2. Understanding Portfolio Theory with Real-World Data and Python

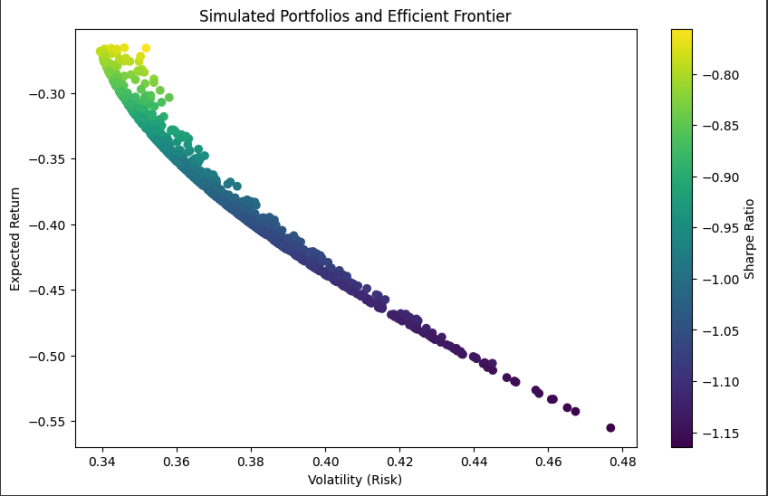

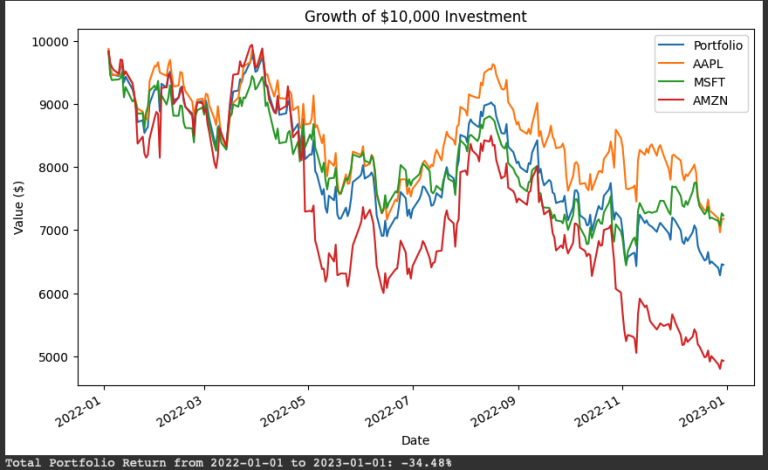

Portfolio theory is a powerful framework that helps investors balance risk and return by constructing optimal portfolios. In this second post in the series portfolio management with Python, we’ll dive into its core ideas—diversification, correlation, and the Efficient Frontier—building on the basics from Post 1. Using Python and real-world stock data from Apple (AAPL), Microsoft…