Understanding the Dynamics of U.S. Treasury Bonds in the Context of a Rising Deficit

As we navigate the economic landscape in late 2024, a key area of focus for investors is the U.S. Treasury bond market are long-term securities. With increasing concerns about the federal deficit and its implications on interest rates, this article discuss key points about the factors influencing bond rates and the potential strategies employed by the Federal Reserve to manage these challenges.

1. The Role of the Federal Deficit

A large U.S. deficit impacts bond rates through several mechanisms:

- Increased Supply of Bonds: To finance a growing deficit, the government often issues more Treasury bonds. When supply outstrips demand, bond prices can fall, leading to higher yields.

- Investor Perception of Risk: As the deficit grows, investors may perceive greater credit risk, demanding higher yields as compensation for the added risk of inflation or potential default.

- Inflation Expectations: Concerns about rising inflation can prompt investors to seek higher returns on long-term bonds, pushing yields upward.

- Impact on Fiscal Policy: Rising interest payment obligations due to the deficit constrain the government’s ability to fund other important services, which can affect overall economic stability.

2. The Federal Reserve’s Impact on Long-Term Rates

The Federal Reserve plays a significant role in influencing long-term interest rates through its policies:

- Zero Lower Bound: The Fed can maintain short-term rates at or near zero to reduce the government’s interest payment obligations. While this can help in the short term, it may lead to inflationary pressures if kept too long.

- Quantitative Easing: By purchasing long-term Treasury bonds directly, the Fed can lower long-term rates, stimulate economic activity, and support financial market stability. This practice, known as quantitative easing (QE), boosts confidence in the economy by ensuring liquidity in the bond market.

- Managing Inflation Expectations: By communicating its intentions clearly and committing to QE, the Fed can shape investor expectations regarding future inflation, thus influencing long-term bond yields.

3. Long-Term Considerations and Risks

While low rates and quantitative easing can provide immediate benefits, they raise important long-term considerations:

- Asset Bubbles: Extended low interest rates may encourage excessive risk-taking in financial markets, potentially leading to asset bubbles.

- Normalization Challenges: The eventual unwinding of Fed bond purchases, or “tapering,” can create volatility in financial markets, as investors adjust to changes in monetary policy.

- Debt Sustainability: High levels of federal debt require careful monitoring to ensure long-term fiscal health. The interaction between government borrowing and investor confidence will be pivotal in maintaining economic stability.

Market Data and Trends: A Visual Analysis

To better understand the current state of Treasury bonds and federal deficits, let’s examine the latest market data and trends that illustrate the concepts discussed above.

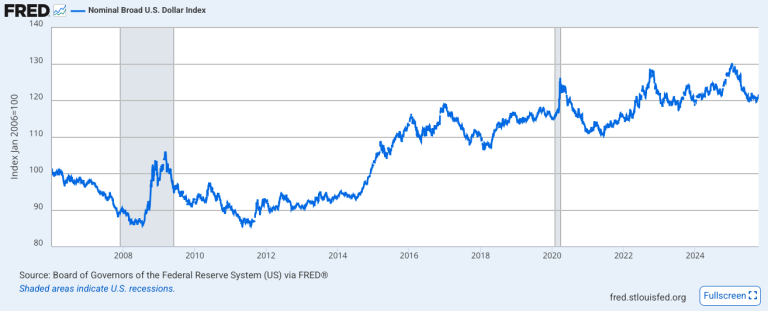

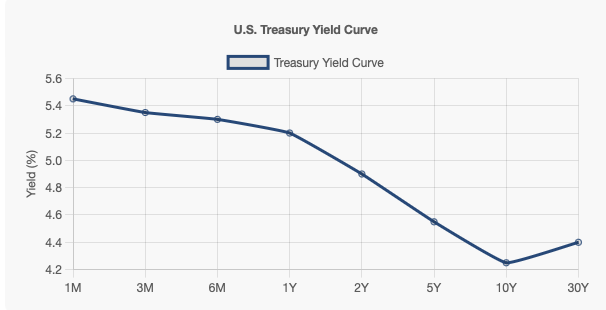

Current Treasury Yield Curve Analysis

The charts above show the current Treasury yield curve, which reflects several key observations:

- Inverted Yield Curve Dynamics: The shorter-term rates (1-month to 1-year) are currently higher than longer-term rates, showing an inverted yield curve. This inversion reflects market expectations about future economic conditions and monetary policy.

- Key Benchmark Rates:

- 10-Year Treasury: 4.25%

- 30-Year Treasury: 4.40%

- 2-Year Treasury: 4.90%

These rates demonstrate the current “higher for longer” interest rate environment, significantly above historical averages of the past decade.

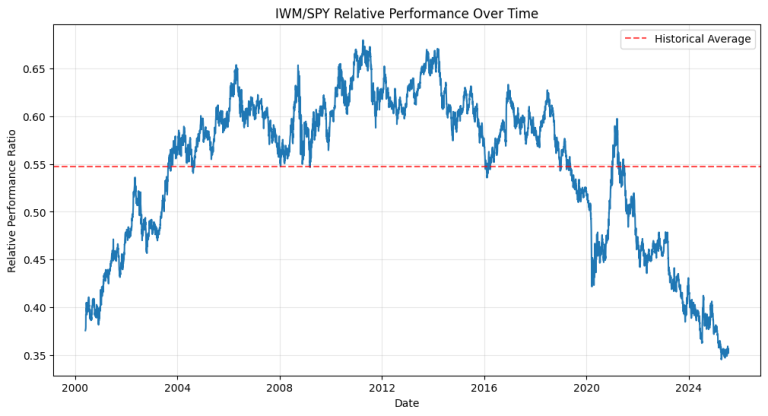

Federal Deficit Trends

The deficit trend chart reveals several important patterns:

- Post-Pandemic Evolution: The dramatic spike in the deficit during 2020 ($3.13 trillion) due to COVID-19 emergency spending has gradually decreased, but remains historically elevated.

- Current Status: The projected 2024 deficit of $1.54 trillion represents a significant fiscal challenge, maintaining pressure on Treasury financing needs.

- Historical Context: Despite improvements from pandemic-era peaks, current deficit levels remain well above pre-2020 averages, indicating persistent structural fiscal challenges.

Impact on Bond Market Dynamics

The visualization of these trends helps explain several key market dynamics discussed in the main article:

- Supply Pressure: The sustained high deficit levels continue to necessitate substantial Treasury issuance, contributing to upward pressure on yields.

- Investor Sentiment: The shape of the yield curve reflects both Federal Reserve policy and market participants’ views on future economic conditions and inflation risks.

- Market Adaptation: The relatively high yields across the curve demonstrate how the market has adjusted to both the Federal Reserve’s monetary policy stance and the government’s significant borrowing needs.

Looking Forward

These data visualizations support the article’s analysis of the challenges facing the Treasury market:

- The persistent deficit levels suggest continued heavy Treasury issuance will be necessary.

- The current yield curve structure indicates market expectations of maintained tight monetary policy in the near term.

- The relationship between deficits and yields highlights the importance of fiscal-monetary policy coordination in managing market stability.

This data-driven perspective reinforces the article’s discussion of the complex interplay between federal deficits, Treasury issuance, and market dynamics, providing concrete evidence of the challenges and considerations facing both policymakers and market participants.

Conclusion

The dynamics of U.S. Treasury bonds amidst a rising deficit reflect an intricate interplay of market forces, investor sentiment, and federal policy. Understanding these factors is essential for investors as they navigate the complexities of the bond market. The Federal Reserve’s strategies, including maintaining low short-term rates and purchasing long-term securities, can provide essential support for economic recovery. However, the long-term implications of these policies require careful scrutiny to mitigate risks and ensure sustainable growth. As we move forward, monitoring these developments will be crucial for sound investment decision-making in the Treasury bond market.