systems make it possible to print the smallest features on microchips at the highest density. EUV systems are used for the most intricate, critical layers on the most advanced microchips. ASML is currently the world’s only manufacturer of EUV lithography systems.

Bear Case and primary concerns:

As mentioned in prior sections, geopolitical tensions with China is for me the greatest bear case. China is a key growing market for ASML, with probably more than 40% of the total ASML sales in 2024. That growth will be limited significantly going forward due to export limitations set up by US and the Netherlands. China’s sales in 2025 are expected to more than half in 2025.

Another point to consider is the somehow downwards revision of the expected growth shared by management in Q3 2024. To put it in context, in 2022, ASML expected to growth sales to the 30 to 40 billions sales by 2025. Recently, the 2025 growth was revised downward to the 30 to 35 billion range. During the ASML Q3 2024 Earnings Call, ASML CEO Christophe Fouquet stated that the company has seen some push outs in investments from its customers, who are remaining cautious. Fouquet explained that the slow recovery in end markets like mobile and PCs, coupled with competitive dynamics in the foundry market, have resulted in a slower ramp of new nodes for some customers.

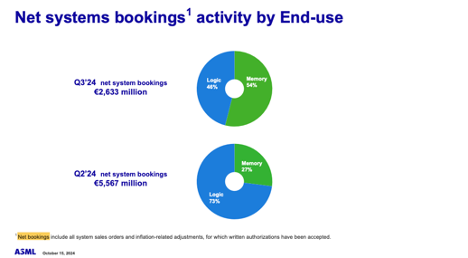

As a result, some customers are delaying their fab construction and changing their lithography demand timelines. For instance, Samsung has delayed the launch of its fabs to 2026. While Intel has delays on its mega fab in Germany. All this has lead to a strong reduction of net bookings reported by ASML:

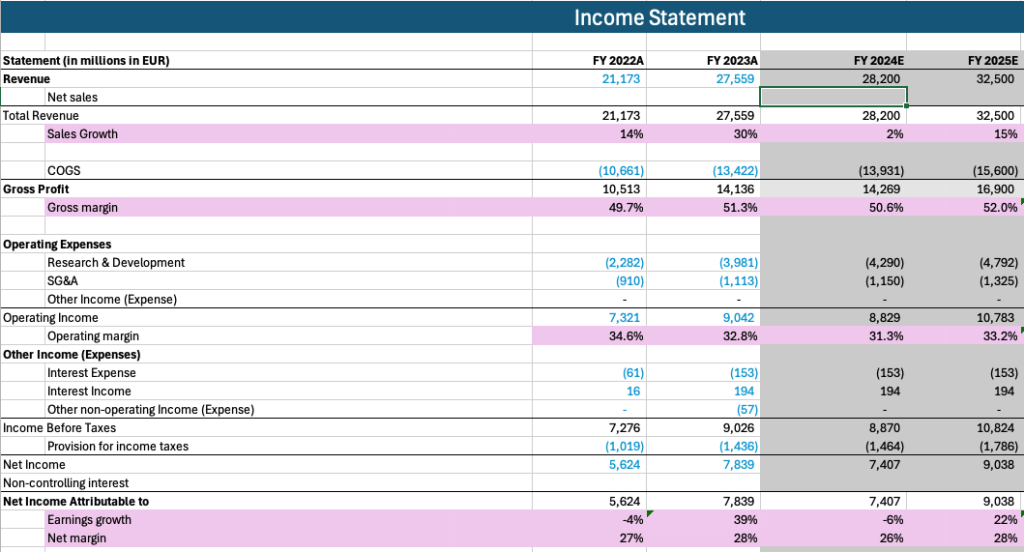

8. FINANCIAL PROJECTIONS

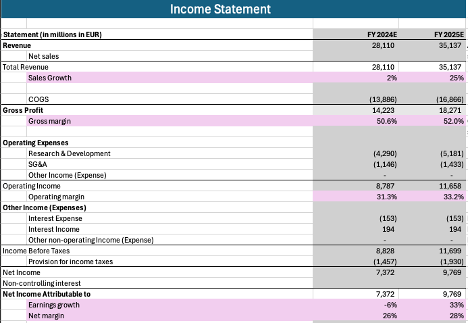

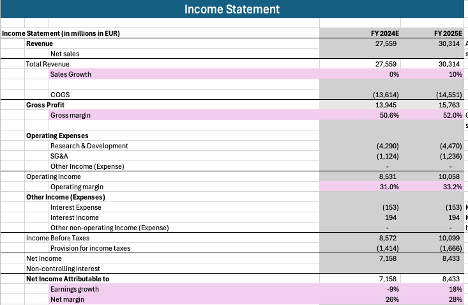

Revenue Growth Trajectory

- FY2024E projects a temporary slowdown to 2% growth, reflecting market normalization

- Growth expected to rebound to 16% in FY2025E, reaching €32.5B as per ASML guidance. (Source)

- While solid, this represents a moderation from historical growth rates (33% in FY2021A, 30% in FY2023A)

- Revised 2025 revenue guidance of €30-35B shows more conservative outlook versus previous €40B target

Order Backlog Analysis

ASML’s substantial order backlog provides significant visibility into future revenue streams. At the end of 2023, the company reported a backlog of €39 billion (source) which exceeds their entire projected revenue for 2025. This backlog has remained robust, though slightly decreased to €36 billion by Q3 2024.

The strength of this backlog is particularly noteworthy given:

- It represents more than a full year of revenue coverage

- Includes both EUV and DUV system orders

- Provides strong revenue visibility despite market uncertainties

- Supports the company’s ability to maintain steady production planning

However, it’s important to note that while the backlog is substantial, ASML has revised its 2025 revenue expectations downward to €30-35 billion from previous estimates of up to €40 billion. This adjustment reflects the slower recovery in traditional market, expected normalization of China sales to about 20% of revenue and Customer delays in fab construction

Valuation Implications

- Forward P/E ratio trending down:

- FY2024E: 50.21x

- FY2025E: 40.72x

- Suggests market pricing in growth moderation

- P/S ratio continues to compress:

- FY2024E: 13.06x

- FY2025E: 11.26x

- Indicates more attractive valuation levels

9. PEER COMPARISON

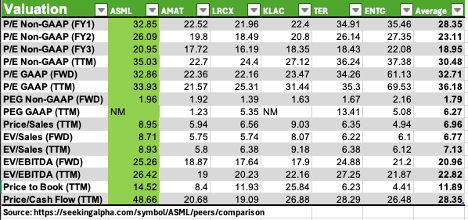

Source: Seeking Alpha valuation metrics comparison. Note that above table is computed by Seeking Alpha and therefore are slighlty different to my ratios calculated in the prior section.

ASML’s valuation metrics are compared against those of its peers, including Applied Materials, Inc. (AMAT), Lam Research Corporation (LRCX), KLA Corporation (KLAC), Teradyne, Inc. (TER), and Entegris, Inc. (ENTG). The data, sourced from Seeking Alpha, reveals the following:

- P/E Ratios: ASML’s P/E ratios, both GAAP and non-GAAP, consistently exceed the peer group average across all forecast periods (FY1, FY2, FY3, and TTM). This indicates that investors are willing to pay a premium for ASML’s earnings compared to its competitors.

- PEG Ratios: While ASML’s forward non-GAAP PEG ratio of 1.96 is slightly above the peer average of 1.79

- Price/Sales, EV/Sales, EV/EBITDA: Across these sales and EBITDA-based metrics, ASML again generally trades at a premium to its peer group. This suggests a higher valuation relative to revenue and operating profitability.

- Price to Book: ASML’s Price to Book ratio is significantly higher than its peers, except for KLAC. This might indicate that the market values ASML’s net assets at a premium.

- Price/Cash Flow: Similar to the other metrics, ASML boasts the highest Price/Cash Flow ratio, further reinforcing its premium valuation in the market.

ASML have premium multiples compared to some of its peers. This probably is the reflection of ASML having a monopolistic position in EUV lithography technology. This monopoly gives ASML significant pricing power and strong growth potential. In addition, there is a strong demand and growth expectation priced in the multiples.

Higher valuation can translated into higher risks if potential future growths do not end up materializing. ASML dependance on only a few customer revenues and geopolitical tensions are some of the key factors that may hurt ASML price in the long term..

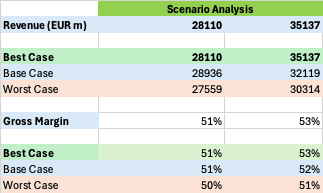

10. SCENARIO ANALYSIS

By running a best case scenario analysis (using top management projections for 2025 for both revenue and gross margin) we get to below financials:

Best case scenario:

An expected revenue of EUR 35 billion in 2025 with a net income of EUR 10 billions. This would translate in a P/S and P/E ratio of 7.49x and 26.95x respectively.

Worst case scenario:

In the lowest guidance range given by ASML management, P/S and P/E ratios would be a bit higher. Still showing healthy profitability but with compressed margins

11. SUMMARY

Based on this analysis, my personal opinion is that ASML does not seem to have a lot of room to grow. I see some headwinds with the China limit exports and the new FABS by Intel and Samsung being delayed. I have to admit, that in the long run, ASML is in a good position due to its monopoly on the EUV Lithography market and the AI growth expected in the next few years. The AI growth will lead to the biggest ASML customers to keep investing in FABs to keep up with the market demand on advance chips.

DISCLAIMER:

This analysis represents personal research and opinion only. It is not professional financial advice and should not be construed as such. The author:

– Is not a registered financial advisor

– Hold a small long position in ASML (less than 3,000 USD)

– Makes no guarantees about accuracy or completeness of information

– Is not responsible for any investment decisions made based on this content

Readers should conduct their own research and consult qualified financial professionals before making investment decisions.