Navigating the Office REIT Market: Investment Insights for 2025

Real Estate Investment Trusts (REITs) offer a compelling avenue for investors seeking real estate exposure without the operational burdens of direct property ownership. By pooling capital to acquire income-generating assets, REITs provide liquidity and diversification, appealing to those balancing portfolio growth with income stability. This analysis focuses on office REITs in the United States—entities that own and manage office properties, ranging from urban high-rises to suburban complexes. As of February 21, 2025, we examine the sector’s current dynamics, supported by recent data.

Understanding REITs and the Appeal of Office REITs

REITs are structured to own, operate, or finance income-producing real estate, with a mandate to distribute at least 90% of taxable income as dividends—an attractive feature for yield-focused investors. Office REITs specialize in office properties, encompassing corporate headquarters, coworking spaces, and professional suites. Historically, they’ve delivered consistent rental income and capital appreciation, though recent disruptions—most notably the shift to remote work—have tested their resilience. What does the data reveal about its current state?

Types of Office REITs: Segmenting the Market

Office REITs vary by focus, each with distinct risk-reward profiles:

- Class A Office REITs: These target premium office buildings in prime metropolitan hubs such as New York or San Francisco. Catering to high-caliber tenants—think technology firms or legal practices—they often exhibit greater stability during economic downturns, albeit at higher acquisition costs.

- Suburban Office REITs: Concentrating on properties outside urban centers, often in business parks, these REITs benefit from lower entry costs. As companies explore cost efficiencies or relocate from downtown areas, suburban assets may gain traction.

- Medical Office Buildings (MOBs): Focused on healthcare-oriented properties, MOB REITs secure long-term leases with stable tenants like hospitals or clinics. Their resilience, driven by consistent healthcare demand, positions them as a defensive play within the sector.

These distinctions matter—Class A REITs may outperform in recessions, while MOBs offer predictability amid uncertainty. Let’s explore how these segments are faring today.

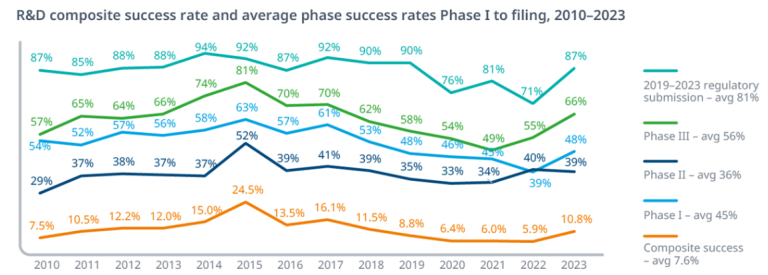

Current State of the Office REIT Market

The office sector has faced significant headwinds. According to CommercialEdge, the national office vacancy rate reached 19.8% by December 2024, up 150 basis points from the prior year. This elevated vacancy is unlikely to decline substantially in 2025, despite return-to-office initiatives. Conversely, rental rates have shown resilience, with the average full-service equivalent listing rate rising 4.5% year-over-year to $33.11 per square foot in December 2024. Regional disparities persist—Midwest markets like Detroit average $21.46 per square foot, while gateway cities command premiums.

Key metrics include:

| Metric | Value (End of 2024) |

|---|---|

| National Vacancy Rate | 19.8% |

| Avg. Listing Rate (per sq ft) | $33.11 |

| Midwest Avg. Rate (per sq ft) | $21.46 |

| Year-over-Year Rate Growth | 4.5% |

Source: CommercialEdge, December 2024

Remote Work’s Lasting Impact

The shift to remote work, accelerated by the pandemic, has reshaped office demand. Hybrid models have persisted, prompting companies to reassess space requirements—often downsizing or reconfiguring layouts for collaboration. While office properties remain essential, their role is evolving, challenging REITs to adapt.

Financial Performance of Office REITs

Office REITs have encountered financial strain. In Q4 2023, SL Green Realty Corp. reported a 43.3% decline in Funds From Operations (FFO)—a critical measure of REIT cash flow—compared to the prior quarter. By Q2 2024, the sector-wide struggle continued, with 12 office REITs posting lower EBITDA and nine experiencing FFO reductions. Median occupancy fell to 83.5%, a multi-year low. Yet, JLL’s 2024 M&A and Strategic Transactions Monitor highlights a countertrend: office REITs achieved robust equity returns last year, suggesting investor optimism may outpace operational recovery.

Peer Comparison: Key Metrics for Leading Office REITs

To provide granularity, we analyze four prominent office REITs—Alexandria Real Estate Equities, Inc., Boston Properties (BXP), Vornado Realty Trust, and SL Green Realty Corp.—using detailed Q4 2024 and full-year 2024 data, augmented with current market capitalization figures:

| Company | Metric | Quarter Ended Dec 31, 2024 | Full Year 2024 | Market Cap (Billions, Feb 2025) | P/FFO (Feb 20, 2025) |

|---|---|---|---|---|---|

| Boston Properties (BXP) | FFO per Share (Diluted) | $1.79 | $7.10 | $11.26 | 9.80 |

| Occupancy: Total Portfolio | 87.5% | N/A | |||

| Occupancy: CBD Portfolio | 90.9% | N/A | |||

| SL Green Realty Corp. | FFO per Share | $1.81 | $8.11 | $4.59 | 7.96 |

| Same-Store Cash NOI (excl. termination) | Decreased 2.7% | Decreased 1.2% | |||

| Occupancy: Manhattan Same-Store Office | 92.5% | N/A | |||

| Vornado Realty Trust | FFO per Diluted Share (non-GAAP) | $0.61 | $2.26 | $8.37 | 17.57 |

| Same-Store NOI at Share % (Decrease) Increase | Total (4.5)% | Total (6.8)% | |||

| Occupancy: Office | 88.8% | N/A | |||

| Alexandria Real Estate Equities, Inc. | FFO per Share – Diluted, as Adjusted | $2.39 | $9.47 | $16.58 | 10.09 |

| Occupancy: Operating Properties (North America) | 94.6% | N/A | |||

| Same-Property NOI Performance | (3.0)% to (1.0)% | N/A | |||

| Same-Property NOI (Cash Basis) | (1.0)% to 1.0% | N/A |

Source: Company filings for Q4 2024; Market Cap and P/FFO February 2025

Metric Definitions

- Funds From Operations (FFO) per Share: A core indicator of operational cash flow, excluding non-cash items like depreciation. Higher FFO reflects stronger earnings capacity.

- Occupancy Rate: Percentage of leasable space occupied, a proxy for revenue stability.

- Same-Store Net Operating Income (NOI): Measures income growth from existing properties, excluding acquisitions or dispositions.

- Market Capitalization: Total value of outstanding shares, reflecting market perception of worth.

Analysis

- Alexandria Real Estate Equities, Inc.: Leads with a Q4 FFO of $2.39 per share and a full-year $9.47, supported by a 94.6% occupancy rate across its North American portfolio. Its $16.58 billion market cap underscores strong investor confidence in its life science and technology focus, though same-store NOI declines of 1.0% to 3.0% indicate selective softening. Dividend yield approximates 4.1%.

- SL Green Realty Corp.: Posts a Q4 FFO of $1.81 per share and a full-year $8.11, with a 92.5% occupancy in Manhattan same-store offices. Its $4.59 billion market cap reflects moderate valuation, and a 2.7% Q4 same-store cash NOI drop (1.2% annually) suggests tenant challenges. Yield is around 6.1%.

- Boston Properties (BXP): Records a Q4 FFO of $1.79 per share and $7.10 for the year, with total portfolio occupancy at 87.5% and CBD assets at 90.9%.

- Vornado Realty Trust: Lags with a Q4 FFO of $0.61 per share and $2.26 annually, despite an $8.37 billion market cap. Occupancy at 88.8% is decent, but a 4.5% Q4 same-store NOI decline (6.8% yearly) highlights operational weakness. Yield is 7.8%, signaling higher risk.

Alexandria stands out for cash flow and stability, appealing to growth investors. Vornado’s high yield offsets weaker fundamentals, while BXP and SL Green provide balanced options.

Investment Considerations: Risks and Opportunities

Is now the time to allocate capital to office REITs? Consider the following:

Risks

- Elevated Vacancies: The persistent 19.8% vacancy rate pressures rental income.

- Debt Maturities: Significant loan obligations loom, and REITs with underperforming assets may face refinancing challenges.

- Macroeconomic Uncertainty: Inflation, interest rate fluctuations, and policy shifts could disrupt demand and financing costs.

Opportunities

- Discounted Valuations: Depressed asset prices present potential entry points for patient investors.

- Adaptive Reuse: Converting offices into residential, data center, or industrial spaces could unlock value.

- Market Stabilization: Reduced construction and stabilizing earnings may tighten supply over time.

- Dividend Income: Office REITs average a 4.5% yield in early 2025, competitive against retail (5.2%) and residential (3.8%) peers, though elevated yields may signal risk.

Leading Office REITs by Market Capitalization

Below are the top office REITs by market capitalization as of February 21, 2025:

| REIT Name | Market Cap (Billion USD, Feb 2025) |

|---|---|

| Alexandria Real Estate Equities | 16.58 |

| Boston Properties | 11.26 |

| Vornado Realty Trust | 8.37 |

| Cousins Properties | 5.02 |

| SL Green Realty Corp. | 4.59 |

| Kilroy Realty | 4.05 |

| Highwoods Properties | 3.12 |

| Piedmont Office Realty Trust | 0.92 |

| Hudson Pacific Properties | 0.41 |

| Equity Commonwealth | 0.18 |

Valuation Insights

Beyond market cap, Funds From Operations (FFO) and Price/FFO ratios refine valuation analysis. Office REITs historically trade at 15-20 times FFO, though some now hover near 10—potentially undervalued, contingent on underlying fundamentals.

Conclusion

The office REIT sector in 2025 presents a difficult landscape—high vacancies and leverage concerns offset by attractive valuations and income potential. Investors must approach it strategically, diversifying across property types (Class A, suburban, MOBs) and prioritizing REITs with robust management and adaptive strategies. Continuous monitoring of market data is essential, as is alignment with individual objectives—whether income generation, capital appreciation, or portfolio diversification. Professional consultation is advisable before committing capital.

Disclaimer: This analysis is for informational purposes only and does not constitute investment advice. Conduct thorough due diligence and consult financial advisors prior to investing.