Waymo is Quietly Winning the Robotaxi Race. So Why Is Everyone Watching Tesla?

One of my friends tried to hail a robotaxi in Austin last week. Not for a real ride, but as an experiment. One app promised a futuristic utopia, a car summoned by a tap, part of a grand vision from the world’s most famous tech CEO. The other app… well, it was just Uber. But when he selected his ride, something new popped up: “You might get a Waymo.”

One experience was a gamble on a future that feels perpetually just around the corner. The other was the future, delivered with the boring reliability of a pizza.

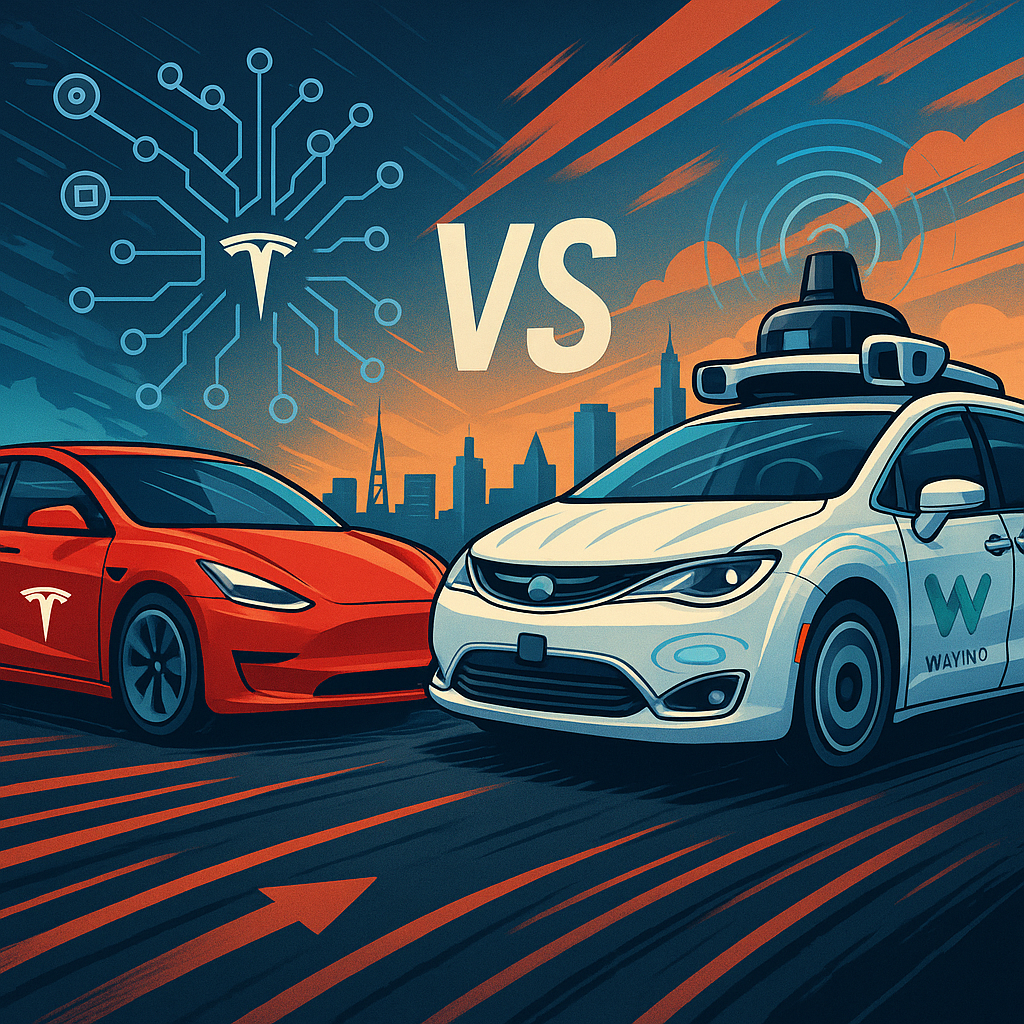

For years, the story of the self-driving car has been dominated by Elon Musk’s grand pronouncements and Tesla’s “Full Self-Driving” ambitions. It’s a fantastic story, full of drama and world-changing potential. There’s just one problem: it isn’t the most important story in autonomous vehicles right now.

The real story belongs to the quiet kid in class who did the homework, aced the tests, and is now running a multi-city business while everyone else is still figuring out the curriculum. That kid is Waymo. And as of mid-2025, Alphabet’s long-term bet isn’t just a science project anymore. It’s a real, scaled, commercial service that’s leaving everyone else in the dust.

So, who is actually winning the robotaxi race, where is the smart money going, and why does the real leader feel like the industry’s best-kept secret? Let’s buckle up.

The Leader You’re Not Watching (But Should Be)

If you live outside of Phoenix, San Francisco, Los Angeles, Austin, or the newly-added Atlanta, you might not realize that the robotaxi revolution has already begun. It’s just not being televised in the way we expected.

Waymo is now giving over 250,000 paid rides every single week. That’s over a million rides a month. In May, the company announced it had crossed 10 million total paid trips—and it did the last 5 million of those in just five months.This isn’t a small-scale trial. This is hockey-stick growth.

I took a ride in San Francisco. I opened the app, hailed the car, and a white Jaguar I-PACE with a funny-looking dome on top pulled up. It navigated the city’s chaotic intersections, avoided a double-parked delivery truck, and dropped me off without any drama. The most exciting part was how… boring it was. And in the world of getting you from Point A to Point B safely, boring is the ultimate feature.

So how did Waymo get here while others have stalled? It comes down to a fundamental disagreement about how a robot should see the world. As I detailed in a previous post comparing the two giants, Tesla vs. Waymo, their approaches are polar opposites.

Waymo’s cars are covered in sensors. They have cameras for seeing in color, radar for detecting speed and cutting through fog, and LiDAR—the big one—which uses lasers to build a real-time, 3D map of the world. It’s like giving the car superhuman senses. This method is expensive and complex, but the data speaks for itself: peer-reviewed studies show Waymo’s cars are involved in 85% fewer crashes with injuries than human drivers in the same areas. It’s a provably safe system.

The Drama Club: Tesla’s Troubled Debut

Then there’s Tesla. After years of promises, Tesla finally launched its own robotaxi service in Austin this month. And the debut has been… rocky. To put it mildly.

First, let’s be clear: Tesla’s service is not fully autonomous. It’s a limited trial with only 10 to 20 cars, and they operate with a human “safety monitor” in the passenger seat. This isn’t a competitor to Waymo One; it’s a public beta test of a Level 2 driver-assist system in a taxi wrapper.

The results have been all over social media. Videos show the cars driving on the wrong side of the road, getting confused at intersections, and braking erratically. It’s been messy enough that the National Highway Traffic Safety Administration (NHTSA) has already opened an inquiry.

Tesla’s bet is that it can achieve full autonomy using only cameras, just like humans use their eyes. It’s an elegant, low-cost approach. If it works, Tesla could activate millions of its cars as robotaxis with a software update, a massively profitable, asset-light dream. The problem is that a car’s cameras can be blinded by sun glare or confused by rain in ways LiDAR isn’t. Right now, that “if” is doing some very heavy lifting.

And let’s not forget the ghost of robotaxi past. GM’s Cruise was once Waymo’s biggest rival, a billion-dollar contender. But after a horrifying incident in 2023 and a crisis of leadership, GM pulled the plug. Cruise is now a cautionary tale about what happens when you move too fast and break trust. The cost wasn’t just the $8 billion GM had lost; it was the public’s confidence.

Follow the Money: A Tale of Two Bets

For anyone looking at this from an investment perspective, this is where it gets really interesting. This is a classic clash of business models.

Waymo’s Playbook: The Capital-Intensive Grind Waymo’s approach is methodical and incredibly expensive. The “Other Bets” division at Alphabet, where Waymo lives, lost $1.23 billion in the first quarter of 2025 alone. They are building the service from the ground up: buying and outfitting cars, setting up depots, and painstakingly mapping every new city.

But with their Uber partnership in Austin and Atlanta, and a new manufacturing facility to scale up production, they are building a powerful moat. Their recent collaboration with Toyota to explore putting the “Waymo Driver” into personally owned cars shows the endgame: become the “Intel Inside” for the entire auto industry. The potential revenue growth is immense, but it requires patience and very, very deep pockets. You can read more on my financial take here: Waymo’s Expected Revenue Growth.

Tesla’s Playbook: The High-Stakes Software Bet Tesla’s model is the opposite. It’s an asset-light, high-margin software play. It sells Full Self-Driving for thousands of dollars and dreams of a future where millions of Tesla owners let their cars earn them money in a shared robotaxi network.

Profitability here isn’t about cost-per-mile; it’s about solving the final, incredibly difficult 1% of the autonomy problem with software alone. If they can’t make that technological leap, the entire robotaxi business model collapses. It’s a bet on a miracle. A potentially world-changing, trillion-dollar miracle, but a miracle nonetheless.

The Road Ahead

So where do we stand in mid-2025?

Waymo is the established incumbent, operating a real business at a scale no one else can touch. Its challenges are now about business execution: cutting costs, expanding efficiently, and managing its capital burn until it reaches profitability.

Tesla is the high-profile challenger, armed with a massive fleet of cars and a revolutionary vision. Its challenge is more fundamental: proving its core technology can actually do the job safely and reliably without a human babysitter.

And don’t count out the dark horse. Amazon’s Zoox, with its purpose-built vehicle and a new factory, is set to launch in Las Vegas later this year. It represents yet another approach.

The race for autonomy is far from over. It’s a marathon of engineering, regulation, and finance. But for the first time, we have a clear leader. So, who are you betting on? The company with tens of millions of miles of proven, driverless data? Or the one with millions of cars waiting for a software update that might change everything?

For now, if I actually need a ride home from the airport, I know which app I’m opening. And the car that shows up won’t need a human driver.

Financial Disclaimer:

The content provided in this article is for informational and educational purposes only and does not constitute financial or investment advice. All investments involve risk, and the past performance of a company or investment is not a guarantee of future results. Readers should conduct their own research and consult with a qualified professional before making any investment decisions.