Is AI the New Gold Rush? The Truth About Tech’s Latest Obsession

Why everyone from your CEO to your barista is suddenly an AI expert—and what history tells us about where this is all heading

Remember when your uncle Steve started day-trading dot-com stocks in 1999? When he quit his accounting job to become a “digital entrepreneur” and insisted that Pets.com was going to revolutionize pet ownership forever? Well, buckle up, because we’re living through that moment again—except this time, it’s all about artificial intelligence.

Walk into any coffee shop in Silicon Valley (or frankly, anywhere with WiFi) and you’ll hear the familiar buzz: “Our startup is using AI to disrupt…” “We just raised $50 million for our AI-powered…” “ChatGPT changed everything, man.” It’s 1999 all over again, complete with breathless media coverage, astronomical valuations, and that intoxicating cocktail of greed and FOMO that makes people do wonderfully stupid things with money.

But here’s the plot twist: this time might actually be different. And before you roll your eyes—yes, I know that’s literally what they said about the dot-com boom—hear me out.

When Everyone Gets Gold Fever

To understand what’s happening with AI, we need to take a little history lesson. Because if there’s one thing humans are remarkably consistent at, it’s losing our collective minds over the Next Big Thing™.

Take the California Gold Rush of 1848. Word spread that you could literally pick gold out of rivers, and suddenly 300,000 people dropped everything to move to California. Most of them went broke. But you know who got rich? The guy selling them shovels. Levi Strauss wasn’t panning for gold—he was making pants for the miners. Smart move, Levi.

Fast-forward 150 years to the dot-com bubble. The internet was going to change everything! Old business rules didn’t apply! Who needs profits when you have “eyeballs” and “page views”? Companies with no revenue were worth billions. Until they weren’t. In 2000, reality came calling with a baseball bat, and the Nasdaq lost 78% of its value.

The pattern is always the same: Revolutionary technology + human psychology + easy money = spectacular boom, followed by spectacular bust.

So when I see AI startups raising hundreds of millions of dollars despite burning through cash faster than a Tesla Cybertruck burns rubber, my bubble-detector starts beeping. When I hear executives say things like “AI will transform everything” with the same breathless enthusiasm that dot-com CEOs once reserved for “the digital revolution,” I get nervous.

But here’s where it gets interesting.

Why This Bubble Might Not Pop (Or At Least, Not How You Think)

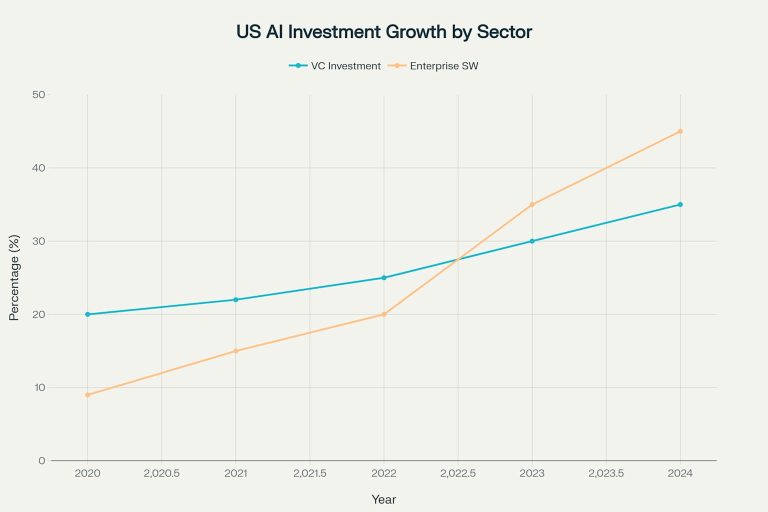

Unlike the dot-com era, when half the companies going public had never made a profit, today’s AI boom is being funded by some of the most profitable companies in human history. We’re talking about Microsoft, Google, Amazon, and Meta—companies that print money like the Federal Reserve.

Microsoft alone is spending $80 billion this year on AI infrastructure. That’s not venture capital funny money or debt financing—that’s cold, hard cash generated by selling Office subscriptions and Azure cloud services. When a company can fund a moon shot with its lunch money, the dynamics change completely.

Then there’s Nvidia, the company making the computer chips that power all this AI magic. Remember how during the Gold Rush, the real money was in selling pickaxes? Nvidia is selling the pickaxes, and business is very good. So good that the company’s profit margins make drug dealers jealous. We’re talking about 56% net profit margins on hardware that every AI company desperately needs.

The difference is stark: In 2000, Cisco—the Nvidia of the internet boom—was trading at 125 times its future earnings. Today, Microsoft trades at about 33 times earnings. That’s still expensive, but it’s not “we’ve-all-lost-our-minds” expensive.

The Tale of Two Markets

Here’s where things get really interesting. The AI boom isn’t one market—it’s two completely different markets wearing a trench coat and pretending to be one market.

Market #1: The Sensible Adults’ Table This is where the big tech companies sit, methodically building the infrastructure for our AI future. They’re buying Nvidia chips by the boatload, constructing massive data centers, and integrating AI into products that millions of people actually use. Microsoft is putting AI in Word. Google is putting AI in search. Meta is using AI to target ads so precisely it’s borderline creepy.

These companies aren’t betting the farm on AI—they’re using AI to make their existing farms more productive. It’s working. Early studies show AI is making software engineers code twice as fast and boosting call center productivity by 14%. That’s not hype; that’s measurable, dollars-and-cents value.

Market #2: The Venture Capital Casino Then there’s the startup ecosystem, where things get… spicier. Here, companies with grand AI visions but modest revenues are raising money at valuations that would make a dot-com CEO blush. OpenAI, the company behind ChatGPT, is valued at $157 billion despite burning through an estimated $700,000 per day just to keep the lights on.

Sound familiar? It should. This is where the bubble lives.

The $320 Billion Question

But even the grown-ups at the adults’ table aren’t immune to irrational exuberance. The four biggest tech companies are planning to spend a combined $320 billion on AI infrastructure in 2025. To put that in perspective, that’s 50% more than the entire global telecom industry spent at the peak of the dot-com bubble, adjusted for inflation.

That’s a lot of data centers. And if demand for AI services doesn’t materialize at the projected scale—if businesses decide they don’t actually need to process every email through a large language model—we could see a glut of unused computing capacity that makes the post-dot-com “dark fiber” surplus look quaint.

Amazon’s CEO calls this a “once-in-a-lifetime opportunity.” That’s exactly what telecom executives said about the internet in 1999. Sometimes once-in-a-lifetime opportunities turn into once-in-a-lifetime mistakes.

The Government Actually Cares This Time

Here’s something genuinely different about the AI boom: governments aren’t waiting for everything to collapse before they start paying attention. Unlike the hands-off approach during the dot-com era, regulators worldwide are actively trying to figure out how to govern AI.

The European Union passed the AI Act. The Biden administration issued executive orders on AI safety. Even China is crafting AI regulations. Whether these efforts will help or hurt remains to be seen, but it’s unprecedented to see this level of regulatory attention during the boom phase rather than after the bust.

The focus isn’t on preventing financial speculation—it’s on existential questions about AI safety, privacy, and the concentration of power among tech giants. These are the kinds of big-picture concerns that could reshape the entire industry, regardless of whether there’s a bubble.

So… Bubble or Boom?

After diving deep into the numbers, the history, and the psychology, here’s my verdict: We’re in both.

The AI revolution is real. The technology works. Companies are seeing genuine productivity gains. The infrastructure being built will power innovation for decades. This isn’t pets.com selling dog food online—this is a fundamental shift in how we work, create, and think.

But layered on top of this legitimate technological transformation is a classic speculative bubble, concentrated in the venture capital world. Startups with unproven business models are raising money at absurd valuations. Investors are throwing cash at anything with “AI” in the pitch deck. The psychological patterns are identical to every boom in history.

The likely outcome? A painful but contained correction in the private markets. Venture-backed AI startups will crash and burn. Investors will lose billions. Talented engineers will get laid off and then promptly hired by the tech giants who have the cash to weather the storm.

But unlike 2000, when the entire tech sector collapsed, the profitable core of the AI ecosystem—the Microsofts and Nvidias of the world—will likely emerge stronger. They’ll buy up the wreckage, absorb the talent, and continue building the AI future at a more sustainable pace.

The Golden Rules of Gold Rushes

History offers some clear lessons for navigating this moment:

Sell shovels, not maps to treasure. The companies providing essential infrastructure—semiconductors, cloud computing, data management—are likely to thrive regardless of which individual AI startups succeed or fail.

Technology isn’t a business model. Having cool AI capabilities doesn’t automatically translate to sustainable profits. The long-term winners will be companies that solve real problems for real customers, not those with the fanciest demos.

Be patient. Revolutionary technologies take time to reach their full potential. The internet didn’t transform productivity overnight—it took more than a decade. AI will likely follow a similar path, with periods of hype followed by periods of disillusionment before reaching a “plateau of productivity.”

The View from 2035

Ten years from now, we probably won’t talk about “AI companies” any more than we talk about “internet companies” or “electricity companies” today. AI will be embedded everywhere—in our cars, our thermostats, our email, our spreadsheets. It will be as invisible and essential as the internet is now.

The companies that win long-term won’t be the ones with the flashiest AI demos at tech conferences. They’ll be the businesses that quietly use AI to serve customers better, operate more efficiently, and create sustainable competitive advantages.

The real gold isn’t in building the next ChatGPT. It’s in using AI to make everything else work better. The companies that figure that out—whether they’re selling insurance or managing supply chains or diagnosing diseases—will be the ones laughing all the way to the bank.

So yes, we’re probably in a bubble. But we’re also in the early stages of a genuine technological revolution. The trick is knowing the difference between the two and betting accordingly.

Just remember: in every gold rush, the house always wins. In this case, the house is the company selling the shovels—and right now, that company is probably run by a guy in a black t-shirt with more money than several small countries.

The author holds shares in several companies mentioned in this article, which may present a conflict of interest. This article offers a personal perspective and does not constitute financial advice. Readers should conduct their own research and consult with financial professionals before making any investment decisions. Investing in rapidly evolving markets like AI carries significant risks.