Understanding US Corporate Earnings During Recessions

Economic recessions stir uncertainty, impacting everything from household budgets to corporate bottom lines. But how exactly do US companies fare when the economy contracts? Understanding the historical relationship between recessions and corporate earnings can provide valuable insights for investors, business leaders, and anyone interested in the economy’s pulse. This article delves into the historical performance of US corporate earnings during downturns, exploring why profits often take a bigger hit than revenues and which sectors tend to weather the storm better.

What Actually Happens to Profits in a Downturn?

Recessions, officially marked by the National Bureau of Economic Research (NBER) as significant, widespread declines in economic activity lasting more than a few months, consistently put downward pressure on corporate performance. Here’s what history tells us about S&P 500 companies’ earnings per share (EPS) during these periods:

- Earnings: Corporate profits fall during recessions.

- Significant Declines: On average, peak-to-trough EPS declines in post-WWII recessions typically ranged from -15% to -30%.

- Severity Matters: The extent of the decline varies greatly. “Standard” recessions might see around a -26% average drop, but severe events like the 2008-2009 Global Financial Crisis (GFC) saw a staggering -56.7% plunge. The median decline across post-WWII recessions is a more modest -13%, highlighting how averages can be skewed by extreme events.

- Timing Lags: Interestingly, the lowest point for earnings often comes after the stock market has bottomed out and even after the NBER declares the recession officially over.

Why Do Earnings Fall More Sharply Than Revenue? The Power of Operating Leverage

A key observation is that corporate earnings almost always fall by a larger percentage than revenues during recessions. Why the bigger hit to the bottom line? The answer lies in operating leverage.

- Fixed Costs: Businesses have costs that don’t change with sales volume, like rent, salaries for administrative staff, and equipment depreciation. These are fixed operating costs.

- The Amplification Effect: When revenues decline during a recession, these fixed costs stay the same. While variable costs (like raw materials) might decrease, the inflexible fixed costs mean that profits shrink proportionally more than revenues did.

- Higher Leverage = Higher Sensitivity: Companies with a higher proportion of fixed costs have higher operating leverage. This makes their profits much more sensitive to revenue changes – both magnifying gains in good times and amplifying losses during downturns.

Sector Showdown: Who Wins and Loses in a Recession?

Not all industries are impacted equally by economic downturns. Performance often splits along cyclical and defensive lines:

- Defensive Sectors (The Resilience Crew): These industries provide essential goods and services, meaning demand stays relatively stable even when wallets tighten. Historically, they outperform (or decline less than) the broader market during recessions.

- Top Performers: Consumer Staples (food, household products), Utilities, and Healthcare consistently show the most resilience. Consumer Staples even averaged a slight positive return during recessions since 1960.

- Cyclical Sectors (The Sensitivity Squad): These industries are highly attuned to economic shifts. Their profits boom during expansions but tend to fall sharply during contractions.

- Typical Laggards: Real Estate, Information Technology, Industrials, Materials, Consumer Discretionary (non-essentials), and Financials often underperform significantly during recessions.

Important Note: While this pattern is historically consistent, the specific cause of a recession matters. The GFC hammered Financials, while the Dot-com bust devastated Technology, showing that nuances exist beyond the broad categories.

Lessons from History: GFC vs. Dot-com

- Global Financial Crisis (2007-2009): A systemic crisis originating in housing and finance led to catastrophic earnings declines (-56.7% for S&P 500 EPS), with the Financial sector hit hardest.

- Dot-com Bust Recession (2001): Triggered by the bursting tech bubble, this recession was milder overall for the economy (GDP-wise) but still caused a major earnings drop (-31.6% for S&P 500 EPS), centered heavily in the Technology sector.

Key Takeaways

- Recessions reliably hurt corporate earnings, often more significantly than revenues due to operating leverage.

- The severity and cause of a recession dictate the depth of the earnings decline.

- Defensive sectors historically offer more protection than cyclical ones during downturns.

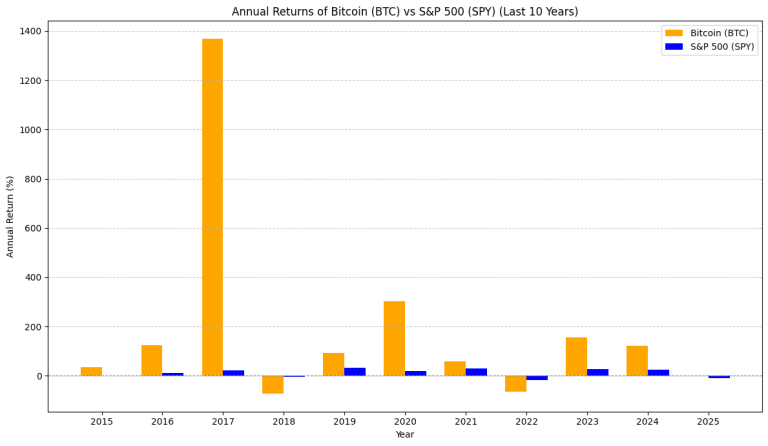

- Markets are forward-looking; stock prices often move before official recession dates or earnings troughs.

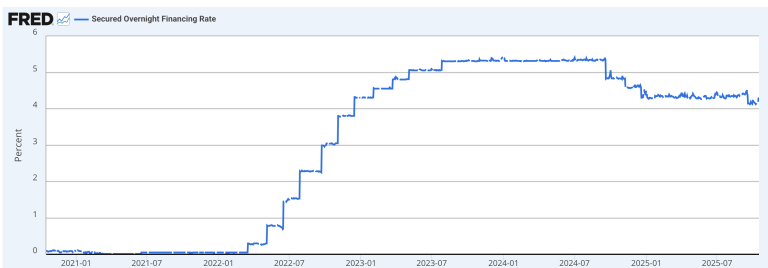

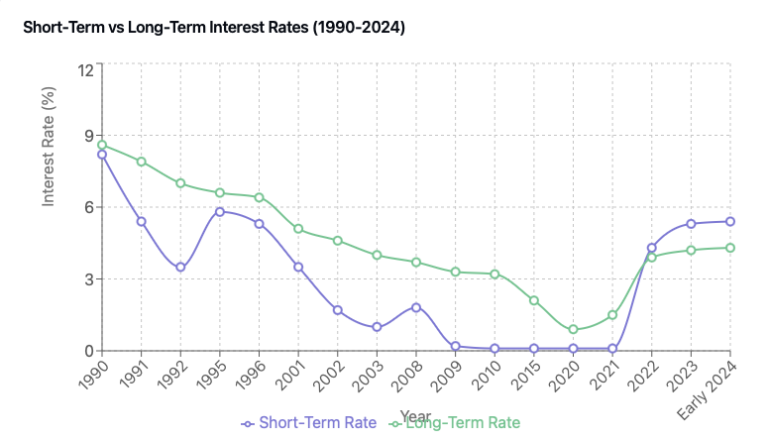

- Structural economic changes (like past benefits from falling interest rates and taxes potentially ending) could influence future recession impacts.

Understanding these historical dynamics provides crucial context for navigating economic uncertainty, whether for business planning, risk management, or investment strategy.

Disclaimer: This article is for informational purposes only and does not constitute financial or investment advice. The robotics market is complex and involves significant risks. Always conduct your own thorough research and consult with qualified professionals before making any financial decisions. This article was drafted with the help of AI and modified by the author before publication